Key Highlights:

- Magic Software Enterprises (MGIC, Financial) reports a modest 3.3% revenue increase to $552.52 million for the year.

- The company anticipates 2025 revenue growth fueled by a strategic merger with Matrix.

- Analysts offer a stable one-year price target, indicating a slight potential upside.

Magic Software Enterprises (MGIC) has released its annual financial results, showcasing a modest revenue rise of 3.3% year-over-year to reach $552.52 million. The company's robust strategy, highlighted by a pivotal merger with Matrix, sets ambitious targets for 2025, with revenue expectations falling between $593 million and $603 million.

Wall Street Analysts Forecast

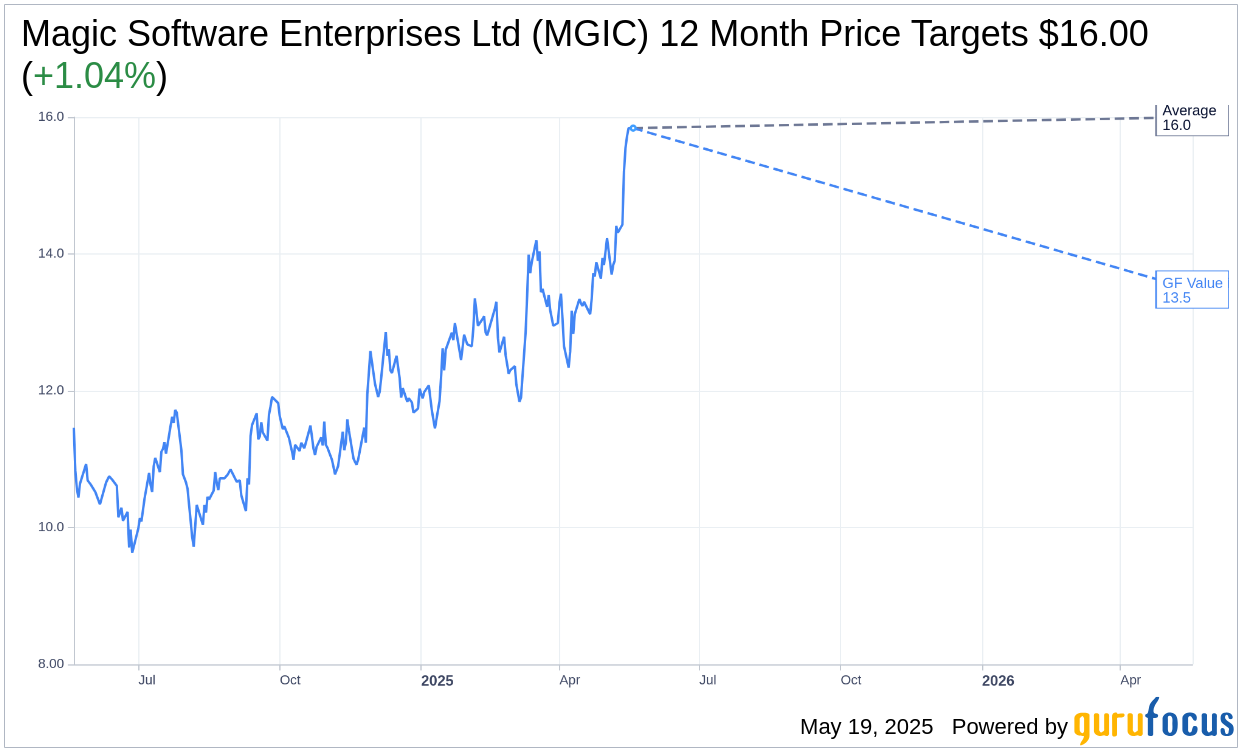

Analysts maintain a cautious outlook for Magic Software Enterprises Ltd (MGIC, Financial), setting a one-year average price target of $16.00. This target derives from a range of estimates, all converging at $16.00, suggesting a minimal upside potential of 1.04% from the current market price of $15.84. For more detailed forecasts, visit the Magic Software Enterprises Ltd (MGIC) Forecast page.

Moreover, brokerage firms' consensus rates MGIC at an average recommendation of 2.5, positioning it within the "Outperform" category. This classification indicates a generally favorable view, with the rating scale spanning from 1 (Strong Buy) to 5 (Sell).

However, according to GuruFocus' GF Value estimates, Magic Software Enterprises Ltd (MGIC, Financial) is projected to have a fair value of $13.48 over the next year. This estimation implies a potential downside of 14.87% from its current trading price of $15.835. The GF Value metric is a pivotal tool, formulated by analyzing historical trading multiples, historical growth, and future business performance projections. Further insights can be explored on the Magic Software Enterprises Ltd (MGIC) Summary page.