Exploring ValueAct Capital (Trades, Portfolio)'s Recent 13F Filing and Investment Strategies

ValueAct Capital (Trades, Portfolio) recently submitted its 13F filing for the first quarter of 2025, offering a glimpse into its strategic investment decisions during this period. ValueAct Capital (Trades, Portfolio), a firm with over two decades of experience, has made more than 100 core investments and its managers have served on 49 public company boards. The firm is known for its long-term investment approach, often holding positions for 3-5 years, and sometimes even a decade or more. According to its website, ValueAct Capital (Trades, Portfolio) emphasizes the importance of relationships with portfolio companies and the institutional investor community, focusing on long-term growth and integrity. The firm values openness, shared learning, and rewards, applying this philosophy to its portfolio companies.

Summary of New Buy

ValueAct Capital (Trades, Portfolio) added a total of two stocks to its portfolio this quarter:

- The most significant addition was Rocket Companies Inc (RKT, Financial), with 6,728,509 shares, accounting for 1.77% of the portfolio and a total value of $81.21 million.

- The second largest addition was Nu Holdings Ltd (NU, Financial), consisting of 3,416,200 shares, representing approximately 0.76% of the portfolio, with a total value of $34.98 million.

Key Position Increases

ValueAct Capital (Trades, Portfolio) also increased its stakes in a total of five stocks:

- The most notable increase was in Meta Platforms Inc (META, Financial), with an additional 803,374 shares, bringing the total to 1,014,874 shares. This adjustment represents a significant 379.85% increase in share count, a 10.11% impact on the current portfolio, with a total value of $584.93 million.

- The second largest increase was in Visa Inc (V, Financial), with an additional 939,350 shares, bringing the total to 1,312,950. This adjustment represents a significant 251.43% increase in share count, with a total value of $460.14 million.

Key Position Reduces

ValueAct Capital (Trades, Portfolio) also reduced its position in four stocks. The most significant changes include:

- Reduced Toast Inc (TOST, Financial) by 5,951,400 shares, resulting in a -69.62% decrease in shares and a -4.94% impact on the portfolio. The stock traded at an average price of $37.44 during the quarter and has returned 11.71% over the past 3 months and 24.09% year-to-date.

- Reduced Expedia Group Inc (EXPE, Financial) by 900,250 shares, resulting in a -44.62% reduction in shares and a -3.82% impact on the portfolio. The stock traded at an average price of $182.16 during the quarter and has returned -17.70% over the past 3 months and -10.61% year-to-date.

