Key Takeaways:

- Coatue Management strategically acquires a significant stake in Philip Morris International.

- Analysts project a promising average price target for Philip Morris International.

- Current GF Value suggests possible downside risk compared to present market price.

Coatue Management's Strategic Investment in Philip Morris

In a noteworthy move, billionaire Philippe Laffont (Trades, Portfolio)’s Coatue Management has added a substantial new holding in Philip Morris International (PM, Financial), acquiring 1.56 million shares in the first quarter. This purchase is part of a larger strategic reallocation that saw Coatue also increase its stake in Alibaba (BABA) while divesting from several other assets.

Wall Street Analysts' Price Projections

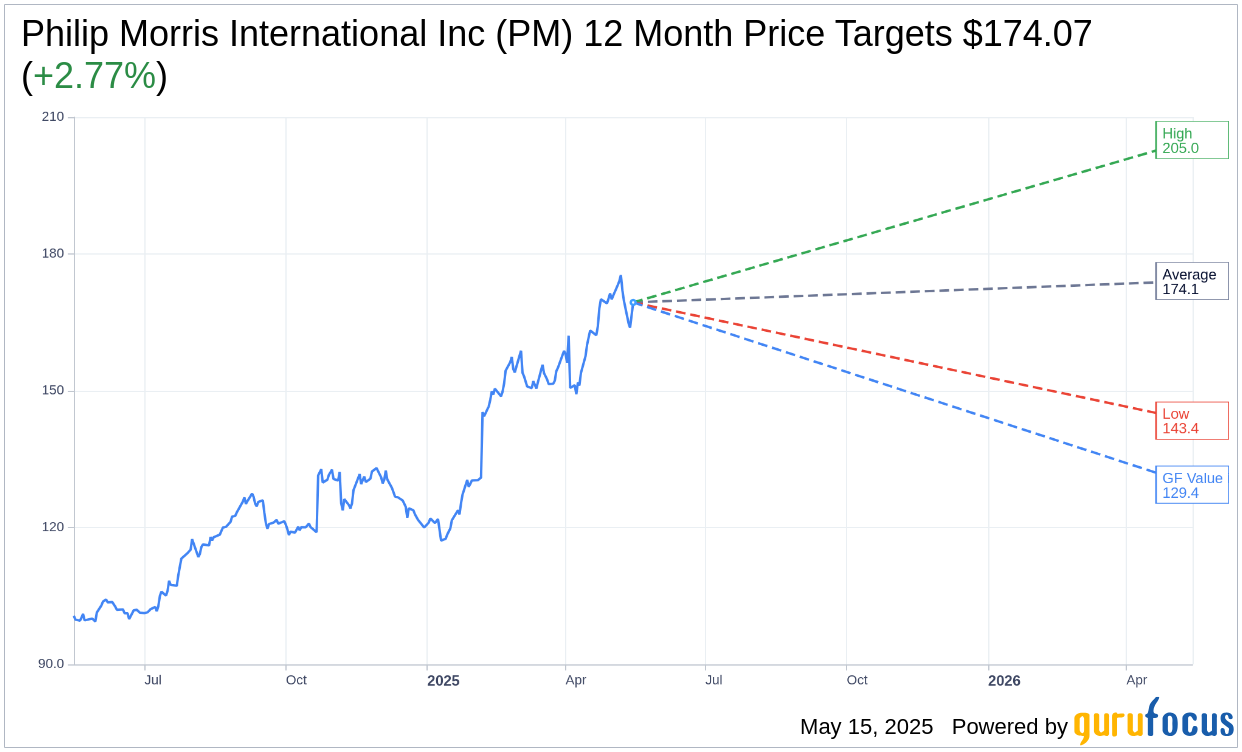

The consensus among 13 analysts suggests an average one-year price target for Philip Morris International Inc (PM, Financial) at $174.07. This target spans from a high estimate of $205.00 to a low estimate of $143.45, indicating a potential upside of 2.77% from its recent trading price of $169.39. Detailed forecast data is accessible on the Philip Morris International Inc (PM) Forecast page.

Brokerage Recommendations and Ratings

According to 16 brokerage firms, Philip Morris International Inc (PM, Financial) enjoys an "Outperform" status, with an average brokerage recommendation of 2.0. This rating falls within a scale where 1 represents a Strong Buy and 5 indicates a Sell, reflecting a positive outlook from the investment community.

Evaluating GF Value and Potential Downside

GuruFocus provides an estimated GF Value for Philip Morris International Inc (PM, Financial) at $129.42 for the upcoming year. This suggests a possible downside of 23.59% from its present market price of $169.385. The GF Value is computed based on historical trading multiples, previous growth trends, and anticipated future performance. More in-depth analysis can be reviewed on the Philip Morris International Inc (PM) Summary page.