Benchmark is set to host a virtual meeting on May 20 at 1 pm, where they will discuss significant insights into company performance. This event aims to equip investors with the tools they need for confident investment decisions. Among the resources available is TipRanks' new KPI Data, which helps investors evaluate a company's performance swiftly and effectively.

Additionally, TipRanks offers a Smart Value Newsletter, delivering information on undervalued and market-resilient stocks directly to subscribers' inboxes. This service is designed to aid investors in making informed choices by identifying potential opportunities in the stock market.

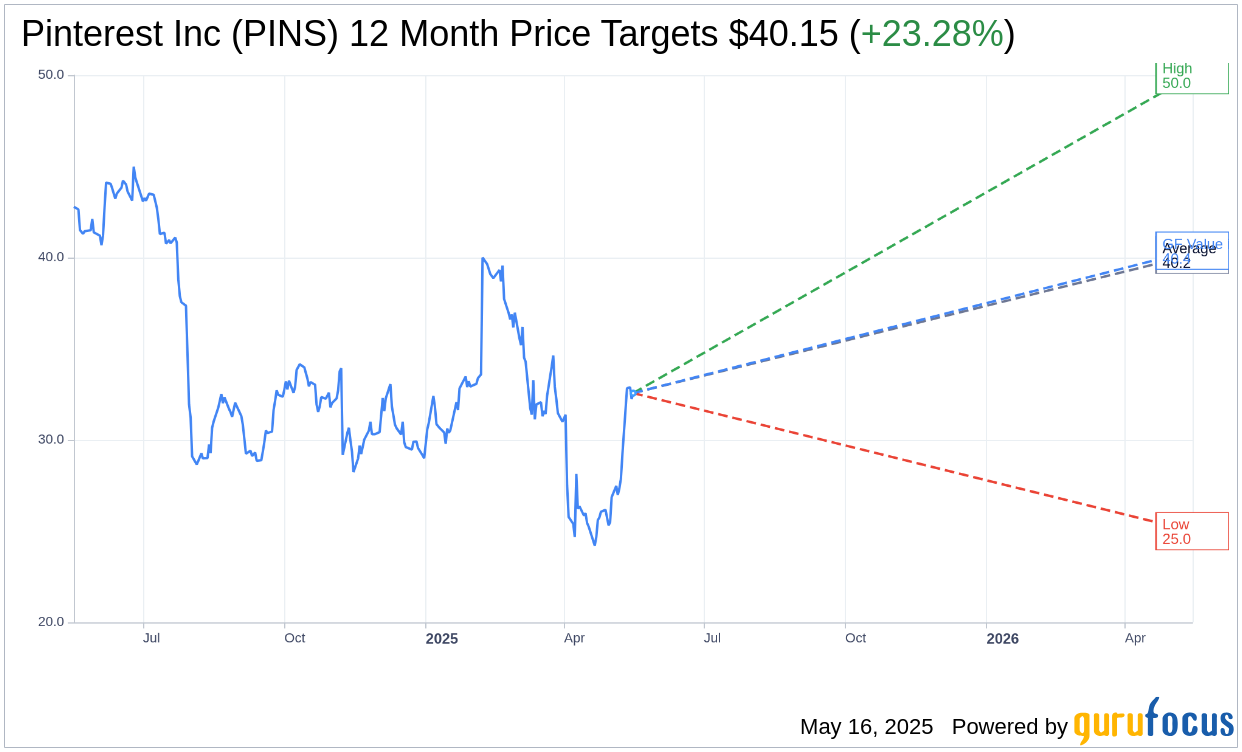

Wall Street Analysts Forecast

Based on the one-year price targets offered by 35 analysts, the average target price for Pinterest Inc (PINS, Financial) is $40.15 with a high estimate of $50.00 and a low estimate of $25.00. The average target implies an upside of 23.28% from the current price of $32.57. More detailed estimate data can be found on the Pinterest Inc (PINS) Forecast page.

Based on the consensus recommendation from 41 brokerage firms, Pinterest Inc's (PINS, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Pinterest Inc (PINS, Financial) in one year is $40.38, suggesting a upside of 23.98% from the current price of $32.57. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Pinterest Inc (PINS) Summary page.

PINS Key Business Developments

Release Date: May 08, 2025

- Revenue: $855 million, up 16% year-over-year.

- Adjusted EBITDA: $172 million, with a margin of 20%, up 300 basis points from last year.

- Monthly Active Users (MAUs): 570 million globally, a 10% increase year-over-year.

- US and Canada Revenue: $663 million, growing 12% year-over-year.

- Europe Revenue: $147 million, growing 24% on a reported basis.

- Rest of World Revenue: $45 million, growing 49% on a reported basis.

- Ad Impressions: Grew 49% year-over-year.

- Ad Pricing: Declined 22% year-over-year.

- Cost of Revenue: $193 million, up 10% year-over-year.

- Non-GAAP Operating Expense: $494 million, up 12% year-over-year.

- Free Cash Flow: $356 million.

- Cash, Cash Equivalents, and Marketable Securities: $2.6 billion.

- Share Repurchases: $175 million allocated in Q1.

- Q2 Revenue Guidance: Expected to be in the range of $960 million to $980 million, representing 12% to 15% growth year-over-year.

- Q2 Adjusted EBITDA Guidance: Expected to be in the range of $217 million to $237 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Pinterest Inc (PINS, Financial) achieved a record number of 570 million monthly active users (MAUs) globally, reflecting a 10% growth year-over-year.

- The company reported Q1 2025 revenue of $855 million, marking a 16% increase year-over-year, driven by strong advertiser performance across the full funnel.

- Adjusted EBITDA grew to $172 million, demonstrating Pinterest Inc (PINS)'s focus on driving profitable growth while investing in high ROI areas.

- Pinterest Inc (PINS) has enhanced its visual search capabilities, with its proprietary multimodal AI model being 30% more likely to recommend relevant content than leading off-the-shelf models.

- The company is successfully expanding its lower-funnel shopping playbook internationally, with shopping ad revenue in Europe and Rest of World regions growing over 3 times faster than overall revenue growth in those areas.

Negative Points

- Ad pricing declined 22% year-over-year, primarily due to international mix shift as Pinterest Inc (PINS) began serving ads in previously unmonetized or under-monetized international markets.

- Despite strong click growth, there is a gap between click growth and advertising dollar growth, indicating a need for better implementation of measurement tools and easier campaign creation.

- The macroeconomic environment remains uncertain, with some pockets of ad spend impacted by tariffs, particularly from Asia-based e-commerce retailers in the US.

- The company is still in the early stages of driving adoption of its Performance+ suite, with more functionality and advertiser adoption needed to fully realize its potential.

- Pinterest Inc (PINS) faces challenges in shifting advertiser perception from being a platform for long-term planning to one that also drives immediate clicks and conversions.