Occidental (OXY, Financial) and its subsidiary, 1PointFive, have entered into a strategic agreement with XRG, a division of ADNOC, to explore a potential joint venture focused on creating a Direct Air Capture (DAC) facility in South Texas. Under this plan, XRG could potentially invest up to $500 million in developing a DAC facility capable of capturing 500,000 tonnes of carbon dioxide annually. This collaboration was formalized through a Strategic DAC Framework Agreement, signed by Occidental's President and CEO, Vicki Hollub, and ADNOC Group CEO, Dr. Sultan Ahmed Al Jaber, during a state visit by U.S. President Donald J. Trump to the United Arab Emirates.

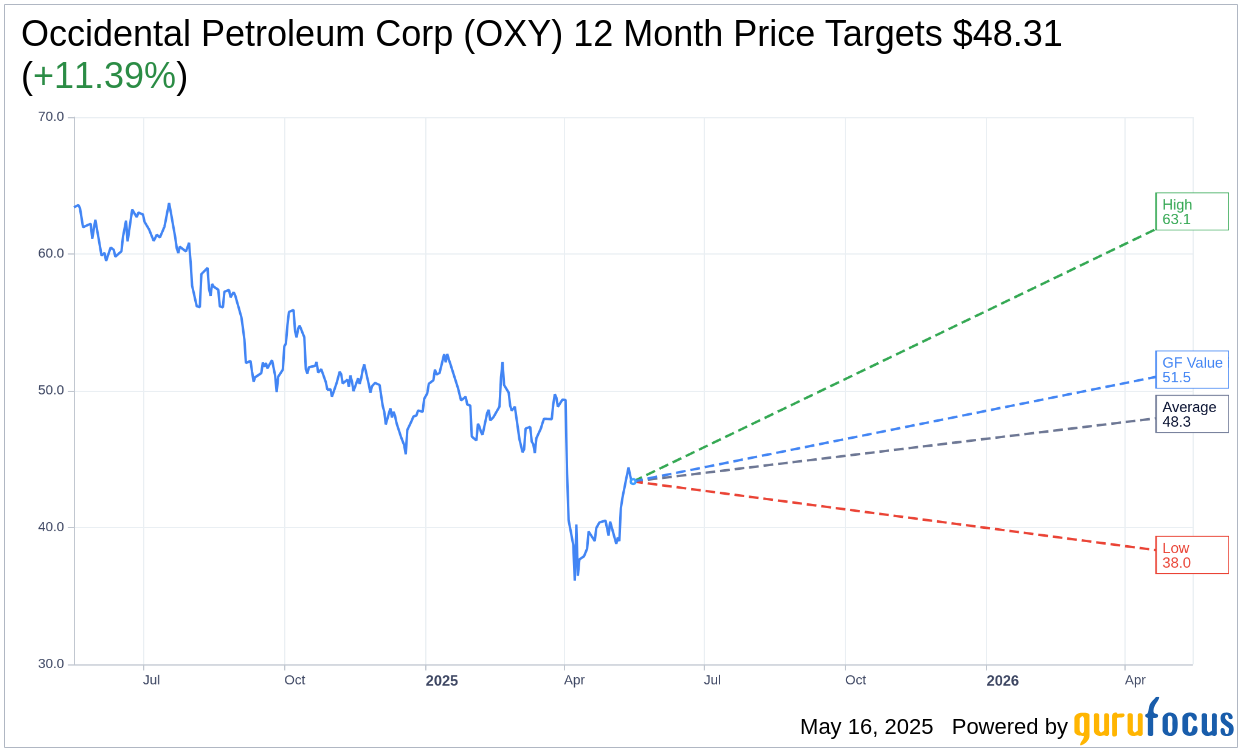

Wall Street Analysts Forecast

Based on the one-year price targets offered by 23 analysts, the average target price for Occidental Petroleum Corp (OXY, Financial) is $48.31 with a high estimate of $63.11 and a low estimate of $38.00. The average target implies an upside of 11.39% from the current price of $43.37. More detailed estimate data can be found on the Occidental Petroleum Corp (OXY) Forecast page.

Based on the consensus recommendation from 26 brokerage firms, Occidental Petroleum Corp's (OXY, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Occidental Petroleum Corp (OXY, Financial) in one year is $51.55, suggesting a upside of 18.86% from the current price of $43.37. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Occidental Petroleum Corp (OXY) Summary page.

OXY Key Business Developments

Release Date: May 08, 2025

- Operating Cash Flow: $3 billion before working capital in Q1 2025.

- Oil and Gas Production: Over 1.39 million BOE per day, at the midpoint of guidance.

- Domestic Operating Cost: $9.05 per BOE, below initial expectations.

- Permian Well Cost Reduction: More than 10% reduction compared to last year.

- Adjusted Profit: $0.87 per diluted share.

- Reported Profit: $0.77 per diluted share.

- Free Cash Flow: Approximately $1.2 billion before working capital.

- Unrestricted Cash: $2.6 billion at the end of Q1 2025.

- Debt Reduction: $2.3 billion retired year-to-date; $6.8 billion over the past 10 months.

- Interest Expense Reduction: $370 million annually from debt repayment.

- OxyChem Performance: $215 million on an adjusted basis.

- Midstream and Marketing Outperformance: Driven by strong gas marketing optimization in the Permian.

- Capital Guidance Reduction: Lowered by $200 million for the year.

- Operating Cost Savings: Estimated $150 million in 2025 OpEx savings.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Occidental Petroleum Corp (OXY, Financial) generated $3 billion in operating cash flow before working capital in the first quarter, showcasing strong financial performance.

- The company achieved a 15% improvement in drilling duration per well in the Permian, leading to a 10% reduction in unconventional well costs, surpassing their initial target.

- OXY is in advanced negotiations to extend the Block 53 contract in Oman by 15 years, potentially unlocking over 800 million gross barrels of additional resources.

- The midstream and marketing business outperformed expectations, driven by strong gas marketing optimization in the Permian.

- OxyChem delivered $215 million on an adjusted basis, overcoming operational challenges and extending its market leadership as a low-cost operator.

Negative Points

- The company faces heightened volatility and uncertainty in the macro environment, impacting commodity price stability.

- OXY's Gulf of America production guidance was revised down due to discretionary capital optimization, including deferring a development well into 2026.

- The company is experiencing elevated domestic operating expenses per BOE due to production mix shifts and maintenance activities.

- Uncertainty around global trade and economic conditions in China is impacting the chemical segment's pricing and demand.

- OXY is closely monitoring the evolving macro backdrop and may need to scale back activity if commodity prices weaken significantly.