- Compagnie Financière Richemont reports solid fiscal year earnings, with a significant revenue increase.

- Analysts offer a stable one-year price target, indicating a slight downside from the current price.

- GuruFocus estimates suggest a notable difference between current trading price and GF Value.

Compagnie Financière Richemont (CFRHF) has released its fiscal year results, showcasing a GAAP earnings per share of €6.39. The company's revenue soared to €21.4 billion, representing a 3.8% increase compared to the previous year. This performance highlights Richemont's robust growth in a competitive market.

Analysts' Insights: Price Targets and Recommendations

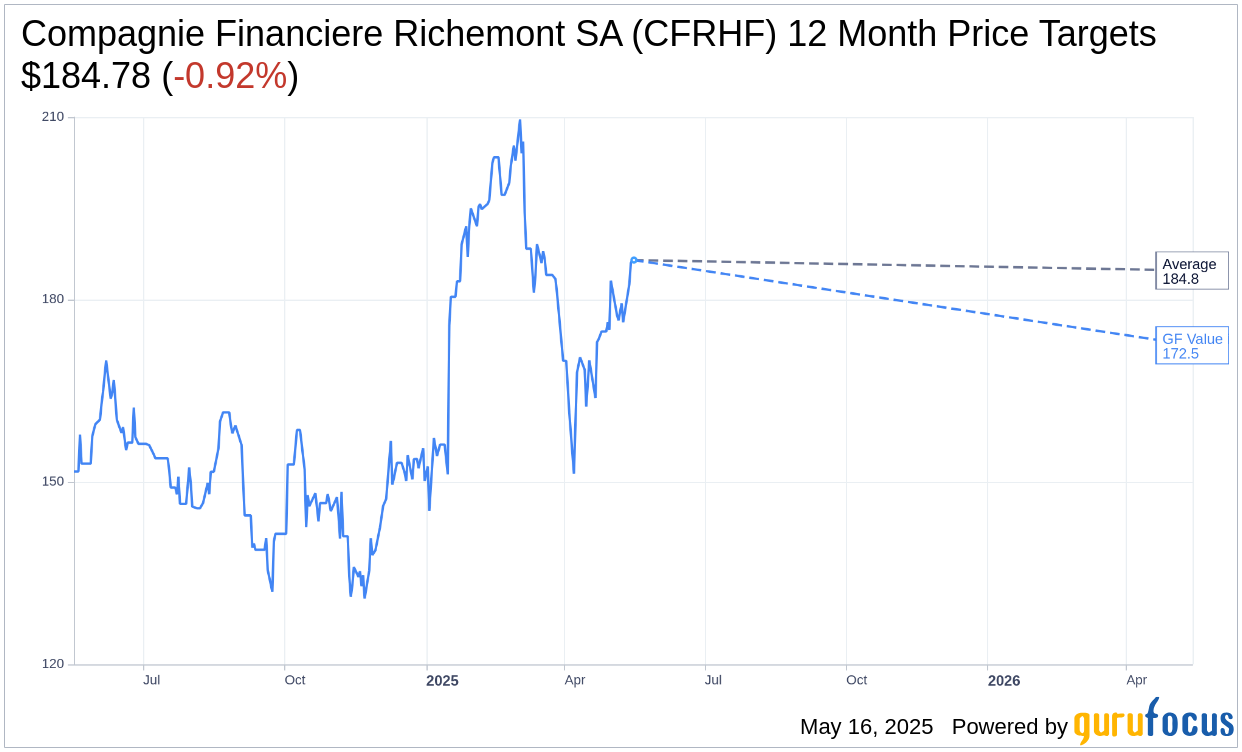

Financial analysts have projected a one-year average price target of $184.78 for Compagnie Financière Richemont SA (CFRHF, Financial), setting both the high and low estimates at the same figure. With the current stock price at $186.50, this prediction implies a slight downside of 0.92%. Investors can explore further details by visiting the Compagnie Financiere Richemont SA (CFRHF) Forecast page.

The consensus among brokerage firms gives Richemont a robust "Buy" status, with an average brokerage recommendation of 1.0 on a scale where 1 signifies Strong Buy and 5 denotes Sell. This positive outlook reflects confidence in the company's potential for future growth.

Evaluating the GF Value for Strategic Investments

According to GuruFocus estimates, the one-year GF Value for Richemont is calculated to be $172.48, suggesting a potential downside of 7.52% from the current stock price of $186.5. The GF Value is a critical metric provided by GuruFocus, representing an estimate of the stock's fair trading value based on its historical performance, growth trends, and future expectations. To delve deeper into the company's financial metrics and valuation, investors can visit the Compagnie Financiere Richemont SA (CFRHF, Financial) Summary page.