- Uber's stock experienced a significant uptick following its annual GO-GET event.

- Wall Street analysts project a moderate upside for Uber's stock in the coming year.

- GuruFocus estimates suggest a potential downside based on current valuations.

Uber Technologies Inc. (UBER) recently energized the market with its annual GO-GET event, unveiling new cost-efficient ride options and user-centric innovations. A major highlight was their strategic alliance with Volkswagen, aiming to introduce electric autonomous vehicles by 2026. With the addition of enhanced Uber One benefits, Uber's stock climbed by 2.1% on the Friday following the event, marking an impressive 10% surge over the week.

Wall Street Analysts' Projections

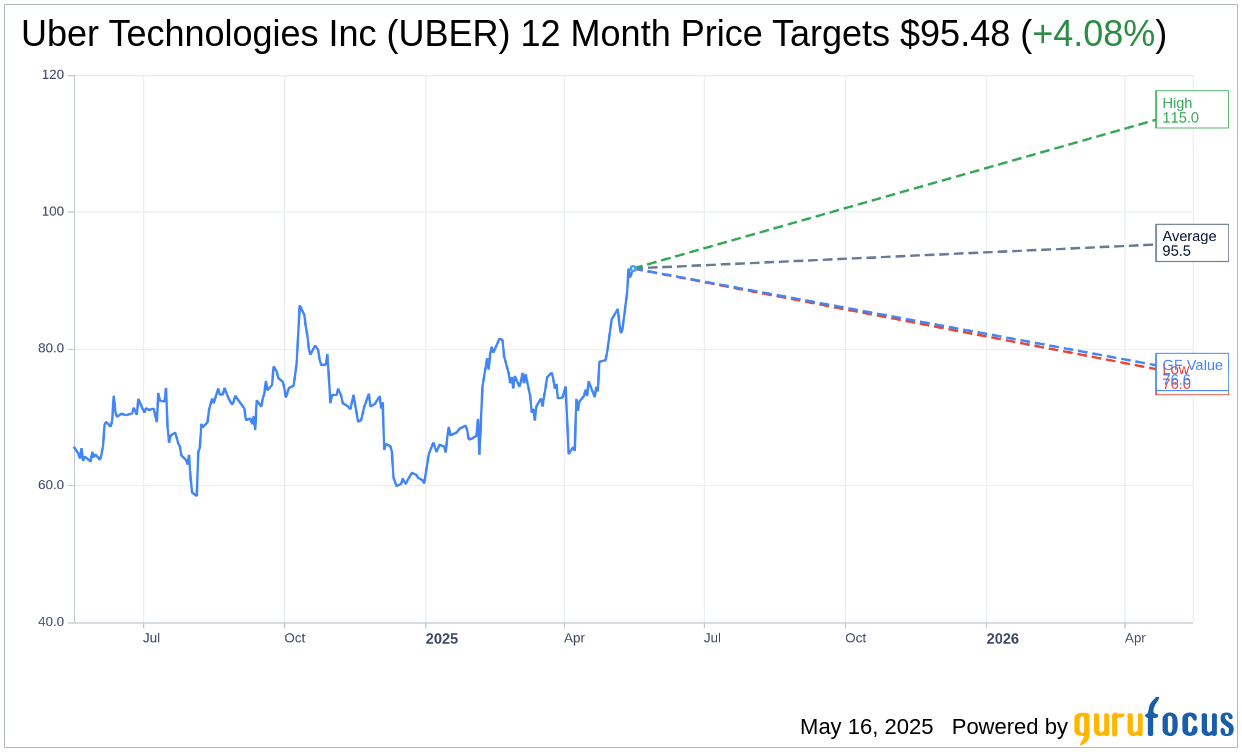

According to projections by 44 analysts, Uber Technologies Inc. (UBER) is anticipated to reach an average price target of $95.48 in the next year. Expectations range from a high of $115.00 to a low of $76.00, implying a modest upside potential of 4.08% from the current price of $91.74. For more in-depth analysis, visit the Uber Technologies Inc (UBER, Financial) Forecast page.

The consensus from 52 brokerage firms calls for an "Outperform" rating for Uber Technologies Inc. (UBER), with an average recommendation score of 2.0 on a scale where 1 indicates a Strong Buy and 5 signifies a Sell.

GuruFocus Valuation Insights

Leveraging GuruFocus estimates, the projected GF Value for Uber Technologies Inc. (UBER) over the next year stands at $76.61, suggesting a potential downside of 16.49% from the current market price of $91.74. The GF Value represents GuruFocus' assessment of a stock's fair value, derived from historical trading multiples, past business growth, and future business performance estimates. For further details, explore the Uber Technologies Inc (UBER, Financial) Summary page.