- CRISPR Therapeutics is at the forefront of personalized gene therapy innovations.

- Analysts provide a mixed forecast with significant potential upside.

- GF Value suggests a potential downside, challenging investor perspectives.

A groundbreaking application of CRISPR technology has successfully delivered a customized treatment for a child afflicted with a rare genetic disorder. This landmark achievement signifies a pivotal progress in the realm of personalized gene therapies, potentially transforming future treatment landscapes with bespoke solutions tailored to individual patient needs.

Wall Street Analysts' Insights

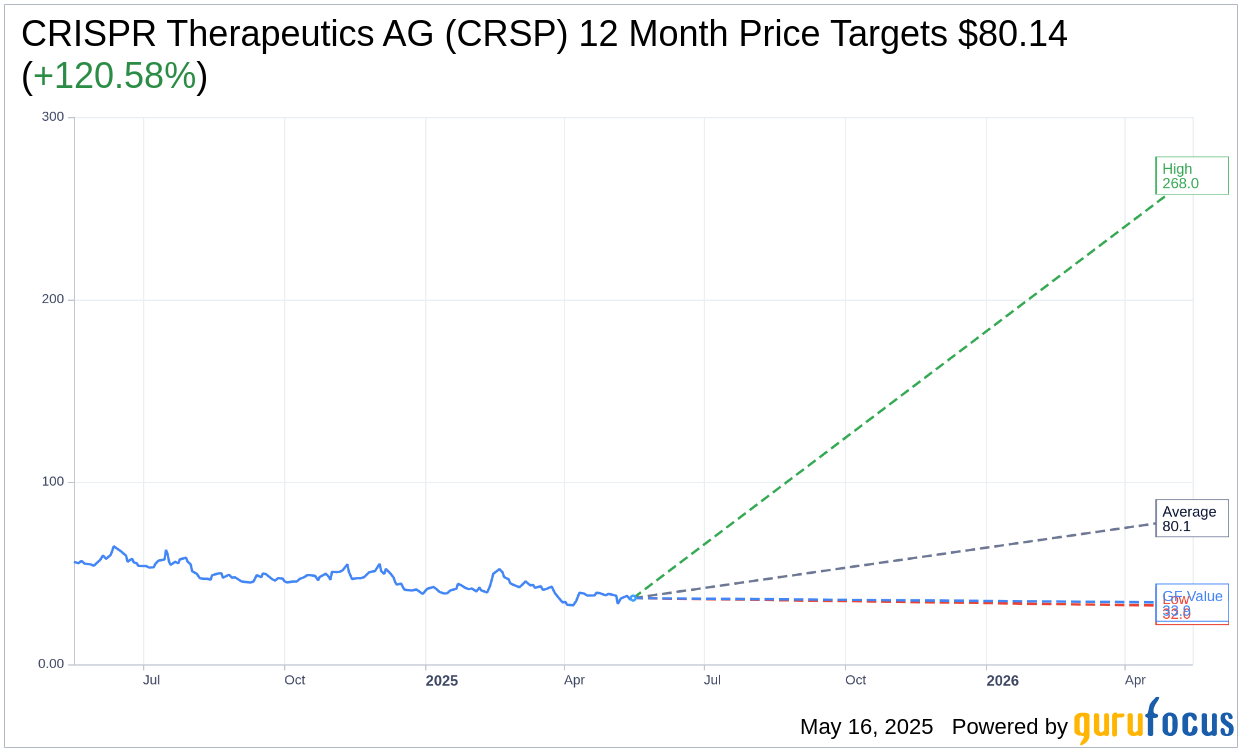

According to projections from 22 analysts, the average one-year price target for CRISPR Therapeutics AG (NASDAQ: CRSP) stands at $80.14. This forecast presents a high estimate reaching $268.00 and a low of $32.00, indicating an average potential upside of 120.58% from its current price of $36.33. Investors interested in a deeper dive can explore more detailed projections on the CRISPR Therapeutics AG (CRSP, Financial) Forecast page.

Brokerage Recommendations

The consensus from 28 brokerage firms places CRISPR Therapeutics AG at an average recommendation of 2.3, reflecting an "Outperform" status. This rating is based on a scale from 1 to 5, where a score of 1 indicates a Strong Buy, and 5 suggests a Sell. Such a rating underscores a generally positive outlook from analysts concerning future performance.

Evaluating GF Value

Per GuruFocus estimates, the projected GF Value for CRISPR Therapeutics AG in one year is $33.87. This suggests a potential downside of 6.77% from the current price of $36.33. The GF Value represents GuruFocus' fair value estimate, derived from historical trading multiples, previous business growth, and future performance projections. Investors can access more comprehensive data on the CRISPR Therapeutics AG (CRSP, Financial) Summary page.