- Regulatory Milestone: Bristol Myers Squibb secures European Commission approval for Opdivo in combination with chemotherapy.

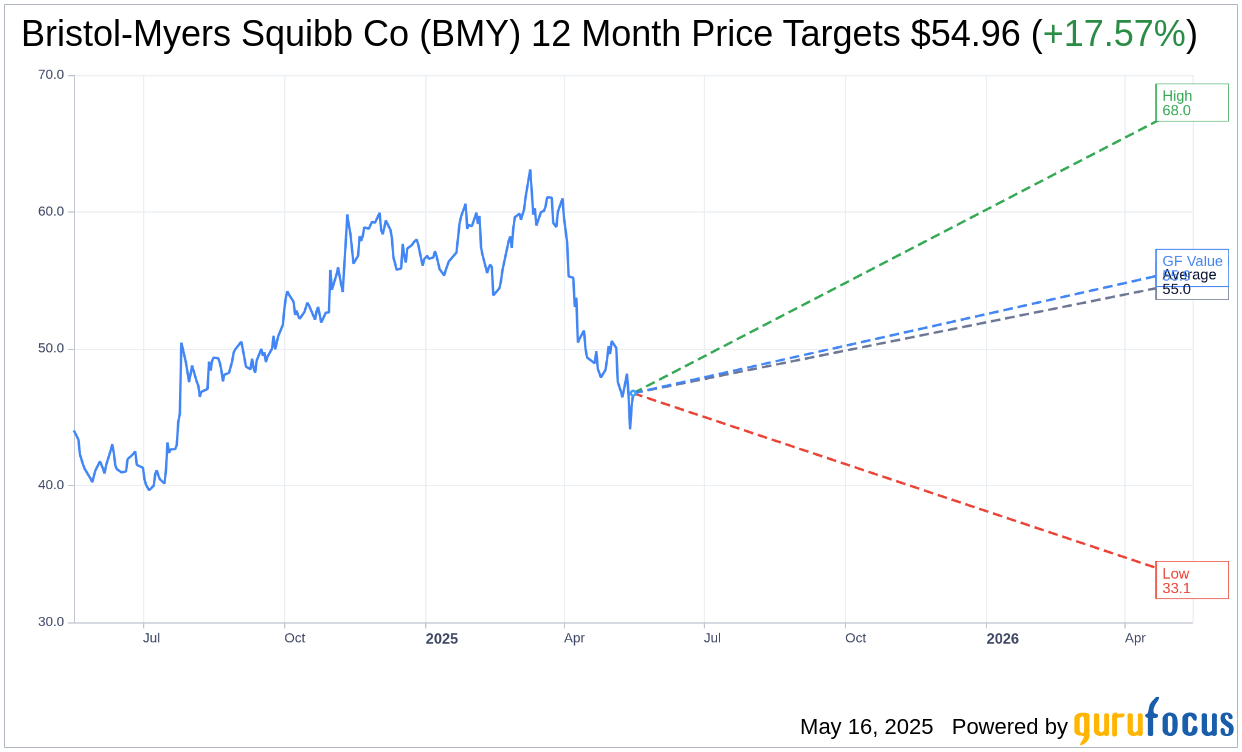

- Analyst Insights: Analysts predict an average price target for BMY at $54.96, indicating a potential upside of 17.57%.

- Investment Potential: The estimated GF Value for BMY suggests a 19.59% upside from the current price.

Bristol Myers Squibb (BMY, Financial) has achieved a significant regulatory milestone with the European Commission's approval of Opdivo (nivolumab) in combination with chemotherapy for non-small cell lung cancer. This approval is consistent with guidance from an EMA panel, recommending the use of Opdivo alongside chemotherapy before surgery and as a standalone treatment post-surgery for tumors with PD-L1 expression of 1% or greater.

Wall Street Analysts Forecast

Wall Street analysts have presented their forecasts for Bristol-Myers Squibb Co (BMY, Financial), with 21 experts providing a one-year average price target of $54.96. The high and low estimates span from $68.00 to $33.10, respectively. Currently priced at $46.75, the average target indicates a potential upside of 17.57%. For more comprehensive estimate data, visit the Bristol-Myers Squibb Co (BMY) Forecast page.

Brokerage Recommendations

The consensus recommendation from 28 brokerage firms places Bristol-Myers Squibb Co (BMY, Financial) at an average brokerage recommendation of 2.7, suggesting a "Hold" status. This rating is derived from a scale where 1 represents a Strong Buy and 5 signifies a Sell.

GuruFocus Estimates

According to GuruFocus estimates, the projected GF Value for Bristol-Myers Squibb Co (BMY, Financial) within a year is $55.91, presenting a potential upside of 19.59% from the current price of $46.75. The GF Value represents GuruFocus' fair value assessment of the stock, based on its historical trading multiples, past business growth, and future performance predictions. For detailed information, explore the Bristol-Myers Squibb Co (BMY) Summary page.