Take-Two Interactive (TTWO, Financial) just put up numbers that demand attention. Revenue came in at $1.58 billion, up 17.3% year-over-year, beating analyst expectations and powered by heavyweights like NBA 2K25, GTA Online, and a deep mobile portfolio. CEO Strauss Zelnick credited “outstanding” label-wide execution and projected FY2026 net bookings of $5.9–$6.0 billion. The real wildcard? Grand Theft Auto VI, set to launch in FY2027—which management believes could reset the baseline for long-term growth and profitability.

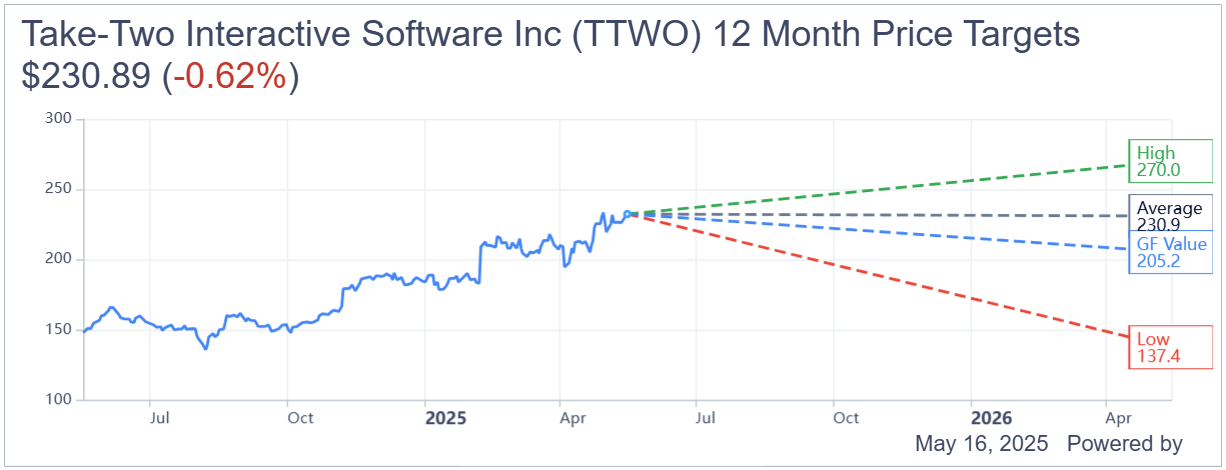

Wall Street's still leaning bullish. Analyst price targets range from $210 to $250, with some outliers stretching to $270 and as low as $137.43. The average 12-month target sits at $230.89—nearly flat from the current price of $232.34. But here's where things get uncomfortable: GuruFocus estimates the GF Value at $205.24, which suggests a potential downside of -11.66%. The market may be pricing in perfection—and when that happens, any misstep can hit harder than expected.

The chart doesn't lie. Take-Two is trading well above its GF Value, hinting at a stock that may be edging into overvalued territory. Momentum's been solid, but the risk-reward here is no longer screaming asymmetry. For investors betting on franchise power and digital monetization, this name stays relevant. But with this kind of setup? Chasing it at the top might not be the smartest play.