Shares of Applied Materials (AMAT, Financial) slid about 5% in pre-market trading on Friday after the company beat second-quarter forecasts but flagged widening guidance and China risks.

The California-based equipment supplier posted earnings of $2.39 per share, beating analysts' estimates by eight cents. Revenue rose to $7.10 billion, up about 7% year-on-year but just shy of the $7.13 billion consensus.

Gross profit margin climbed to 49.2%, the highest since 2000. CFO Brice Hill attributed the improvement to a “favorable mix of our products and business segments,” while reiterating confidence in the company's supply chain and operational flexibility.

Applied Materials returned $2 billion to shareholders during the quarter through dividends and repurchases, reducing its share count by roughly 1.4%. It also authorized an additional $10 billion for future buybacks, bringing total remaining authorizations to $15.9 billion.

However, management widened its Q3 revenue outlook range by $100 million to account for ongoing macroeconomic and trade-related volatility. CEO Gary Dickerson also noted weaker sales in power electronics tools linked to the 200 mm wafer market, citing persistent export restrictions impacting demand from China.

Is Applied Materials a Buy Now?

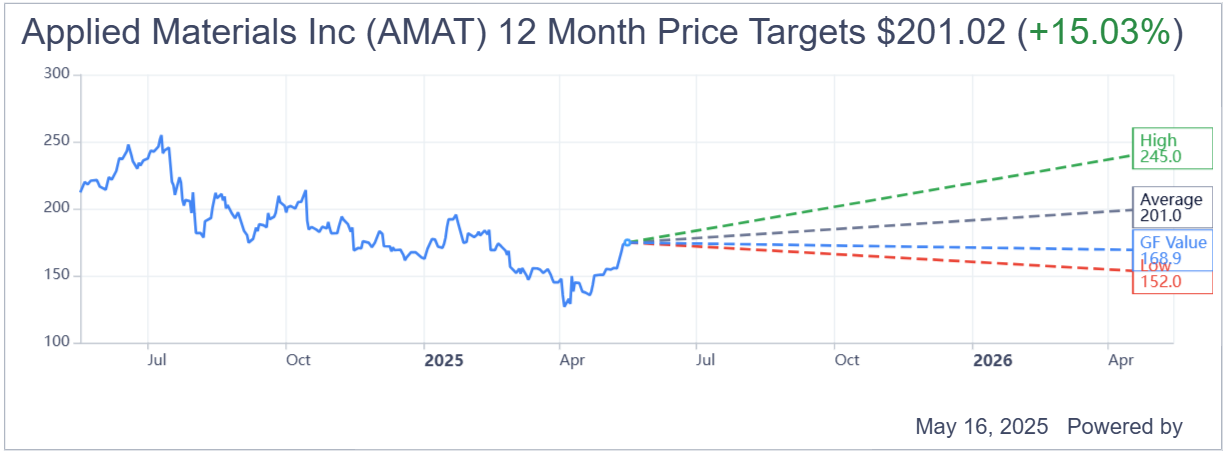

Based on the one year price targets offered by 32 analysts, the average target price for Applied Materials Inc is $201.02 with a high estimate of $245.00 and a low estimate of $152.00. The average target implies a upside of +15.03% from the current price of $174.75.

Based on GuruFocus estimates, the estimated GF Value for Applied Materials Inc in one year is $168.87, suggesting a downside of -3.36% from the current price of $174.75. For deeper insights, visit the AMAT Forecast page.