Third Point has reported that it no longer holds any stake in Workday (WDAY, Financial), as indicated in its latest 13F filing. This marks a change from their previous filing on February 14, 2025, where they disclosed a new investment of 500,000 shares in the company. The investment landscape remains dynamic, and such adjustments in holdings are part of strategic decisions made by investment firms.

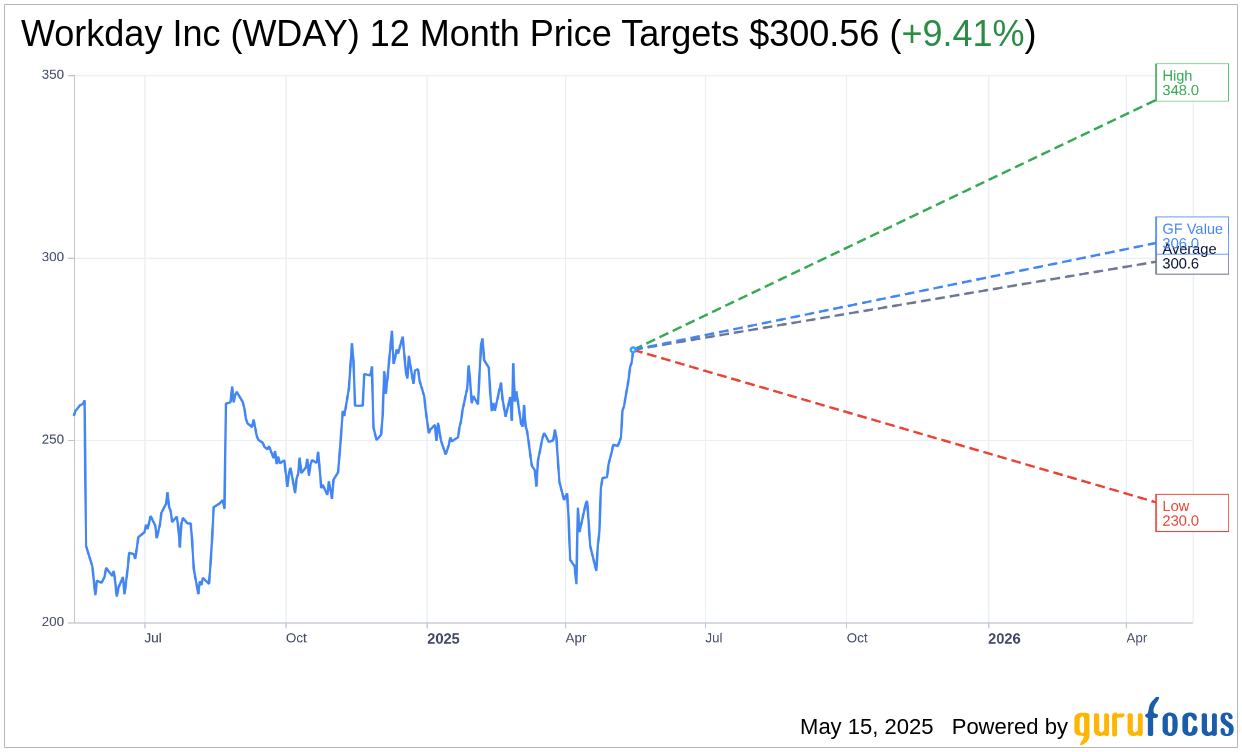

Wall Street Analysts Forecast

Based on the one-year price targets offered by 34 analysts, the average target price for Workday Inc (WDAY, Financial) is $300.56 with a high estimate of $348.00 and a low estimate of $230.00. The average target implies an upside of 9.41% from the current price of $274.71. More detailed estimate data can be found on the Workday Inc (WDAY) Forecast page.

Based on the consensus recommendation from 40 brokerage firms, Workday Inc's (WDAY, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Workday Inc (WDAY, Financial) in one year is $306.04, suggesting a upside of 11.4% from the current price of $274.71. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Workday Inc (WDAY) Summary page.

WDAY Key Business Developments

Release Date: February 25, 2025

- Subscription Revenue (Q4): $2.04 billion, up 16%.

- Full Year Subscription Revenue (FY25): $7.718 billion, growth of 17%.

- Total Revenue (Q4): $2.21 billion, growth of 15%.

- Full Year Total Revenue (FY25): $8.45 billion, up 16%.

- Non-GAAP Operating Margin (Q4): 26.4%.

- Full Year Non-GAAP Operating Margin (FY25): 25.9%.

- Operating Cash Flow (Q4): $1.11 billion.

- Full Year Operating Cash Flow (FY25): $2.46 billion, growth of 15%.

- 12-Month Subscription Revenue Backlog (cRPO): $7.63 billion, growing 15%.

- Total Subscription Revenue Backlog: $25.06 billion, up 20%.

- Gross Revenue Retention Rate: 98%.

- Headcount: Approximately 20,400 workmates.

- FY26 Subscription Revenue Guidance: Approximately $8.8 billion, growth of 14%.

- FY26 Non-GAAP Operating Margin Guidance: Approximately 28%.

- FY26 Operating Cash Flow Guidance: $2.75 billion.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Workday Inc (WDAY, Financial) reported a 16% growth in subscription revenue for Q4, showcasing strong demand for its services.

- The company achieved a 26% non-GAAP operating margin, indicating efficient cost management and operational execution.

- Workday Inc (WDAY) expanded its customer base significantly, adding notable clients such as Bayer, Henkel, and the State of North Carolina.

- The launch of the Agent System of Record positions Workday Inc (WDAY) as a leader in managing AI agents, enhancing its competitive edge.

- Workday Inc (WDAY) saw strong international performance, particularly in the UK and Germany, despite macroeconomic headwinds.

Negative Points

- The restructuring led to a workforce reduction of approximately 8%, which could impact employee morale and productivity.

- There is a $75 million charge related to restructuring, affecting GAAP operating income for the quarter.

- The strengthening of the US dollar poses a $20 million headwind to the company's FY26 subscription revenue outlook.

- Despite strong Q4 results, the macroeconomic environment in EMEA remains challenging, potentially impacting future growth.

- The company faces risks associated with the integration and management of third-party AI agents, which could lead to operational complexities.