Quick Summary:

- DigitalBridge (DBRG, Financial) shares surged by 38.6% amid acquisition discussions with 26North Partners.

- Analysts' average price target suggests a potential 35.29% upside.

- Current brokerage consensus rates the stock as "Outperform."

DigitalBridge (DBRG) witnessed a remarkable 38.6% surge this week. This increase was fueled by news that 26North Partners is engaged in advanced talks to acquire the company. This performance stands out as the largest gain among financial stocks with a market capitalization exceeding $2 billion, all within a landscape of easing global trade tensions.

Wall Street Analysts Forecast

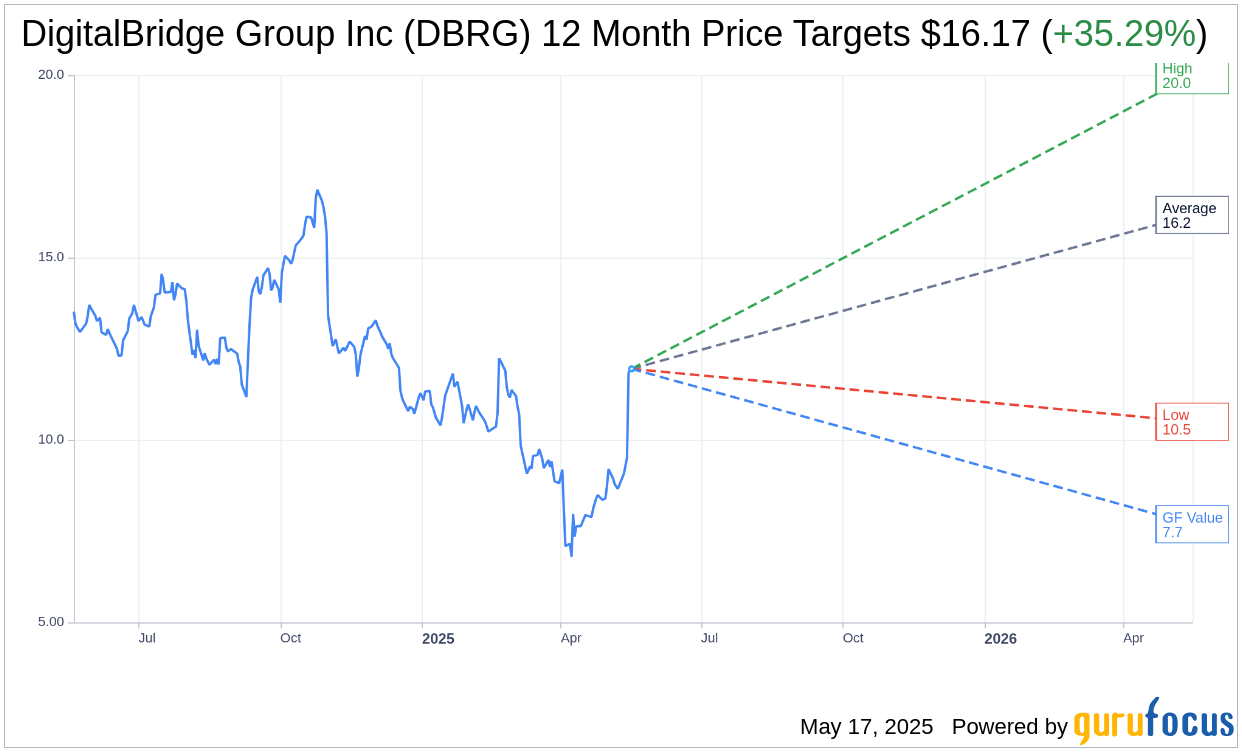

Nine analysts have projected a one-year price target for DigitalBridge Group Inc (DBRG, Financial) with an average target of $16.17. The projections span a high of $20.00 and a low of $10.50. This average target suggests a potential upside of 35.29% from the current trading price of $11.95. For more detailed estimate data, please visit the DigitalBridge Group Inc (DBRG) Forecast page.

The consensus recommendation from 10 brokerage firms rates DigitalBridge Group Inc (DBRG, Financial) at an average of 2.0, translating to an "Outperform" status. The recommendation scale ranges from 1 (Strong Buy) to 5 (Sell), providing investors with a spectrum of insights.

According to GuruFocus estimates, the projected GF Value for DigitalBridge Group Inc (DBRG, Financial) over the next year is $7.69. This assessment indicates a potential downside of 35.65% from the current stock price of $11.95. The GF Value is calculated considering the historical trading multiples of the stock, past business growth, and future business performance projections. More comprehensive data is available on the DigitalBridge Group Inc (DBRG) Summary page.