- Take-Two Interactive reports a fourth-quarter revenue surge of 12.9% year-over-year, outpacing forecasts by $30 million.

- Despite revenue growth, the company saw a significant GAAP EPS loss, missing projections by $21.03.

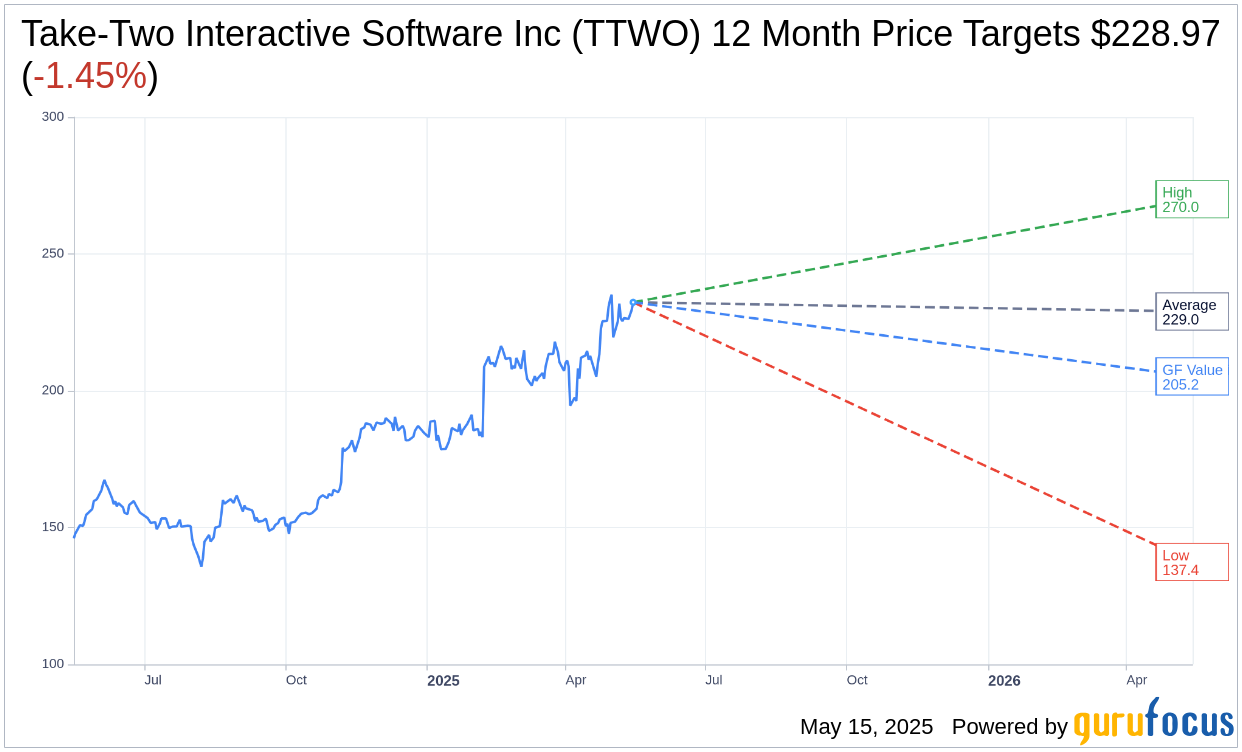

- Wall Street remains optimistic with price targets implying a slight downside from current value.

Take-Two Interactive (NASDAQ: TTWO) has unveiled its fourth-quarter financial results, showcasing strong revenue figures but also highlighting some areas of concern. The company reported a GAAP EPS loss of $21.08, falling short of analyst expectations by $21.03. Yet, the silver lining is their impressive revenue growth, which hit $1.58 billion—a notable 12.9% increase from the previous year, exceeding forecasts by $30 million. This robust revenue was largely fueled by the success of key gaming titles like NBA 2K25 and Grand Theft Auto, contributing to a 17% rise in net bookings.

Wall Street Analysts Forecast

The outlook from Wall Street analysts suggests a cautiously optimistic view of Take-Two Interactive. With one-year price targets compiled from 29 analysts, the average target is pinned at $228.97. Estimates vary, with the highest pegged at $270.00 and the lowest at $137.43. This average estimate points to a potential downside of 1.45% from the current trading price of $232.34. For further insights into these projections, visit the Take-Two Interactive Software Inc (TTWO, Financial) Forecast page.

Analyst recommendations reinforce this sentiment, with 30 brokerage firms delivering an average recommendation of 1.8 for Take-Two Interactive, qualifying it under the "Outperform" category. This rating scale, ranging from 1 (Strong Buy) to 5 (Sell), indicates a generally favorable outlook for the company from the investment community.

From a valuation perspective, GuruFocus provides an estimated GF Value of $205.24 for Take-Two Interactive in the coming year. This positions the current price at a potential downside of 11.66%, highlighting the difference between market expectations and intrinsic value as estimated by GuruFocus. For further analysis and historical performance data, visit the Take-Two Interactive Software Inc (TTWO, Financial) Summary page.