Key Insights:

- Super Micro Computer (SMCI, Financial) stock surged by 42.82% amid a new strategic partnership.

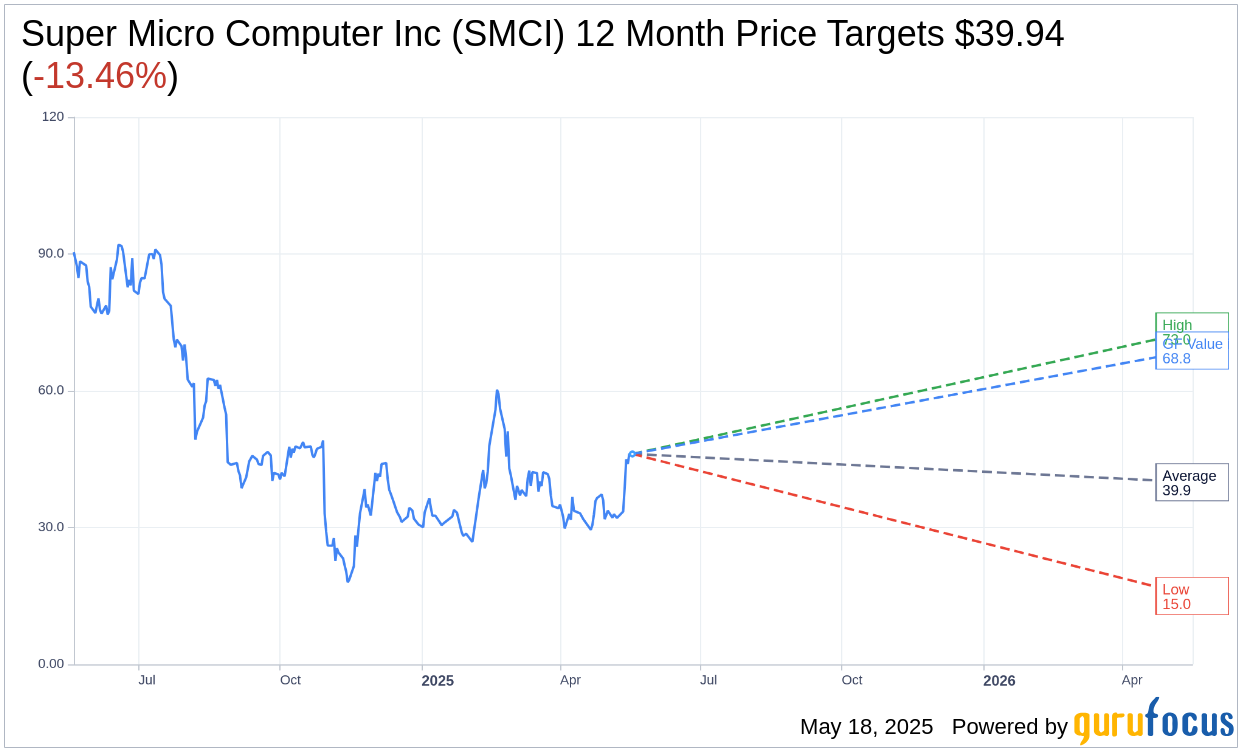

- Wall Street analysts offer mixed forecasts, with price targets ranging significantly.

- GuruFocus projects a 49.14% upside in stock value based on its GF Value metric.

Super Micro Computer Inc. (NASDAQ: SMCI), a leader in high-performance computing solutions, has captured market attention with a striking 42.82% increase in its stock price. This remarkable growth follows the announcement of a groundbreaking $20 billion multi-year agreement with DataVolt, a prominent Saudi Arabian entity. This partnership aims to leverage GPU platforms, revitalizing investor confidence after the company addressed previous audit and delisting challenges.

Wall Street Analysts' Projections

Delving into analysts' insights, Super Micro Computer Inc's stock receives a varied outlook from Wall Street. Fourteen analysts have set an average one-year target price of $39.94. Their estimates show a wide range, with the highest target at $73.00 and the lowest at $15.00. As of now, this average estimate implies a potential downside of 13.46% from the current stock price of $46.15. For detailed projection data, investors can explore the Super Micro Computer Inc (SMCI, Financial) Forecast page.

Furthermore, the consensus recommendation from 16 brokerage firms places Super Micro Computer Inc's stock at an average rating of 2.8, suggesting a "Hold" status. This rating is determined on a scale from 1 to 5, where 1 signifies a Strong Buy and 5 denotes a Sell.

GuruFocus Fair Value Analysis

According to GuruFocus estimates, the anticipated GF Value for Super Micro Computer Inc (SMCI, Financial) over the next year is projected at $68.83. This estimate indicates a promising upside of 49.14% from the current trading price of $46.15. The GF Value represents GuruFocus' estimation of the fair trading value, based on historical trading multiples, past business growth, and prospective performance. For an in-depth view of these estimates, visit the Super Micro Computer Inc (SMCI) Summary page.

In summary, while Super Micro Computer Inc has shown impressive stock performance recently, investors should consider both the diverse analyst forecasts and the bullish GuruFocus valuation when evaluating their investment strategies.