Key Takeaways:

- Ventas Inc (VTR, Financial) experiences a significant rise in short interest, reflecting increasing bearish sentiment.

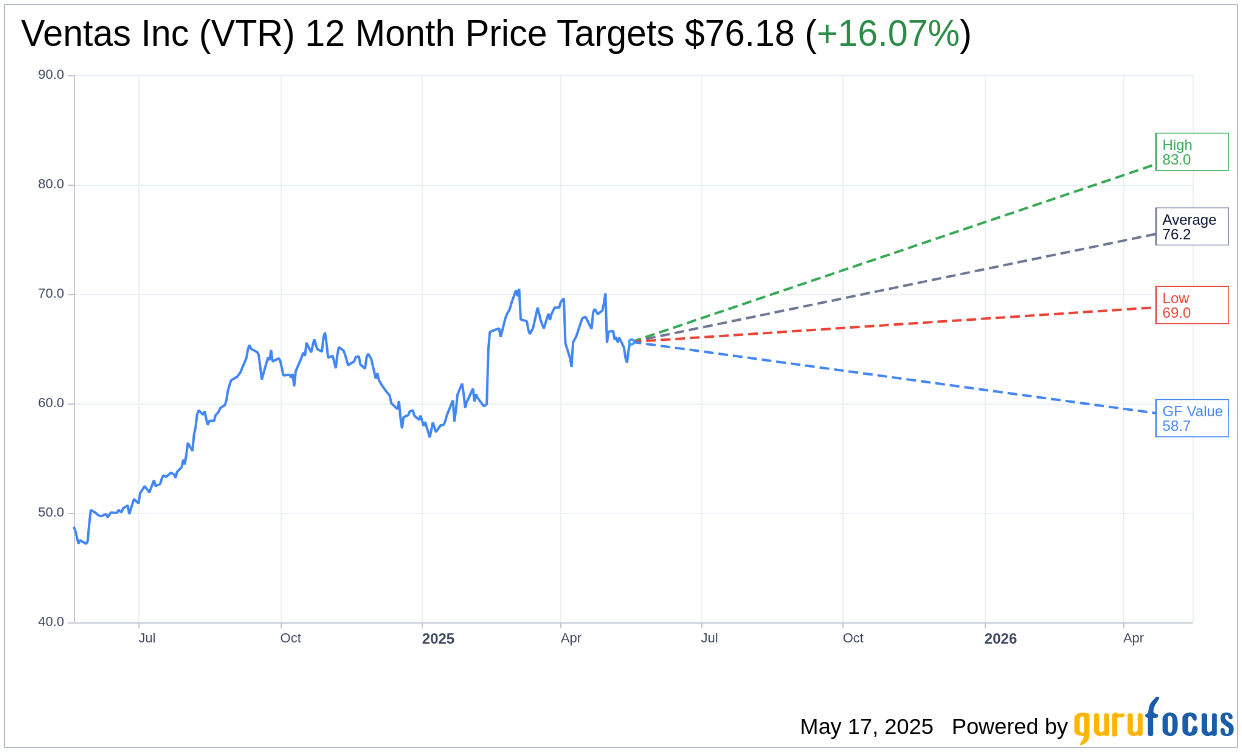

- Analyst forecasts present a 16.07% upside potential, with an "Outperform" consensus recommendation.

- Despite upward analyst projections, GuruFocus GF Value suggests a potential downside of 10.62%.

Rising Short Interest in Ventas Inc (VTR)

In April, Ventas Inc (VTR), a notable player in the health care REIT sector, saw its short interest surge by 120 basis points to 3.05%, marking the largest increase within its sector. This notable rise signals a growing bearish outlook among investors, despite the sector exhibiting mixed trends overall.

Analyst Forecasts and Price Targets

According to the one-year price targets from 17 analysts, Ventas Inc (VTR, Financial) shares are anticipated to reach an average target price of $76.18. This reflects a high estimate of $83.00 and a low estimate of $69.00. Such projections predict an upside potential of 16.07% from the current trading price of $65.63. For more comprehensive forecast data, visit the Ventas Inc (VTR) Forecast page.

Brokerage Recommendations and Ratings

The consensus among 20 brokerage firms positions Ventas Inc (VTR, Financial) with an average recommendation of 1.8, which translates to an "Outperform" status. The rating system varies from 1 (indicating Strong Buy) to 5 (indicating Sell), showcasing favorable sentiment from brokerage analysts.

Evaluating Ventas Inc Through GuruFocus GF Value

Contrarily, GuruFocus provides a different valuation perspective. The estimated GF Value for Ventas Inc (VTR, Financial) in one year is projected at $58.66. This suggests a potential downside of 10.62% from the current market price of $65.63. The GF Value metric evaluates the stock's fair trading value based on historical trading multiples, past business growth, and future performance forecasts. Additional data can be explored on the Ventas Inc (VTR) Summary page.