- SFL Corporation Ltd holds strong with a stable quarterly dividend, offering an enticing forward yield of 12.39%.

- Analysts foresee a potential 28.38% upside with a target price of $11.40 for SFL Corporation Ltd.

- GuruFocus' valuation suggests a promising 33.78% upside based on the estimated GF Value.

SFL Corporation Ltd (SFL, Financial) continues to attract investor attention with its latest announcement of a quarterly dividend of $0.27 per share, maintaining its previous payout. This decision solidifies a forward yield of 12.39%, which is appealing to income-focused investors. The dividend is set for distribution on June 27, with investors needing to be on record by June 12, which is also the ex-dividend date.

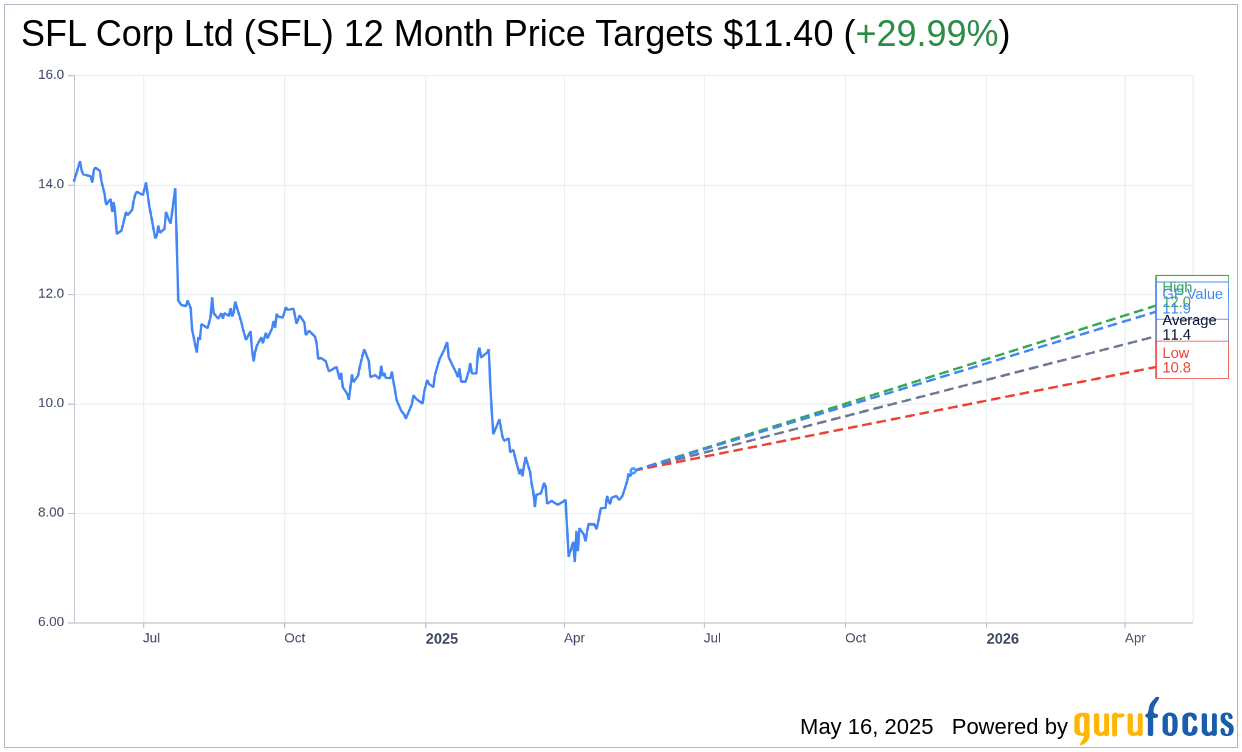

Wall Street Analysts Forecast

Informed by the insights of three financial analysts, the one-year price target for SFL Corporation Ltd (SFL, Financial) averages at $11.40. With projections ranging from a high of $12.00 to a low of $10.80, these estimates signal an optimistic upside potential of 28.38% from the current trading price of $8.88. Investors seeking more comprehensive estimate data can explore the details on the SFL Corp Ltd (SFL) Forecast page.

Moreover, with a consensus recommendation score of 2.0 from four brokerage firms, SFL Corporation Ltd (SFL, Financial) holds an "Outperform" status. The rating scale ranges from 1, indicating a Strong Buy, to 5, denoting a Sell, suggesting a positive outlook from analysts.

GuruFocus GF Value Insight

Delving into the valuation metrics, GuruFocus estimates the GF Value of SFL Corporation Ltd (SFL, Financial) at $11.88 over the next year. This figure implies an enticing upside of 33.78% from its current price of $8.88. The GF Value is GuruFocus' measure of what the stock should ideally be worth, derived from its historical trading multiples, past business growth, and future performance expectations. For those interested in diving deeper, additional data is available on the SFL Corp Ltd (SFL) Summary page.

Also check out: (Free Trial)