Portfolio Overview

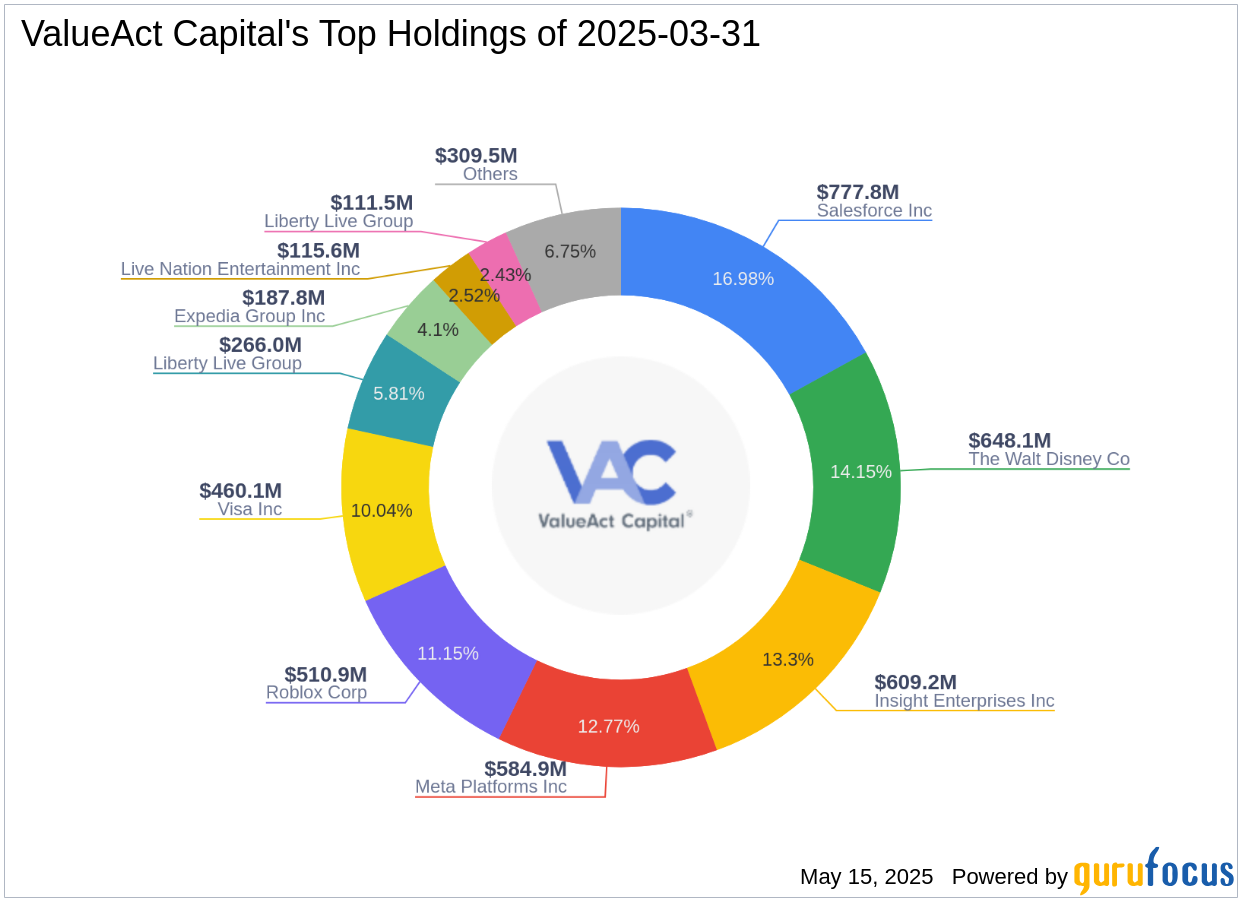

As of the first quarter of 2025, ValueAct Capital (Trades, Portfolio)'s portfolio included 14 stocks. The top holdings were 16.98% in Salesforce Inc (CRM, Financial), 14.15% in The Walt Disney Co (DIS, Financial), 13.3% in Insight Enterprises Inc (NSIT, Financial), 12.77% in Meta Platforms Inc (META, Financial), and 11.15% in Roblox Corp (RBLX, Financial).

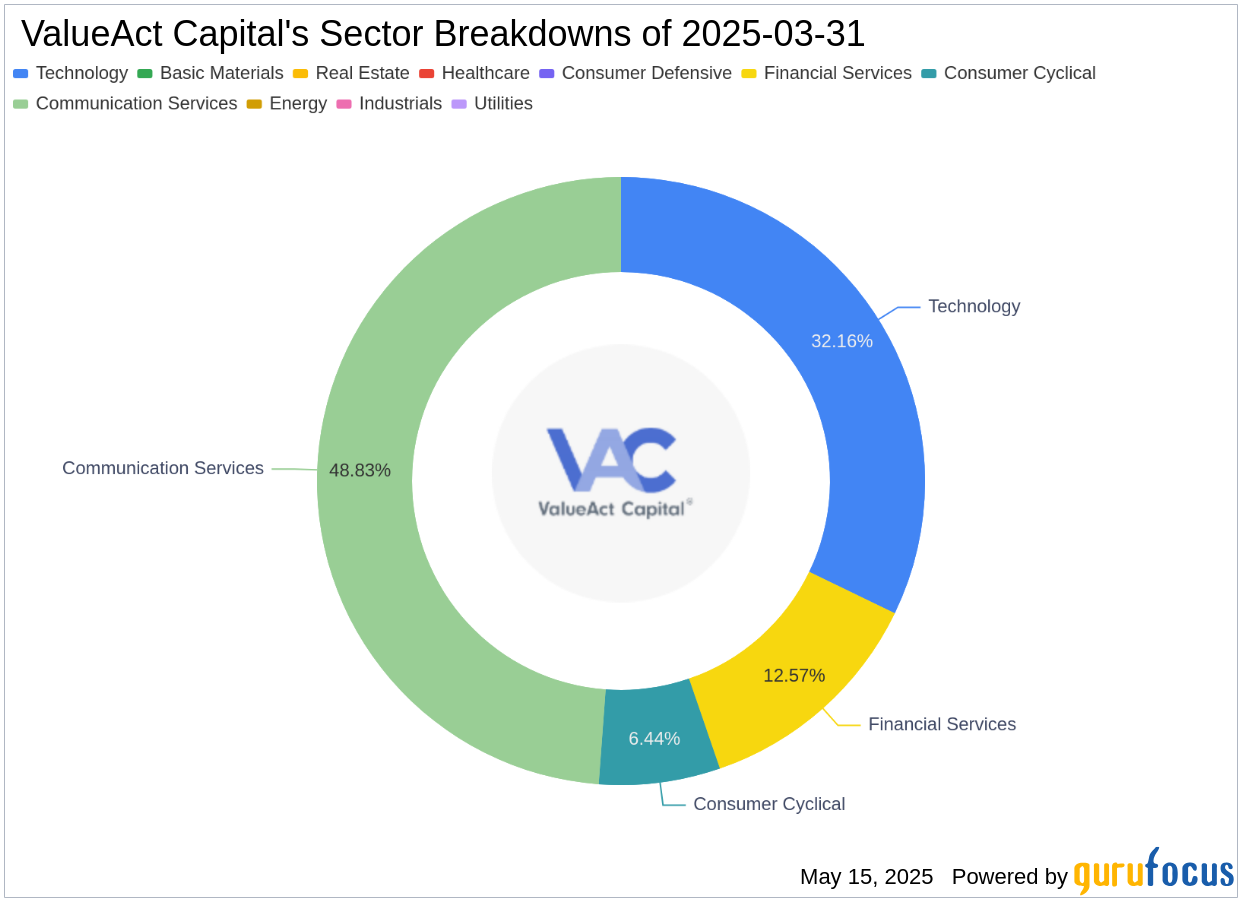

The holdings are primarily concentrated in four of the 11 industries: Communication Services, Technology, Financial Services, and Consumer Cyclical.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: