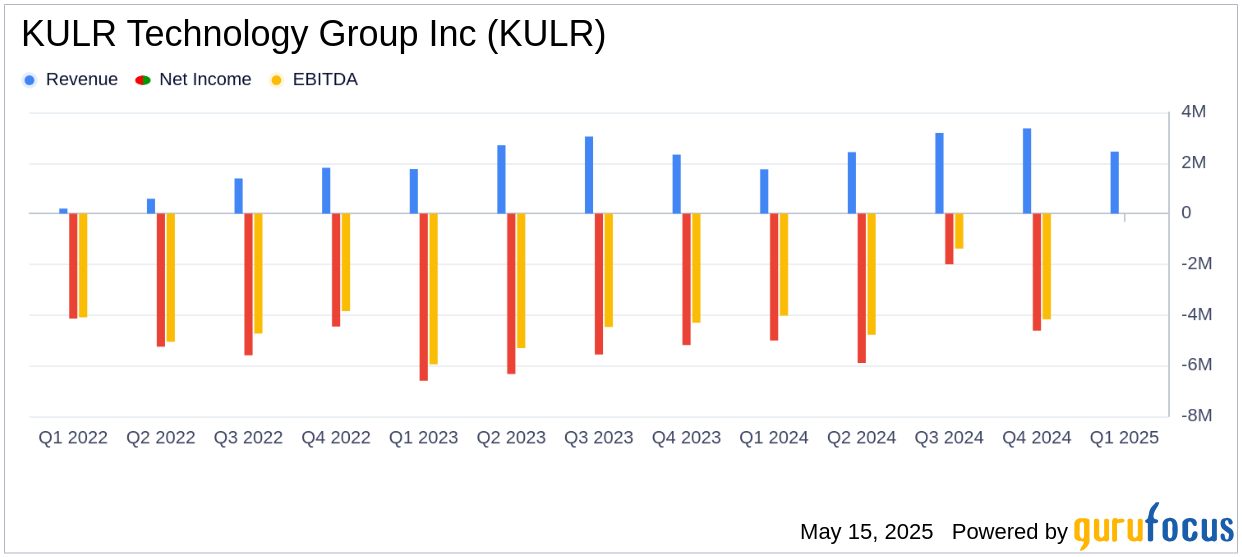

KULR Technology Group Inc (KULR, Financial) released its 8-K filing on May 15, 2025, detailing its financial results for the first quarter ended March 31, 2025. The company, known for its high-performance thermal management technologies, reported a revenue increase of 40% year-over-year to $2.45 million, falling short of the analyst estimate of $2.85 million. The net loss widened to $18.81 million, or $0.07 per share, compared to a net loss of $5.0 million, or $0.04 per share, in the same period last year, missing the estimated earnings per share of -0.02.

Company Overview

KULR Technology Group Inc develops and commercializes advanced energy management solutions, focusing on applications such as electric vehicles, AI and Cloud computing, energy storage, and 5G communication technologies. The company is strategically positioned in the hardware industry, leveraging its expertise to drive innovation in thermal management technologies.

Financial Performance and Challenges

Despite a significant increase in revenue, KULR Technology Group Inc faced challenges with its gross margin, which declined to 8% from 29% in the previous year. This decrease was attributed to unexpected labor hours required for technical projects. The company's operating loss also increased to $9.44 million, driven by higher selling, general, and administrative (SG&A) expenses, which rose to $7.20 million, and increased research and development (R&D) expenses, which reached $2.45 million.

Financial Achievements and Industry Impact

KULR Technology Group Inc's financial achievements include a substantial increase in product sales, which rose by 88.7% to approximately $1.16 million. This growth is crucial for the company as it continues to expand its footprint in the hardware industry, particularly in high-growth sectors like robotics and AI. The company's strategic initiatives, such as its partnership with German Bionic and its expansion into the Bitcoin treasury, highlight its commitment to innovation and diversification.

Key Financial Metrics

As of March 31, 2025, KULR Technology Group Inc reported cash and current accounts receivable of $27.59 million. The company's balance sheet remains strong with over $100 million in cash and Bitcoin holdings and virtually no debt. This financial position supports KULR's growth strategy in its battery and AI Robotics businesses.

| Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Revenue | $2.45 million | $1.75 million |

| Gross Margin | 8% | 29% |

| SG&A Expenses | $7.20 million | $4.21 million |

| R&D Expenses | $2.45 million | $955 thousand |

| Net Loss | $18.81 million | $5.0 million |

Management Commentary and Strategic Initiatives

KULR Chief Financial Officer, Shawn Canter, stated, “We are proud to put up another same quarter over quarter positive beat. We extended our streak of record trailing-twelve-months revenue, and we continue to demonstrate our leadership as a bitcoin treasury company.”

The company announced several strategic initiatives, including a $6.7 million award from the Texas Space Commission to advance its KULR ONE Space Battery Platform and a partnership with German Bionic to expand into the robotics market. Additionally, KULR increased its Bitcoin holdings to 716 BTC, reporting a 197.5% BTC yield, and launched a blockchain-secured supply chain initiative.

Analysis and Outlook

KULR Technology Group Inc's first-quarter results reflect both the opportunities and challenges it faces in the rapidly evolving hardware industry. While the company has made significant strides in revenue growth and strategic partnerships, the decline in gross margins and increased operating losses highlight areas for improvement. The company's strong cash position and innovative initiatives position it well for future growth, but careful management of expenses and operational efficiencies will be crucial to achieving profitability.

Explore the complete 8-K earnings release (here) from KULR Technology Group Inc for further details.