Key Takeaways:

- Starbucks aims to enhance margins and reduce costs through strategic operational changes.

- Analyst price targets show a potential upside for Starbucks shares.

- The GF Value suggests a significant potential gain for investors.

Starbucks Corporation (SBUX, Financial) is taking strategic steps to boost its financial health. As shared by CFO Cathy Smith, the company plans to focus on improving margins and reducing overheads. Key initiatives include decreasing capital expenditures and ramping up service speed to strengthen customer loyalty. Additionally, Starbucks intends to increase labor hours, aiming to stimulate more transactions. Despite these initiatives, the company's shares have seen a 4.4% decline year-to-date.

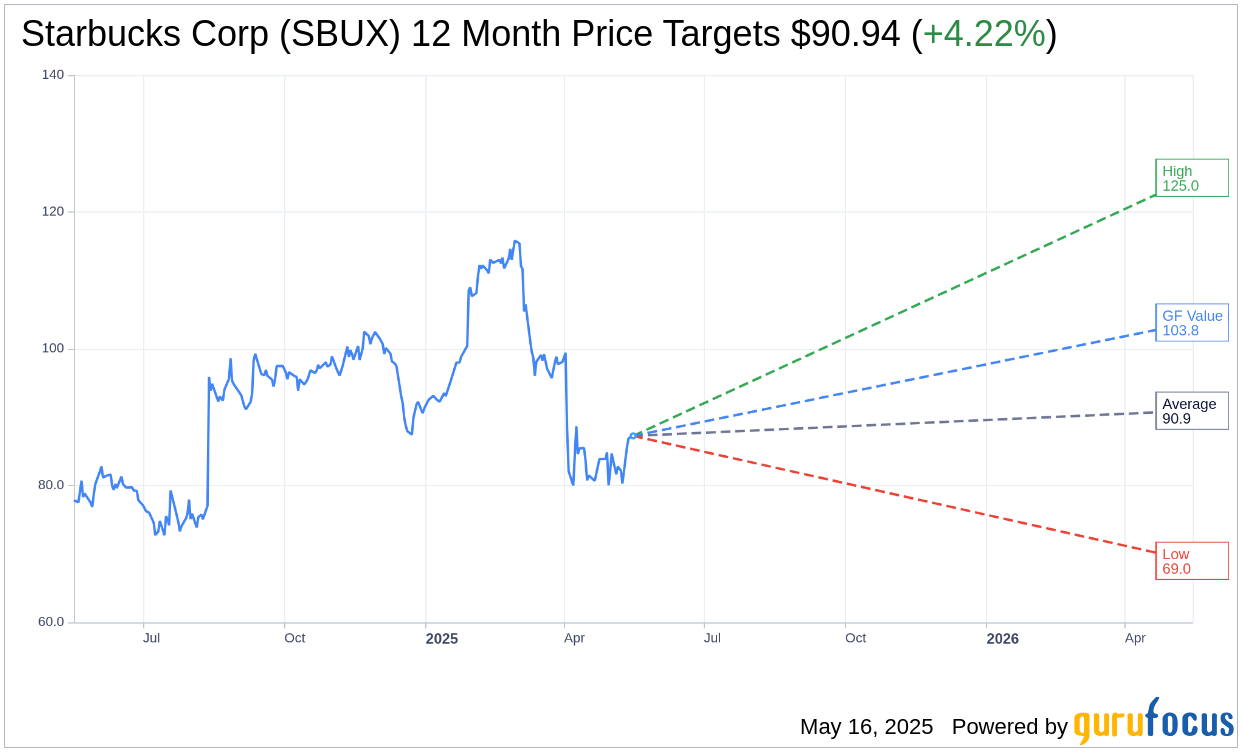

Wall Street Analysts Forecast

According to a survey of 30 analysts, the average one-year price target for Starbucks Corp (SBUX, Financial) stands at $90.94. This projection spans from a high of $125.00 to a low of $69.00, suggesting a potential upside of 4.22% from the recent stock price of $87.26. For a more detailed outlook, visit the Starbucks Corp (SBUX) Forecast page.

Furthermore, Starbucks Corp's (SBUX, Financial) average brokerage recommendation sits at 2.5, out of a 1 to 5 scale, indicating an "Outperform" status among 38 brokerage firms. Here, 1 represents a Strong Buy, while 5 indicates a Sell.

The estimated GF Value for Starbucks Corp (SBUX, Financial) is projected to be $103.84 in one year. This presents a promising upside of 19% from the current trading price of $87.26. The GF Value, a crucial metric from GuruFocus, is derived from historical trading multiples, past business growth, and future business performance estimates. For further insights, visit the Starbucks Corp (SBUX) Summary page.