- Dingdong (DDL, Financial) records a Q1 revenue of $755 million, with a year-over-year growth of 8.5% but falls short of expectations by $4.06 million.

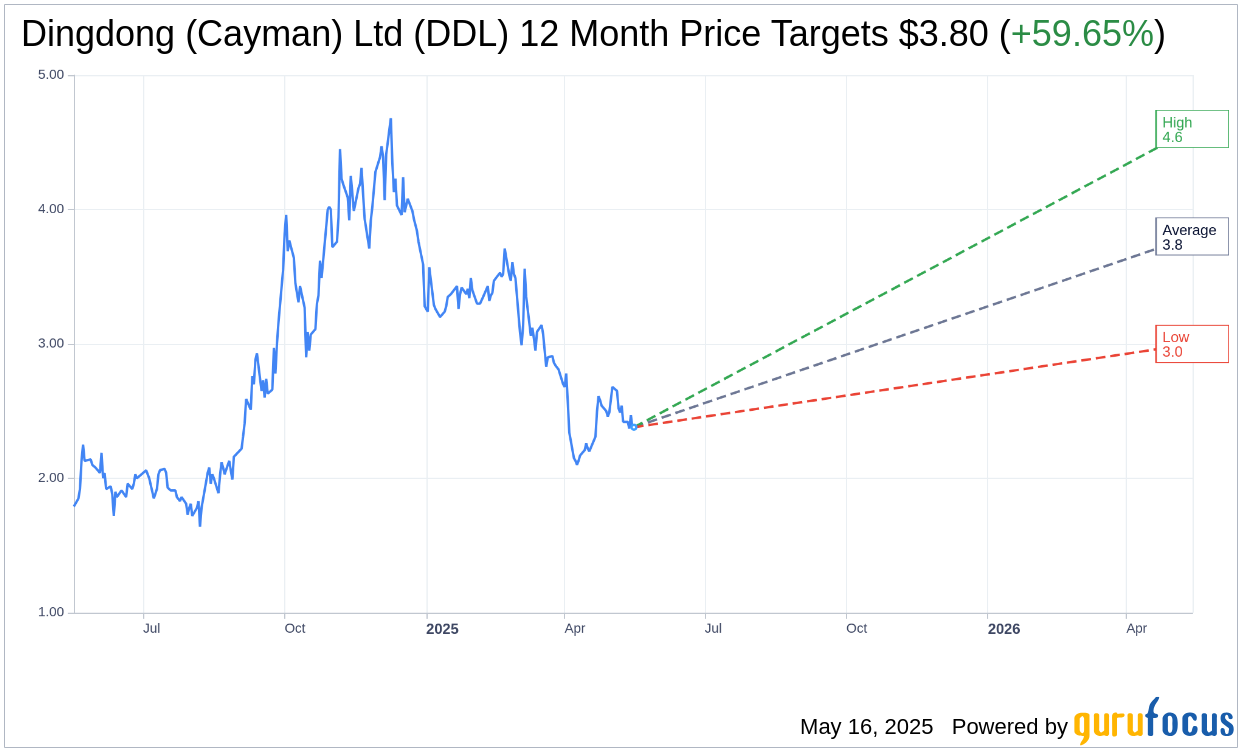

- Analysts project an average price target of $3.80, suggesting a 59.65% potential upside from the current stock price.

- Dingdong maintains an "Outperform" rating from analysts, with a brokerage recommendation average of 2.3.

Dingdong (Cayman) Ltd (DDL) recently reported its Q1 financial results, showcasing a revenue of $755 million. This marks an 8.5% increase compared to the same period last year, though the figure fell short by $4.06 million against projections. Amidst these results, Dingdong witnessed a robust rise in its total number of orders by 12.1%, positioning itself for future growth and profitability into Q2 2025.

Wall Street Analysts' Forecasts

In assessing Dingdong's stock potential, two Wall Street analysts have put forward one-year price targets for DDL. The average price target is set at $3.80, with estimates ranging from a high of $4.60 to a low of $3.00. This suggests a promising upside potential of approximately 59.65% from the current trading price of $2.38. For investors seeking detailed projections, additional information is available on the Dingdong (Cayman) Ltd (DDL, Financial) Forecast page.

Additionally, the consensus recommendation from three brokerage firms currently pegs Dingdong (Cayman) Ltd's (DDL, Financial) average brokerage recommendation at 2.3, signaling an "Outperform" status. This rating is derived from a scale where 1 indicates a Strong Buy and 5 represents a Sell, highlighting analysts' favorable outlook towards the stock's future performance.