Barclays has adjusted its price target for NetEase (NTES, Financial), raising it from $104 to $118 while maintaining an Equal Weight rating on the stock. This adjustment follows the company's recent earnings announcement, where new game releases performed well. The better-than-expected profit was mainly attributed to reduced expenses, which are expected to rise gradually. Investors received this update through a research note, highlighting the company's strategic moves in the gaming sector and the potential for growth. Despite the increase in the price target, the overall rating remains unchanged, indicating a balanced outlook on NetEase's stock performance.

Wall Street Analysts Forecast

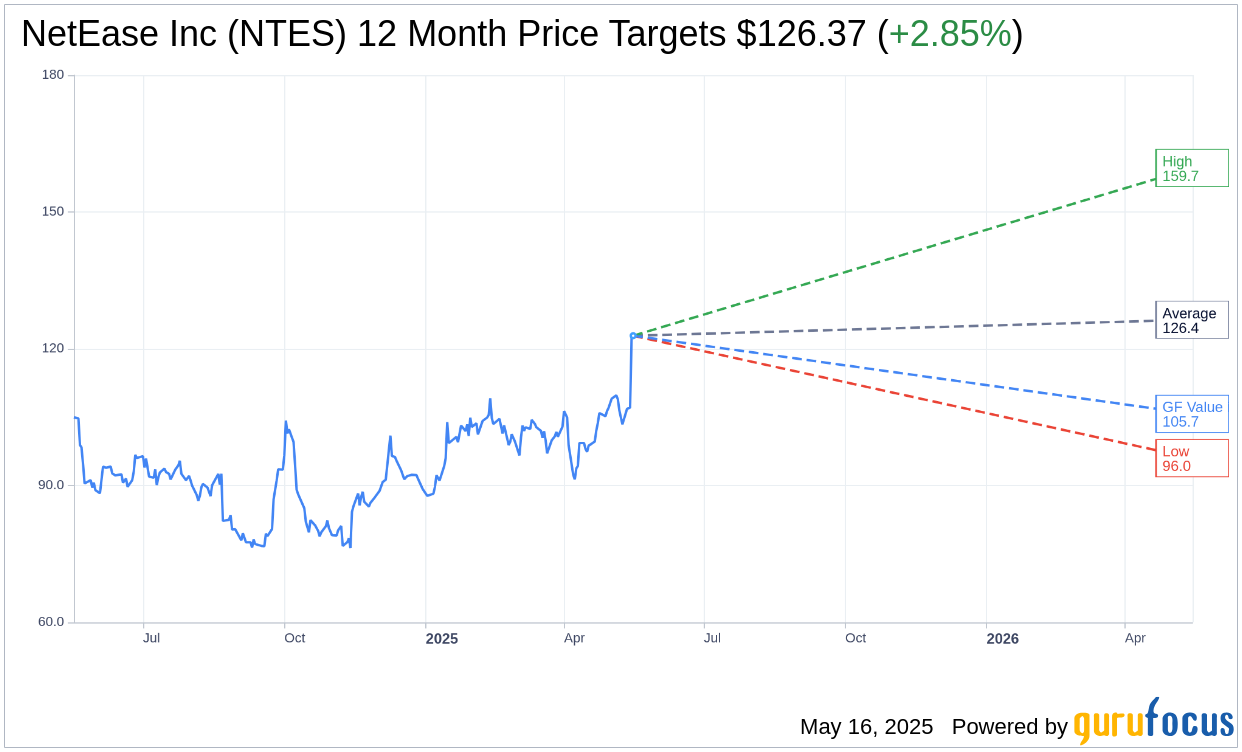

Based on the one-year price targets offered by 31 analysts, the average target price for NetEase Inc (NTES, Financial) is $126.37 with a high estimate of $159.65 and a low estimate of $96.01. The average target implies an upside of 2.85% from the current price of $122.86. More detailed estimate data can be found on the NetEase Inc (NTES) Forecast page.

Based on the consensus recommendation from 30 brokerage firms, NetEase Inc's (NTES, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for NetEase Inc (NTES, Financial) in one year is $105.73, suggesting a downside of 13.94% from the current price of $122.86. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the NetEase Inc (NTES) Summary page.

NTES Key Business Developments

Release Date: May 15, 2025

- Total Net Revenue: RMB28.8 billion (USD4.0 billion), up 7.4% year over year.

- Games and Related VAS Revenue: RMB24.0 billion, up 12% year over year.

- Online Games Revenue: RMB23.5 billion, up 14% quarter over quarter and 15% year over year.

- PC Games Revenue: 34% of total online games revenue, up 13% quarter over quarter and 85% year over year.

- Youdao Revenue: RMB1.3 billion, down 7% year over year and 3% quarter over quarter.

- NetEase Cloud Music Revenue: RMB1.9 billion, down 8% year over year and 1% quarter over quarter.

- Innovative Businesses and Others Revenue: RMB1.6 billion, down 17% year over year and 29% quarter over quarter.

- Gross Profit: RMB18.5 billion, up 9% year over year and 14% quarter over quarter.

- Gross Profit Margin: 64.1% in Q1 2025, compared to 63.4% in Q1 2024.

- Operating Expense: RMB8.0 billion, 28% of net revenues.

- Non-GAAP Net Income: RMB11.2 billion (USD1.5 billion), up 32% year over year.

- Non-GAAP Basic Earnings per ADS: USD2.44 or USD0.49 per share.

- Cash Position: RMB137.0 billion as of March 31, 2025.

- Dividend: USD0.135 per share or USD0.675 per ADS.

- Share Repurchase Program: 21.6 million ADS repurchased for USD1.9 billion.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- NetEase Inc (NTES, Financial) reported a 7% year-over-year increase in total net revenue, driven by strong performance in gaming and value-added services.

- The company's flagship titles and new game releases, such as Marvel Rivals and FragPunk, have achieved significant success globally, contributing to a 12% year-over-year increase in gaming revenue.

- NetEase Inc (NTES) has successfully expanded its global gaming portfolio, with games like Once Human and Where Winds Meet gaining traction in multiple regions.

- The company continues to innovate with AI-driven enhancements in gaming experiences and educational services, leading to strong user engagement and growth in AI subscription sales.

- NetEase Inc (NTES) maintains a robust cash position and has approved a dividend payout, reflecting strong financial health and shareholder value creation.

Negative Points

- NetEase Inc (NTES) faced a decline in Youdao's learning services revenue, with a 7% year-over-year decrease, as the company prioritizes core services with long-term potential.

- NetEase Cloud Music experienced an 8% decline in net revenue from the same period last year, primarily due to decreased revenue from social entertainment services.

- The company's innovative businesses and others segment saw a 17% year-over-year decrease in net revenue, impacted by declines in Yanxuan and advertising services.

- Despite the successful launch of Once Human mobile, monetization remains conservative, with management focusing on enhancing commercialization strategies.

- FragPunk's popularity declined rapidly after its initial launch, highlighting challenges in maintaining engagement in the competitive FPS game market.