Applied Therapeutics (APLT, Financial) revealed comprehensive 12-month clinical findings alongside fresh 18 and 24-month topline data from the INSPIRE Phase 2/3 trial during an oral presentation at the Peripheral Nerve Society 2025 Annual Meeting in Edinburgh, Scotland. This trial focuses on assessing govorestat's efficacy in treating Sorbitol Dehydrogenase Deficiency, linked to Charcot-Marie-Tooth disease.

The trial, involving 49 evaluable patients as of February 2024, reported that after 12 months of treatment, govorestat significantly reduced sorbitol levels, correlating with improvements in several secondary clinical endpoints. Despite this, the primary endpoint, the 10-Meter Walk Run Test (10MWRT), did not achieve statistical significance. Moreover, the trial evolved by excluding the 10MWRT from the CMT-FOM assessment, which now comprises 11 components.

Govorestat notably enhanced the Charcot-Marie-Tooth Health Index (CMT-HI) score over 12 months, with significant correlations noted between reductions in sorbitol and improvements in mobility and balance domains. The drug maintained a consistent safety profile, showing similar adverse event rates between the treatment and placebo groups.

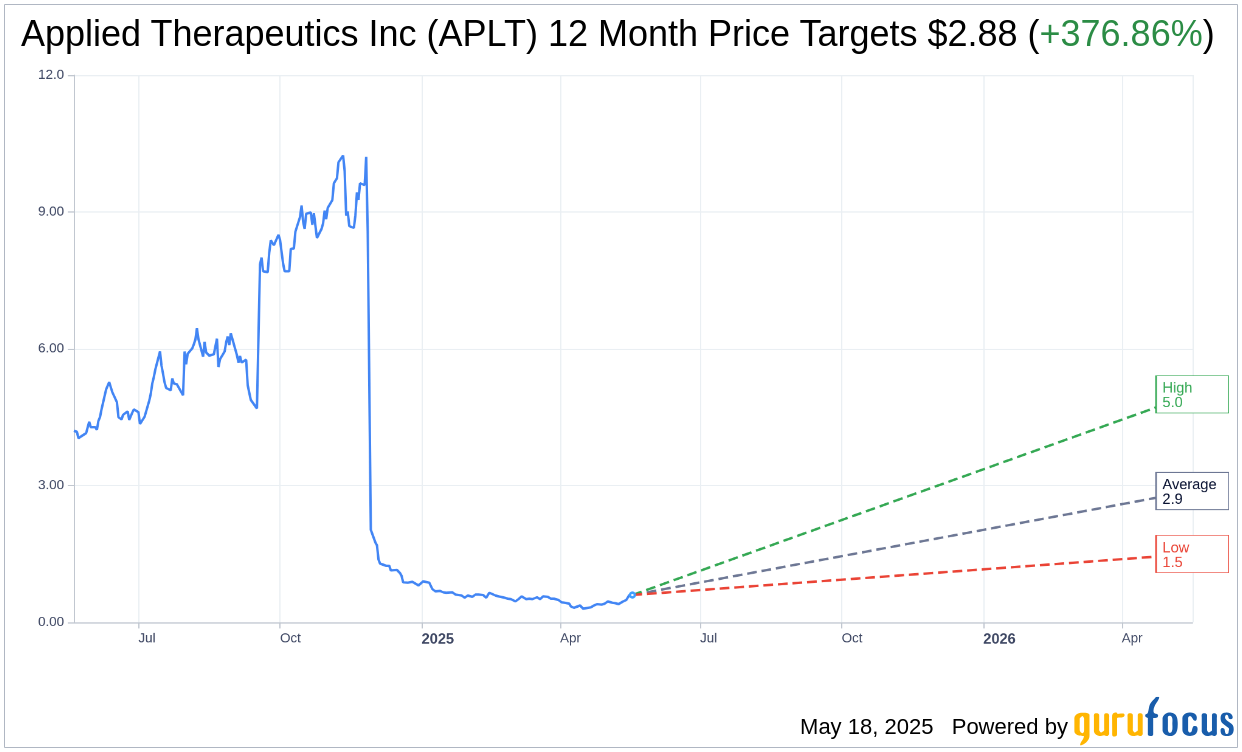

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for Applied Therapeutics Inc (APLT, Financial) is $2.88 with a high estimate of $5.00 and a low estimate of $1.50. The average target implies an upside of 376.86% from the current price of $0.60. More detailed estimate data can be found on the Applied Therapeutics Inc (APLT) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, Applied Therapeutics Inc's (APLT, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.