Quick Summary:

- SmartStop Self Storage REIT, Inc. (STSFF, Financial) reports a Q1 GAAP EPS of -$0.40.

- Revenue grows by 11.1% year-over-year, reaching $7.3 million.

- Wall Street suggests a potential upside of 17.05% with an "Outperform" rating consensus.

SmartStop Self Storage REIT, Inc. (STSFF) recently announced its financial performance for the first quarter, showcasing a challenging yet promising landscape for investors. The company reported a GAAP EPS of -$0.40, while revenue soared to $7.3 million, marking an impressive 11.1% increase from the previous year. Additionally, the firm experienced a notable 13.6% boost in same-store net operating income, alongside a 2.1% rise in average physical occupancy for the quarter.

Wall Street Analysts Forecast

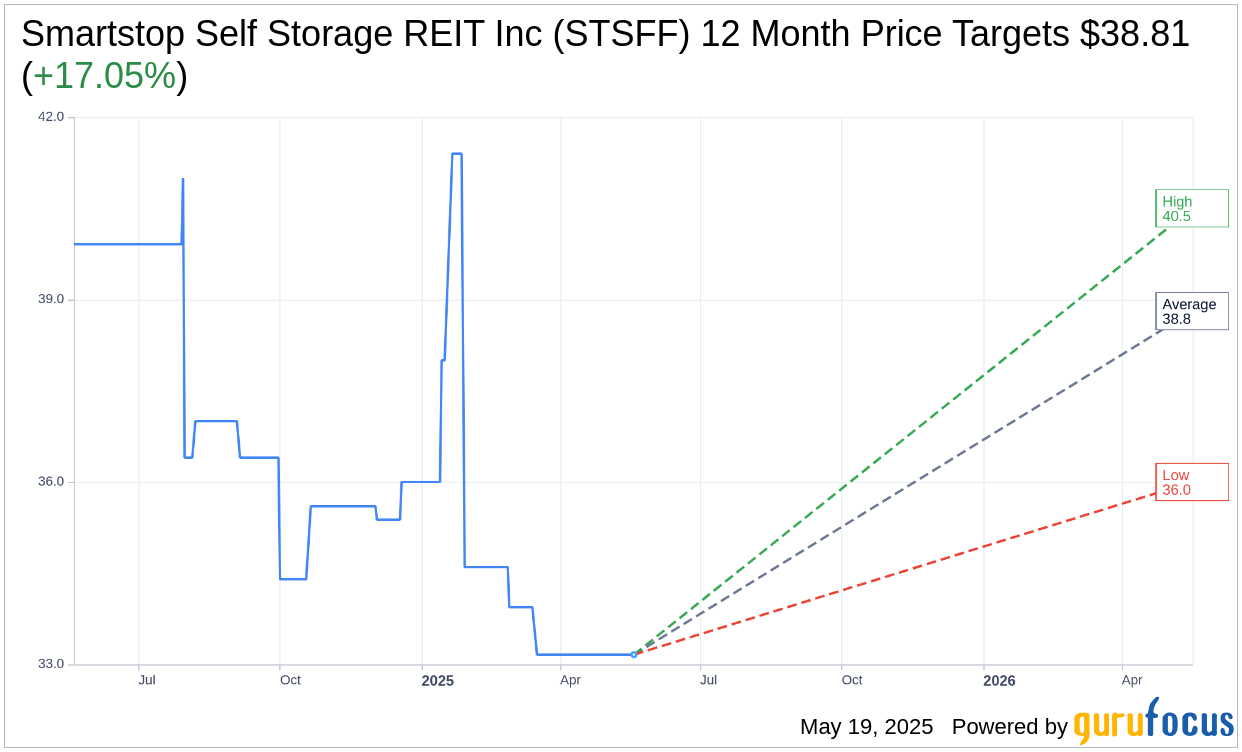

Analysts on Wall Street have set optimistic forecasts for SmartStop Self Storage REIT Inc (STSFF, Financial), with a one-year price target averaging $38.81. This includes a high estimate of $40.50 and a low estimate of $36.00. These projections suggest a potential upside of 17.05% from the current share price of $33.16, making it an intriguing opportunity for investors. For a comprehensive view of these estimates, you can visit the Smartstop Self Storage REIT Inc (STSFF) Forecast page.

Adding to the optimism, consensus from 10 brokerage firms assigns Smartstop Self Storage REIT Inc (STSFF, Financial) an average brokerage recommendation of 1.8, signaling an "Outperform" status. The rating system employed ranges from 1, indicating a Strong Buy, to 5, representing a Sell.