ManpowerGroup (MAN, Financial) has inaugurated its new AIHR Hub in Paris, situated at its French headquarters in La Défense. This development was highlighted at the Choose France Summit, where the company emphasized its dedication to providing AI-driven, human-centric solutions to benefit both its clients and job seekers. This initiative aligns with ManpowerGroup's strategy of strengthening its investment in France, establishing the country as a pivotal center for innovation and growth.

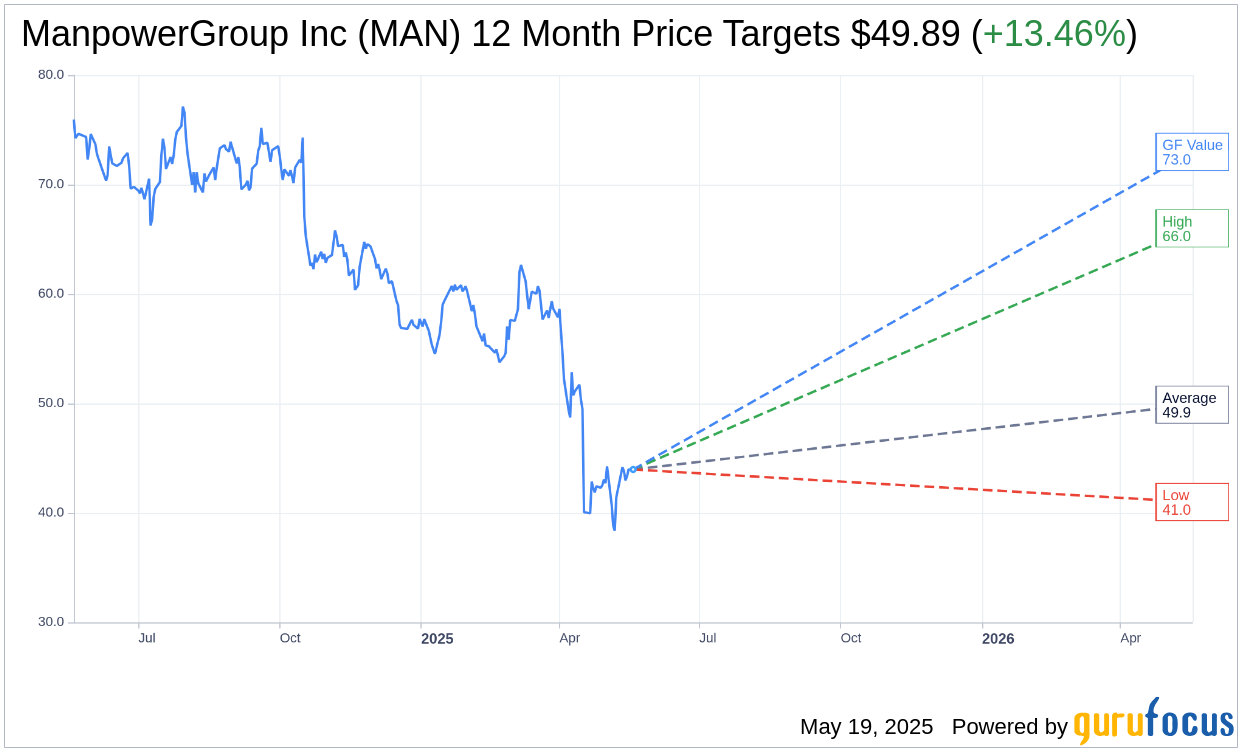

Wall Street Analysts Forecast

Based on the one-year price targets offered by 9 analysts, the average target price for ManpowerGroup Inc (MAN, Financial) is $49.89 with a high estimate of $66.00 and a low estimate of $41.00. The average target implies an upside of 13.46% from the current price of $43.97. More detailed estimate data can be found on the ManpowerGroup Inc (MAN) Forecast page.

Based on the consensus recommendation from 13 brokerage firms, ManpowerGroup Inc's (MAN, Financial) average brokerage recommendation is currently 2.8, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for ManpowerGroup Inc (MAN, Financial) in one year is $72.99, suggesting a upside of 66% from the current price of $43.97. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the ManpowerGroup Inc (MAN) Summary page.

MAN Key Business Developments

Release Date: April 17, 2025

- Revenue: $4.1 billion, down 5% year over year in constant currency.

- Reported EBITA: $36 million.

- Adjusted EBITA: $52 million, a decrease of 32% in constant currency year over year.

- Reported EBITA Margin: 0.9%.

- Adjusted EBITA Margin: 1.3%.

- Reported Earnings Per Diluted Share: $0.12.

- Adjusted Earnings Per Diluted Share: $0.44, a decrease of 51% year over year in constant currency.

- Gross Profit Margin: 17.1% for the quarter.

- SG&A Expense: $670 million, down 4% year over year on a constant currency basis.

- Free Cash Flow: Outflow of $167 million compared to an inflow of $104 million in the prior year.

- Net Debt: $677 million at quarter end.

- Americas Revenue: $1.1 billion, an increase of 5% year over year in constant currency.

- Southern Europe Revenue: $1.8 billion, a 5% decrease in constant currency.

- Northern Europe Revenue: $731 million, a 14% decline in constant currency.

- Asia Pacific Middle East Revenue: $476 million, an increase of 7% in organic constant currency.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- ManpowerGroup Inc (MAN, Financial) reported revenue of $4.1 billion for the first quarter, which was above the high end of their constant currency guidance range.

- The company saw positive revenue growth in key markets such as the US, Italy, Spain, and continued strong performance in Latin America and Asia Pacific Middle East.

- ManpowerGroup Inc (MAN) is making significant progress in its back-office transformation, with 50% of revenues now going through the new platform, which is expected to yield efficiency gains.

- The company is leveraging AI and data analytics to provide unique workforce insights to clients, enhancing service delivery and client engagement.

- ManpowerGroup Inc (MAN) continues to invest in key markets with growth potential, such as Italy and Japan, and is seeing positive results from these investments.

Negative Points

- Revenue decreased by 5% year over year in constant currency, reflecting a challenging environment in Europe and North America.

- Adjusted earnings per share decreased by 51% year over year in constant currency, indicating significant pressure on profitability.

- Permanent recruitment softened further, impacting margins, particularly in France and other European countries.

- The company faced a 32% decrease in adjusted EBITA in constant currency year over year, highlighting operational challenges.

- ManpowerGroup Inc (MAN) is experiencing elevated uncertainty due to recent US trade policy announcements, affecting client confidence and hiring decisions.