On May 15, 2025, vTv Therapeutics Inc (VTVT, Financial) released its 8-K filing detailing the financial results for the first quarter ended March 31, 2025. The company, a clinical-stage biopharmaceutical firm, is focused on developing orally administered treatments for metabolic and inflammatory diseases, with a particular emphasis on cadisegliatin, a potential first-in-class oral adjunctive therapy for type 1 diabetes (T1D).

Financial Performance and Challenges

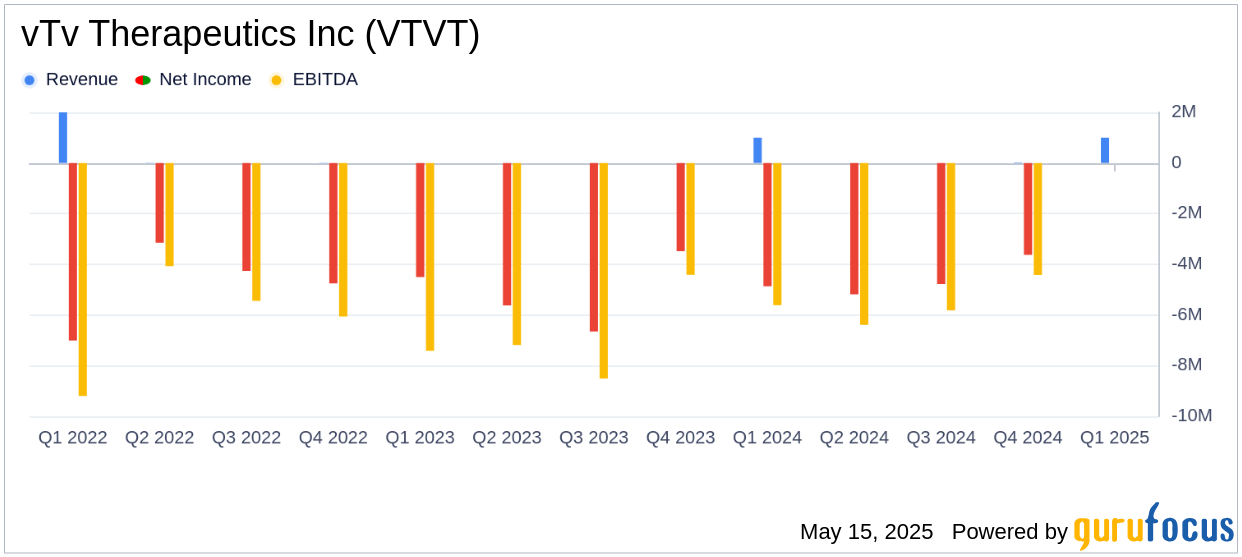

vTv Therapeutics Inc reported a net loss of $5.1 million, or $0.77 per basic share, for the first quarter of 2025. This represents an improvement compared to the net loss of $4.9 million, or $1.17 per basic share, in the same period last year. The company's cash position decreased to $31.1 million from $36.7 million at the end of 2024, reflecting ongoing operational expenses.

Key Financial Metrics

The company's research and development (R&D) expenses increased slightly to $2.8 million from $2.6 million in the previous year, driven by higher indirect costs and project-related expenses. However, this was partially offset by reduced spending on cadisegliatin due to lower clinical trial and drug manufacturing costs. General and administrative (G&A) expenses decreased to $3.7 million from $4.0 million, primarily due to reductions in payroll and legal expenses.

Corporate Developments and Achievements

vTv Therapeutics Inc has made significant progress in its clinical pipeline, particularly with the cadisegliatin program. The company reinitiated screening for the Phase 3 CATT1 trial, evaluating cadisegliatin as an adjunctive therapy to insulin for T1D. A protocol amendment was submitted to shorten the trial duration from 12 to 6 months, expediting the timeline for topline data expected in the second half of 2026.

“Our late stage cadisegliatin program is advancing with potential to be the first oral adjunct therapy for T1D,” said Paul Sekhri, Chairman, President and Chief Executive Officer of vTv Therapeutics.

Balance Sheet and Cash Flow

As of March 31, 2025, vTv Therapeutics Inc's total assets stood at $32.0 million, down from $38.3 million at the end of 2024. The company's liabilities decreased slightly to $23.1 million from $24.0 million, while stockholders' equity dropped to $8.9 million from $14.3 million, reflecting the ongoing net losses.

Analysis and Industry Context

vTv Therapeutics Inc's financial results highlight the typical challenges faced by clinical-stage biopharmaceutical companies, including high R&D expenses and the need for substantial capital to advance drug development. The company's focus on cadisegliatin, a novel treatment for T1D, positions it well within the biotechnology industry, where innovation and successful clinical trials can lead to significant market opportunities.

Overall, vTv Therapeutics Inc's Q1 2025 financial results demonstrate a narrowing net loss and strategic advancements in its clinical pipeline, which are crucial for its long-term success in the competitive biotechnology sector.

Explore the complete 8-K earnings release (here) from vTv Therapeutics Inc for further details.