vTv Therapeutics (VTVT, Financial) is progressing with its late-stage development of cadisegliatin, which holds the potential to become the first oral adjunct treatment for Type 1 Diabetes (T1D). The company has resumed participant screening in its Phase 3 CATT1 study. A recent protocol change has shortened the study duration from 12 to 6 months, which means topline results from this trial are now expected in the latter half of 2026.

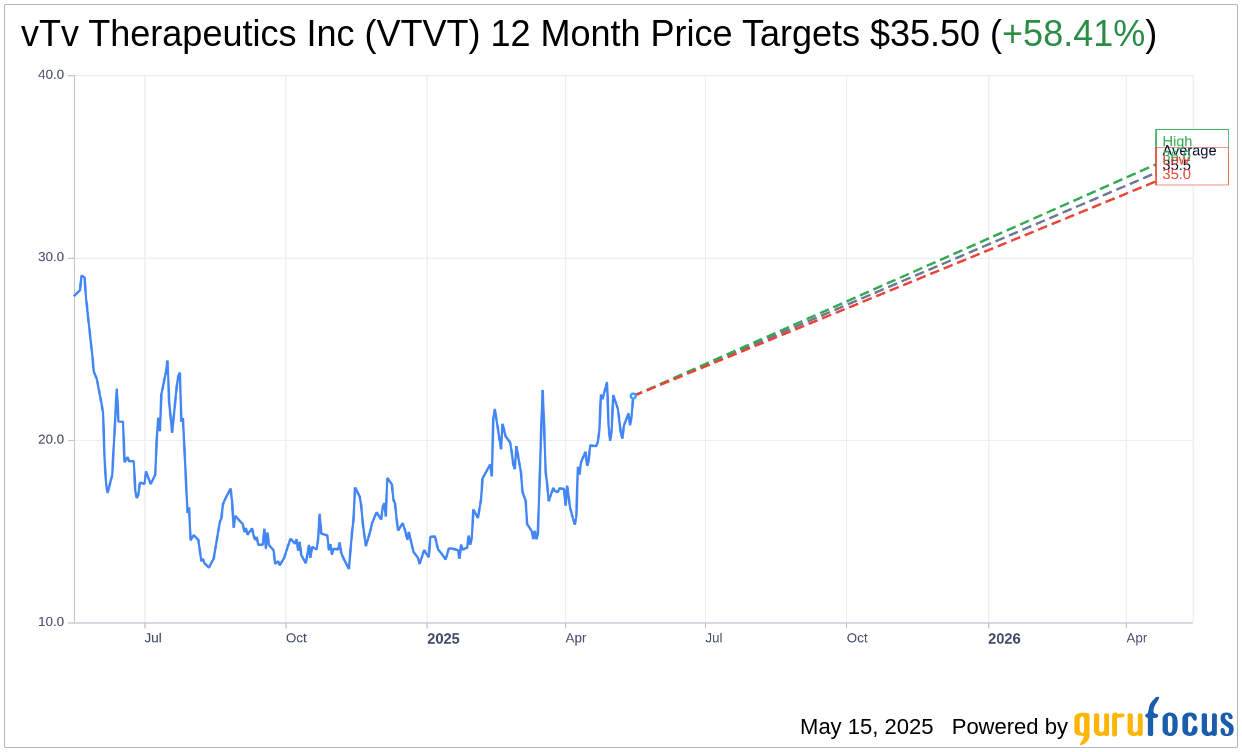

Wall Street Analysts Forecast

Based on the one-year price targets offered by 2 analysts, the average target price for vTv Therapeutics Inc (VTVT, Financial) is $35.50 with a high estimate of $36.00 and a low estimate of $35.00. The average target implies an upside of 58.41% from the current price of $22.41. More detailed estimate data can be found on the vTv Therapeutics Inc (VTVT) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, vTv Therapeutics Inc's (VTVT, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for vTv Therapeutics Inc (VTVT, Financial) in one year is $10.71, suggesting a downside of 52.21% from the current price of $22.4098. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the vTv Therapeutics Inc (VTVT) Summary page.