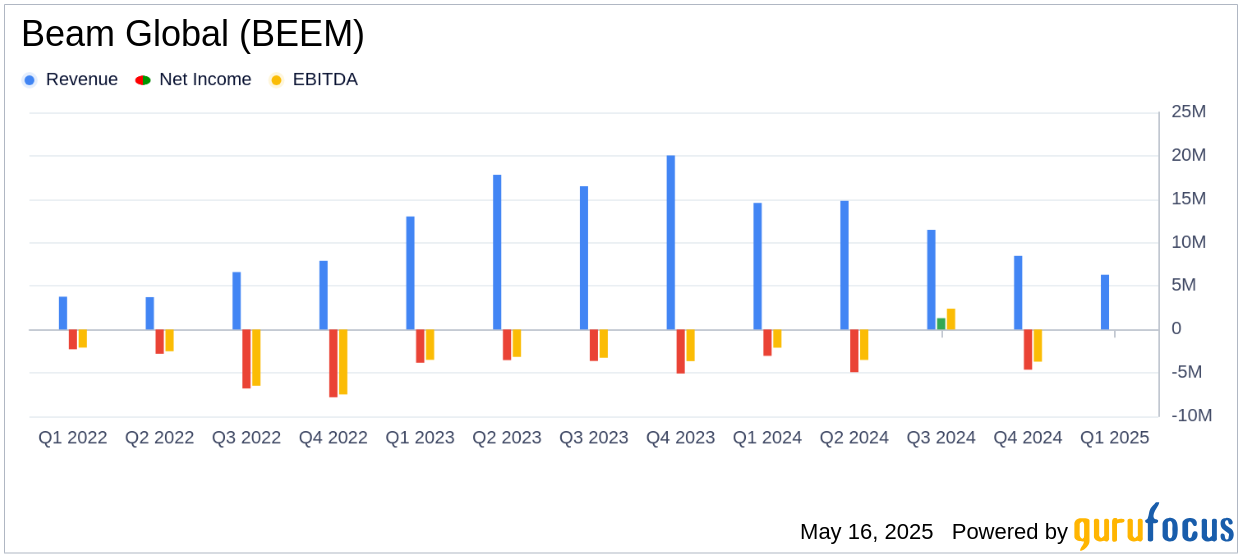

On May 15, 2025, Beam Global (BEEM, Financial) released its 8-K filing detailing its financial results for the first quarter of 2025. Beam Global, a leader in sustainable technology for electric vehicle (EV) charging and energy security, reported a challenging quarter with revenues of $6.3 million, falling short of the estimated $14.15 million. The company, known for its innovative EV ARC and Solar Treelines, continues to focus on expanding its international footprint and enhancing its product offerings.

Financial Highlights and Challenges

Beam Global's Q1 2025 revenue of $6.3 million represents a significant decline from the previous year's $14.56 million. This decrease is attributed to uncertainties in the U.S. government's zero-emission vehicle strategy, particularly related to the presidential election. Despite this, the company achieved a positive GAAP gross margin of 8% and an adjusted non-GAAP gross margin of 21%, indicating improved operational efficiency.

The company's net loss for the quarter was $15.5 million, which includes $12.5 million in non-cash expenses such as goodwill impairment and depreciation. This compares to a net loss of $3.0 million in the same period last year. The goodwill impairment of $10.8 million was due to a decrease in market capitalization, but Beam Global maintains that this does not reflect negatively on its operational performance or future prospects.

Strategic Achievements and International Expansion

Beam Global's strategic initiatives include expanding its European sales network and entering the Middle Eastern market. The company shipped EV ARC units and other infrastructure solutions to various U.S. states and internationally to countries like Croatia, Serbia, and Spain. The company also achieved CE certification for its EV ARC and was granted a U.S. patent for its High-Volume Battery Assembly and Safety Technology.

Though we are navigating through a series of uncertainties in the U.S. market, our other expansion efforts lead us to believe that we have the pieces in place to return to growth in this and future quarters," said Desmond Wheatley, CEO of Beam Global.

Financial Metrics and Balance Sheet Overview

Beam Global's balance sheet shows total assets of $46.8 million as of March 31, 2025, down from $61.5 million at the end of 2024. The company remains debt-free with a $100 million line of credit available. Cash reserves stood at $2.5 million, a decrease from $4.6 million at the end of the previous year. The company's backlog of $6.3 million and a focus on enterprise customers, which now account for 53% of revenues, highlight its strategic shift towards more stable revenue streams.

| Financial Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Revenue | $6.3 million | $14.56 million |

| Gross Profit | $0.5 million | $1.5 million |

| Net Loss | $(15.5) million | $(3.0) million |

| Cash | $2.5 million | $4.6 million |

Analysis and Future Outlook

Beam Global's Q1 2025 results reflect the challenges of navigating a volatile U.S. market while pursuing international growth. The company's strategic focus on diversifying its revenue streams and expanding its global presence is crucial for long-term sustainability. Despite the current financial setbacks, Beam Global's innovative product lineup and strategic partnerships position it well for future growth opportunities.

Investors and stakeholders will be keenly watching Beam Global's ability to leverage its international expansion and product innovations to offset domestic market challenges and drive future revenue growth.

Explore the complete 8-K earnings release (here) from Beam Global for further details.