The Chemours Company (CC, Financial) has entered into a strategic partnership with DataVolt, a leader in sustainable digital infrastructure, to advance innovative cooling technologies for data centers. This collaboration aims to enhance data center efficiency and sustainability by focusing on cutting-edge liquid cooling methods such as two-phase direct-to-chip and immersion cooling. The initiative seeks to support the growing requirements of artificial intelligence and next-generation digital infrastructure.

As part of the agreement, the companies will develop cooling solutions utilizing Chemours' Opteon dielectric fluids, known for their ultra-low global warming potential, to improve infrastructure readiness. This collaboration furthers Chemours' commitment to expanding its Liquid Cooling portfolio, providing comprehensive solutions tailored for AI and advanced digital systems.

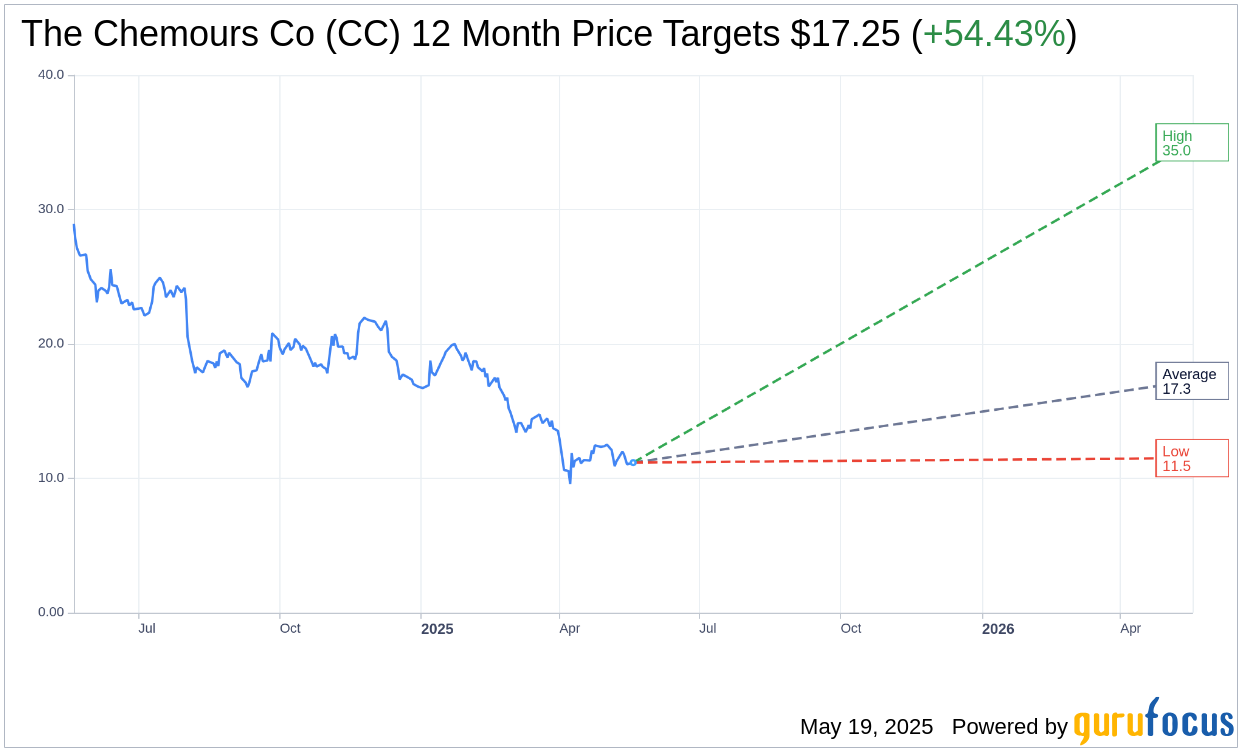

Wall Street Analysts Forecast

Based on the one-year price targets offered by 10 analysts, the average target price for The Chemours Co (CC, Financial) is $17.25 with a high estimate of $35.00 and a low estimate of $11.50. The average target implies an upside of 54.43% from the current price of $11.17. More detailed estimate data can be found on the The Chemours Co (CC) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, The Chemours Co's (CC, Financial) average brokerage recommendation is currently 2.7, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for The Chemours Co (CC, Financial) in one year is $26.84, suggesting a upside of 140.29% from the current price of $11.17. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the The Chemours Co (CC) Summary page.

CC Key Business Developments

Release Date: May 07, 2025

- Consolidated Net Sales: Approximately $1.4 billion, consistent with prior year.

- Adjusted EBITDA: $166 million, down from $191 million in the prior year.

- Net Loss: $4 million or $0.03 per diluted share, compared to net income of $54 million or $0.36 per diluted share in the prior year.

- TSS Net Sales: $466 million, a 3% increase from the prior year.

- TSS Adjusted EBITDA Margin: 30%, decreased by 3 percentage points.

- TT Net Sales: $597 million, a 1% increase year-over-year.

- TT Adjusted EBITDA: $50 million, a 28% decrease compared to the prior year.

- APM Net Sales: $294 million, a 3% decrease compared to the prior year.

- APM Adjusted EBITDA Margin: Increased by 1 percentage point to 11%.

- Capital Expenditures: $84 million, an 18% decrease compared to the prior year.

- Free Cash Flow: Use of $196 million, compared to a use of $392 million in the prior year.

- Gross Debt: $4.1 billion with approximately $1.1 billion in total liquidity.

- Dividend Reduction: Declared a dividend for the second quarter at a reduced rate of $8.75 per share, reflecting a 65% reduction.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- The Chemours Co (CC, Financial) reported a 40% year-over-year net sales increase in Opteon Refrigerants, driven by increased demand for blend due to the US AIM Act transition mandate.

- The company successfully ramped up its 40% capacity expansion of Opteon feedstock at the Corpus Christi site, ensuring no disruption to customer orders despite a brief outage.

- Chemours' TSS business achieved a 30% adjusted EBITDA margin, positioning well for the peak cooling season.

- The company has a strategic agreement with Navin Fluorine to produce Opteon two-phase immersion cooling fluid, addressing data cooling center needs.

- Chemours anticipates a significant cash flow benefit of approximately $100 million to $115 million from the expiration of high-grade ore feedstock contracts by 2027.

Negative Points

- Chemours reported a net loss of $4 million for the first quarter, compared to a net income of $54 million in the prior year.

- The company's adjusted EBITDA decreased to $166 million from $191 million in the prior year, primarily due to lower pricing and unfavorable currency movements.

- Chemours' TT segment faced challenges with lower pricing and additional costs from plant downtime due to cold weather.

- The APM segment experienced a 3% decrease in net sales due to weakened cyclical end markets and products serving the hydrogen market.

- Chemours reduced its dividend by 65% to $8.75 per share to balance capital return to shareholders with balance sheet flexibility.