Key Highlights:

- Take-Two Interactive (TTWO, Financial) showcases robust Q4 results with significant revenue growth.

- Analysts maintain optimistic outlooks with a mix of target price estimations.

- Future projections signal potential growth, fueled by impending game releases.

Take-Two Interactive (TTWO) has reported impressive fourth-quarter results, highlighting its robust performance amidst industry challenges. With $1.58 billion in bookings and non-GAAP earnings of $1.08 per share, the company demonstrates its capacity to generate substantial revenue streams. Despite a notable $3.55 billion goodwill impairment, Take-Two remains optimistic, projecting fiscal year 2026 net bookings between $5.9 billion and $6 billion. This optimism is buoyed by the much-anticipated release of Grand Theft Auto VI, which is expected to significantly enhance future profitability.

Wall Street Analysts’ Projections

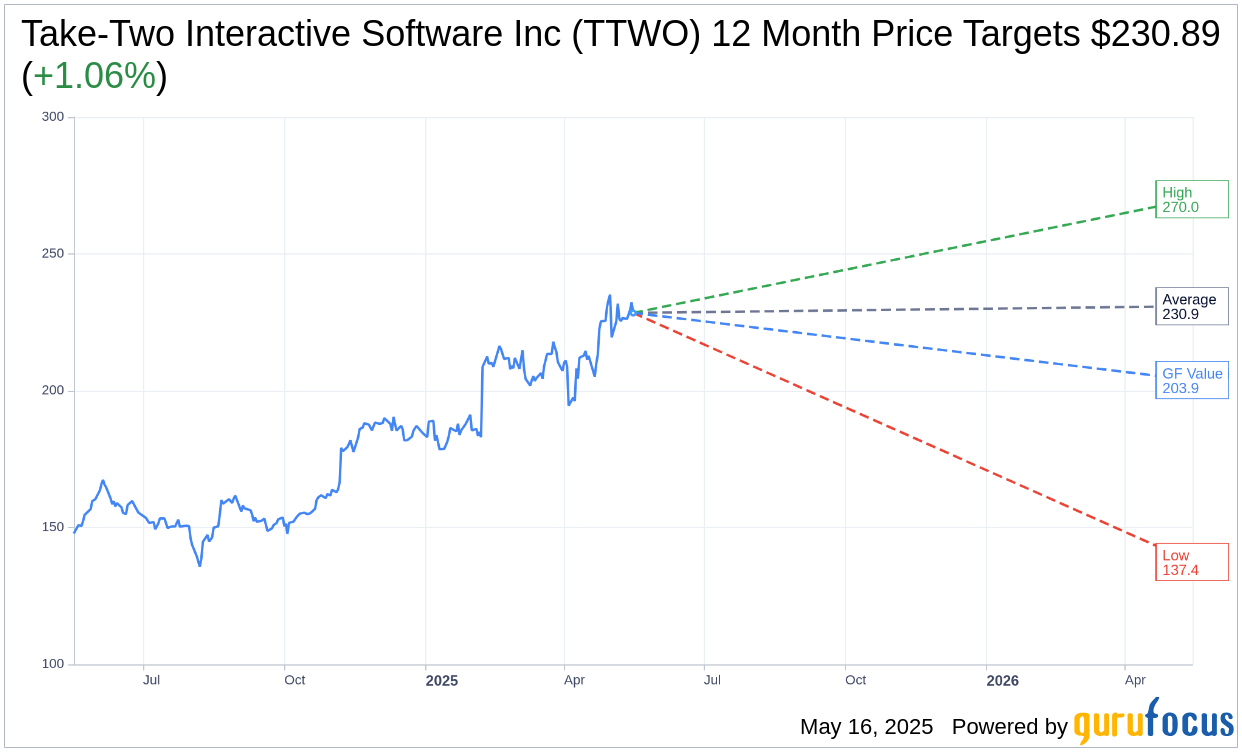

Wall Street analysts have set ambitious price targets for Take-Two Interactive Software Inc (TTWO, Financial). Based on the year-ahead projections from 28 analysts, the average target price stands at $230.89. Notably, estimates range from a high of $270.00 to a low of $137.43. The current average target suggests a modest upside potential of 1.06% from its existing price of $228.47. Investors can explore more detailed projections on the Take-Two Interactive Software Inc (TTWO) Forecast page.

Further analysis by 30 brokerage firms results in a consensus recommendation of 1.8 for Take-Two Interactive Software Inc (TTWO, Financial), positioning the stock in the "Outperform" category. This rating underscores investor confidence in the company’s strategic direction and future growth potential, where the scale spans from a "Strong Buy" at 1, to a "Sell" at 5.

GuruFocus Valuation Insight

According to GuruFocus estimates, the GF Value for Take-Two Interactive Software Inc (TTWO, Financial) is projected at $203.92 over the next year. This suggests a possible downside of 10.74% from its current stock price of $228.465. The GF Value is a proprietary metric by GuruFocus that provides an estimation of the stock's fair trading value, calculated through historical multiples, past growth, and future performance forecasts. Investors seeking deeper insights can visit the Take-Two Interactive Software Inc (TTWO) Summary page for comprehensive data.