Bristol Myers Squibb (BMY, Financial) has secured approval from the European Commission for a new treatment approach involving Opdivo for patients with resectable non-small cell lung cancer (NSCLC). This regimen, intended for adult patients whose tumors express PD-L1 at levels of 1% or higher, involves administering Opdivo in combination with chemotherapy before surgery, followed by Opdivo alone afterward. This approval introduces another valuable perioperative immunotherapy option for individuals at high risk of recurrence, aiming to reduce the likelihood of the cancer coming back and enhancing long-term patient outcomes.

The approval is significant as it offers a novel strategy that could potentially alter the treatment landscape for certain NSCLC patients, providing them with better chances of preventing cancer recurrence and improving their survival prospects. Bristol Myers Squibb aims to meet the critical need for effective interventions at the early stages of the cancer treatment process with this newly sanctioned option.

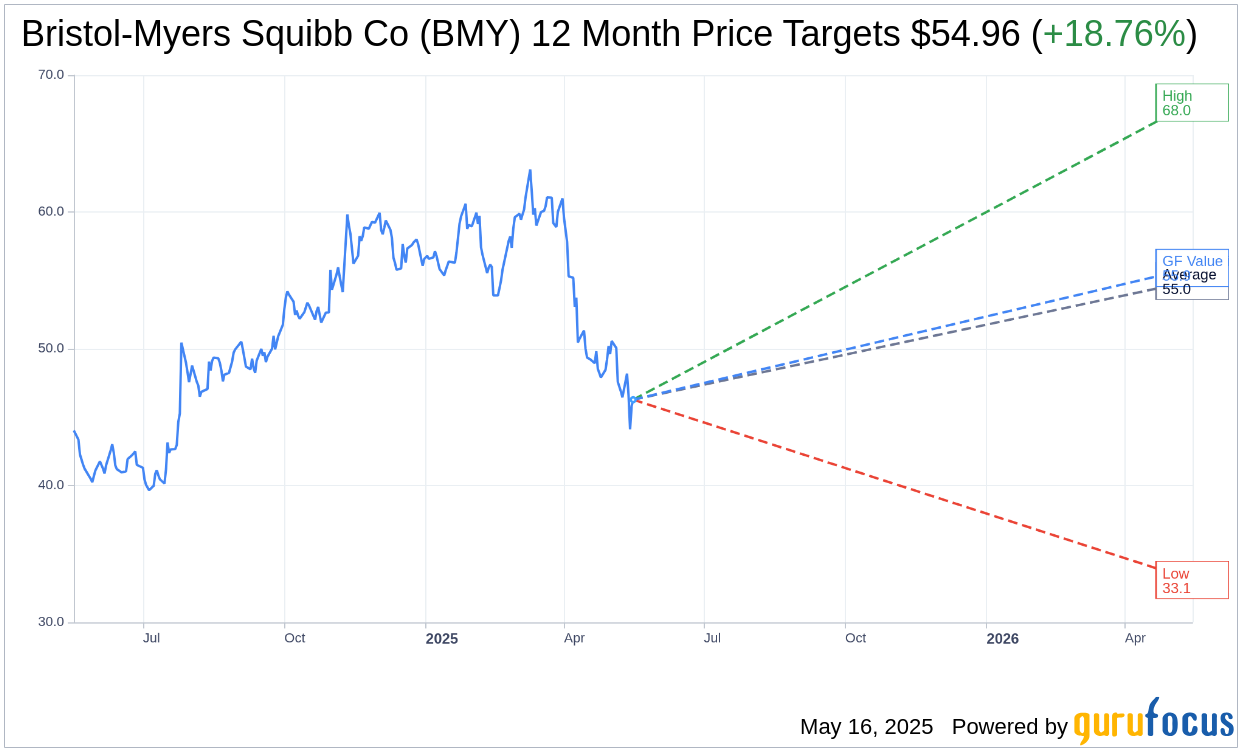

Wall Street Analysts Forecast

Based on the one-year price targets offered by 21 analysts, the average target price for Bristol-Myers Squibb Co (BMY, Financial) is $54.96 with a high estimate of $68.00 and a low estimate of $33.10. The average target implies an upside of 18.76% from the current price of $46.28. More detailed estimate data can be found on the Bristol-Myers Squibb Co (BMY) Forecast page.

Based on the consensus recommendation from 28 brokerage firms, Bristol-Myers Squibb Co's (BMY, Financial) average brokerage recommendation is currently 2.7, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Bristol-Myers Squibb Co (BMY, Financial) in one year is $55.91, suggesting a upside of 20.81% from the current price of $46.28. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Bristol-Myers Squibb Co (BMY) Summary page.