HP Enterprise (HPE, Financial) has unveiled several updates to its suite of Nvidia AI Computing solutions, aiming to support the full AI lifecycle and cater to various sectors including businesses, service providers, governmental bodies, and research institutions. These updates involve deeper integration with Nvidia AI Enterprise, enhancing HPE Private Cloud AI through accelerated computing capabilities.

The introduction of the HPE Alletra Storage MP X10000 software development kit into the Nvidia AI Data Platform highlights the company's commitment to technological advancement. Additionally, HPE is launching new compute and software products featuring the Nvidia RTX Pro 6000 Blackwell Server Edition GPU, alongside a validated design for the Nvidia Enterprise AI Factory.

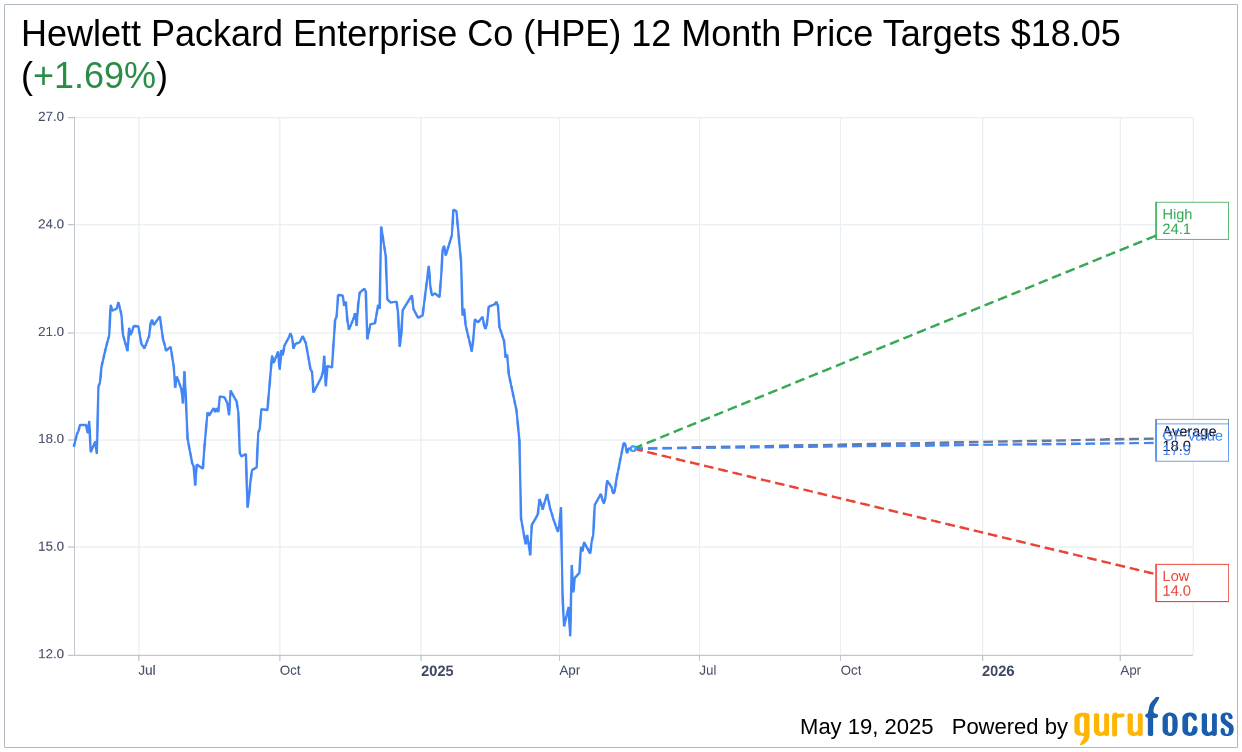

Wall Street Analysts Forecast

Based on the one-year price targets offered by 13 analysts, the average target price for Hewlett Packard Enterprise Co (HPE, Financial) is $18.05 with a high estimate of $24.11 and a low estimate of $14.00. The average target implies an upside of 1.69% from the current price of $17.75. More detailed estimate data can be found on the Hewlett Packard Enterprise Co (HPE) Forecast page.

Based on the consensus recommendation from 15 brokerage firms, Hewlett Packard Enterprise Co's (HPE, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Hewlett Packard Enterprise Co (HPE, Financial) in one year is $17.92, suggesting a upside of 0.96% from the current price of $17.75. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Hewlett Packard Enterprise Co (HPE) Summary page.

HPE Key Business Developments

Release Date: March 06, 2025

- Revenue: $7.9 billion, up 17% year over year.

- Non-GAAP Diluted Net Earnings Per Share: $0.49, within the guided range of $0.47 to $0.52.

- Non-GAAP Gross Margin: 29.4%, down 680 basis points year over year.

- Non-GAAP Operating Margin: 9.9%, down 160 basis points year over year.

- Free Cash Flow: Negative $877 million, reflecting normal seasonal patterns.

- Server Revenue: $4.3 billion, up 30% year over year.

- Intelligent Edge Revenue: $1.1 billion, up 2% quarter over quarter.

- Hybrid Cloud Revenue: $1.4 billion, up 11% year over year.

- Annual Recurring Revenue (ARR): $2.1 billion, up 46% year over year.

- AI Systems Revenue: $900 million in Q1.

- Financial Services Revenue: $873 million, up 2% year over year.

- Operating Cash Flow: Consumed $390 million in the quarter.

- Inventory: $8.6 billion at the end of the period, up $767 million quarter over quarter.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Hewlett Packard Enterprise Co (HPE, Financial) delivered strong double-digit year-over-year revenue growth of 17%, marking the fourth consecutive quarter of improved top-line growth.

- The Intelligent Edge segment recorded 2% quarter-over-quarter revenue growth, marking the third consecutive quarter of sequential revenue growth.

- HPE's GreenLake Cloud platform surpassed $2 billion in annual recurring revenue, up 46% year over year, highlighting strong demand for hybrid cloud and AI workloads.

- The company achieved significant growth in its AI systems business, with $1.6 billion in new AI system orders and a 29% quarter-over-quarter increase in AI systems backlog.

- HPE's innovation efforts continue to pay off, with new product launches such as the ProLiant Gen12 server platform and the Alletra MP storage portfolio showing strong market interest and adoption.

Negative Points

- HPE faced challenges in its Server segment, with operating margins falling below expectations due to pricing competition and inventory valuation issues.

- The company is experiencing pressure from tariffs on imports, which are expected to impact the Server business and overall profitability.

- HPE plans to reduce its workforce by 5% over the next 12 to 18 months, affecting approximately 2,500 positions, as part of cost-cutting measures.

- The proposed acquisition of Juniper Networks is facing legal challenges from the Department of Justice, potentially delaying the expected synergies from the deal.

- Free cash flow was negative $877 million for the quarter, reflecting normal seasonality but also impacted by inventory levels and restructuring charges.