Key Highlights:

- Quantum Computing Inc (QUBT, Financial) surges over 36% after surpassing first-quarter earnings expectations.

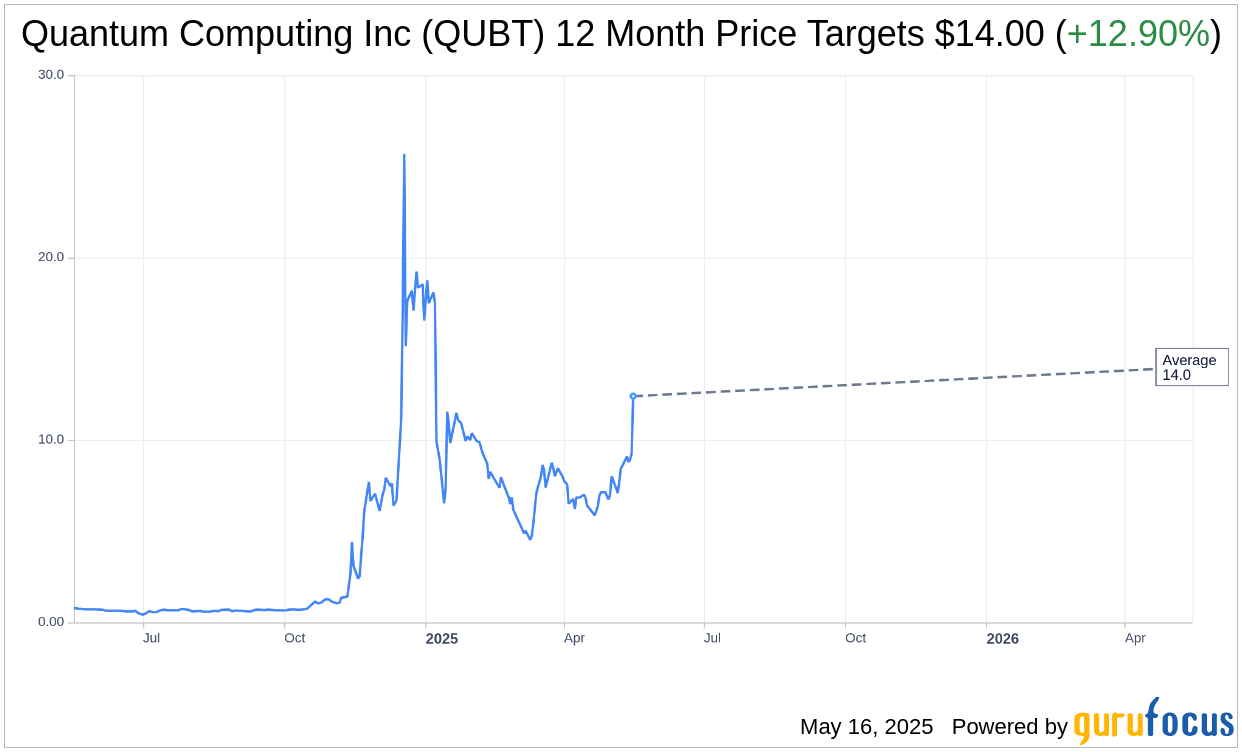

- Analysts predict a potential 14.01% upside with a target price of $14.00.

- Despite current growth, the GF Value suggests a significant downside risk.

Quantum Computing (QUBT) recently witnessed a remarkable surge in its stock price, climbing over 36% as the company unveiled first-quarter earnings that shattered expectations. Quantum Computing reported earnings of $0.11 per share on $39,000 in revenue, exceeding what analysts had anticipated.

Wall Street Analysts Forecast

According to one analyst's one-year price targets, Quantum Computing Inc (QUBT, Financial) averages a target price of $14.00. This analysis offers both a high and low estimate of $14.00, suggesting a potential upside of 14.01% from the current trading price of $12.28. For further detailed estimate data, investors can visit the Quantum Computing Inc (QUBT) Forecast page.

The consensus from one brokerage firm positions Quantum Computing Inc's (QUBT, Financial) average brokerage recommendation at 2.0, categorizing it as "Outperform." The rating scale ranges from 1 to 5, with 1 representing a Strong Buy and 5 indicating a Sell.

Long-term Stock Valuation Concerns

Despite the optimistic current trading outlook, the GF Value projection estimates that Quantum Computing Inc (QUBT, Financial) in one year could be valued at $1.28. This suggests a substantial downside risk of 89.58% from the current price of $12.2801. The GF Value is GuruFocus' estimate of the stock's fair trading value, derived from historical trading multiples, past business growth, and future performance projections. For more in-depth analysis, investors are encouraged to explore the Quantum Computing Inc (QUBT) Summary page.