- Cosan (CSAN, Financial) reported a Q1 net loss that narrowed significantly from the previous year.

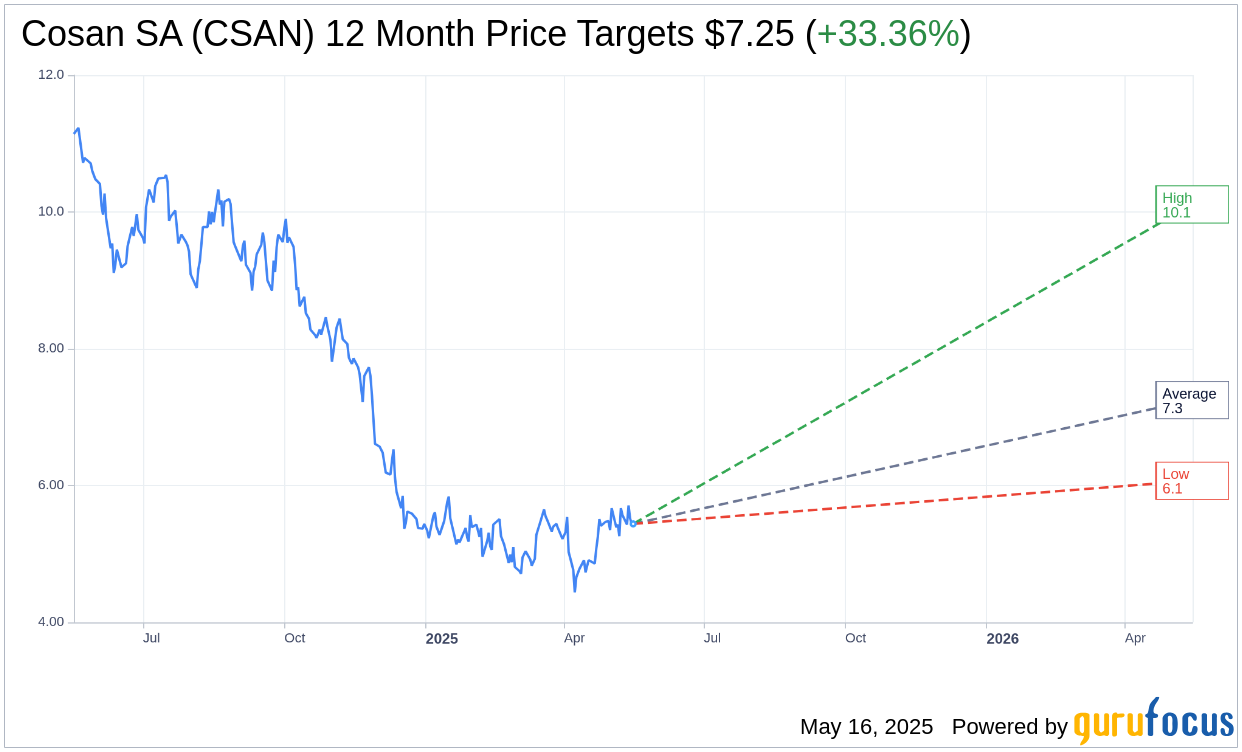

- Analysts see a potential 33.36% upside for Cosan stock, with price targets ranging from $6.07 to $10.11.

- GuruFocus estimates a substantial upside of 212.5% to a GF Value of $17.00.

Cosan (CSAN) has made significant strides in financial optimization, announcing a first-quarter net loss of R$1.8 billion, which reflects a reduction of R$1.6 billion compared to the prior year. A notable achievement is the reduction of net debt to R$17.5 billion, attributed to strategic initiatives such as selling Vale shares and astute debt management practices.

Wall Street Analysts' Insights

According to insights from four leading analysts, the average one-year price target for Cosan SA (CSAN, Financial) stands at $7.25. This target encompasses a high estimate of $10.11 and a low estimate of $6.07. With the current trading price at $5.44, these estimates suggest a promising upside of 33.36%. For a deeper dive into the numbers, visit the Cosan SA (CSAN) Forecast page.

The consensus rating from five brokerage firms classifies Cosan SA as "Outperform," with an average brokerage recommendation of 2.4 on a scale from 1 (Strong Buy) to 5 (Sell). This indicates a favorable outlook among analysts.

GuruFocus Valuation Insights

GuruFocus offers a compelling perspective with an estimated GF Value for Cosan SA (CSAN, Financial) in one year projected at $17.00. This figure represents a substantial upside of 212.5% from the current market price of $5.44. The GF Value reflects a comprehensive calculation that combines historical trading multiples, past growth, and future performance projections. Explore more about this valuation on the Cosan SA (CSAN) Summary page.