Key Highlights:

- ZIM Integrated's earnings per share are expected to skyrocket by 161.3% year-over-year.

- Projected revenue growth for Q1 stands at an impressive 17.9%.

- Current analyst sentiment suggests a potential downside for the stock.

ZIM Integrated (ZIM, Financial) is set to reveal its first-quarter earnings on May 19, before the opening bell. Analysts are anticipating a notable leap in financial performance, predicting a 161.3% surge in earnings per share to $1.96, and a 17.9% uptick in revenue to $1.84 billion.

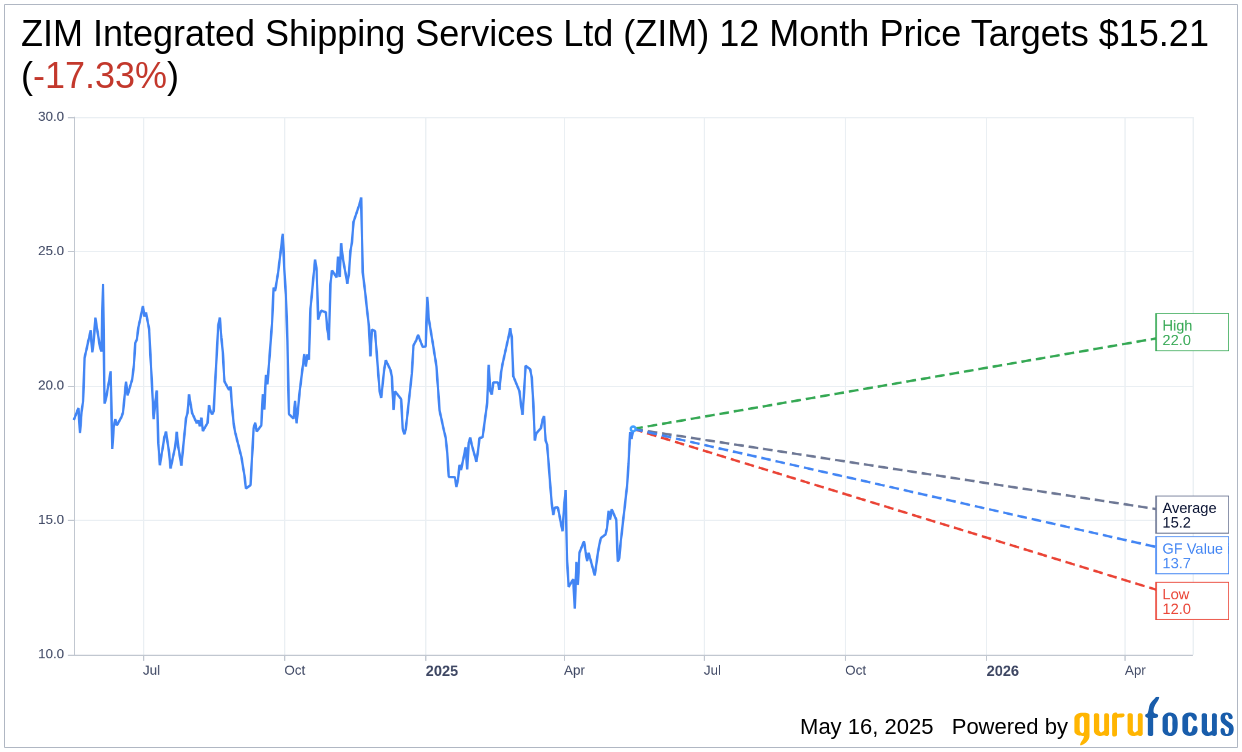

Analyst Price Forecast

Wall Street analysts have provided one-year price targets for ZIM Integrated Shipping Services Ltd (ZIM, Financial), presenting an average target price of $15.21. Their forecasts range from a high of $22.00 to a low of $12.00, suggesting an average potential downside of 17.33% from ZIM's current price of $18.40. Investors looking for more comprehensive estimate data can explore the ZIM Integrated Shipping Services Ltd (ZIM) Forecast page.

Brokerage Recommendations

The consensus from eight brokerage firms categorizes ZIM Integrated Shipping Services Ltd (ZIM, Financial) with an average recommendation of 3.8, classifying it as "Underperform." This scale ranges from 1 to 5, where 1 indicates a Strong Buy, and 5 signifies Sell.

GF Value Estimate

According to GuruFocus, the estimated GF Value for ZIM Integrated Shipping Services Ltd (ZIM, Financial) in the upcoming year is projected to be $13.70. This estimation suggests a downside of 25.54% from the current stock price of $18.40. The GF Value represents GuruFocus' assessment of what the stock should be valued at, derived from historical multiples, past business growth, and anticipated future performance. For a deeper analysis, visit the ZIM Integrated Shipping Services Ltd (ZIM) Summary page.