ZIM Integrated Shipping Services (ZIM, Financial) reported impressive financial results for the first quarter. The company achieved a revenue of $2.01 billion, a significant increase from the $1.56 billion it recorded in the same period last year. This growth was driven by a 12% rise in carried volume and strong earnings performance.

The company also announced a net income of $296 million for the quarter. Demonstrating its commitment to returning capital to shareholders, ZIM declared a dividend of 74 cents per share, totaling $89 million, which accounts for roughly 30% of the quarterly net income.

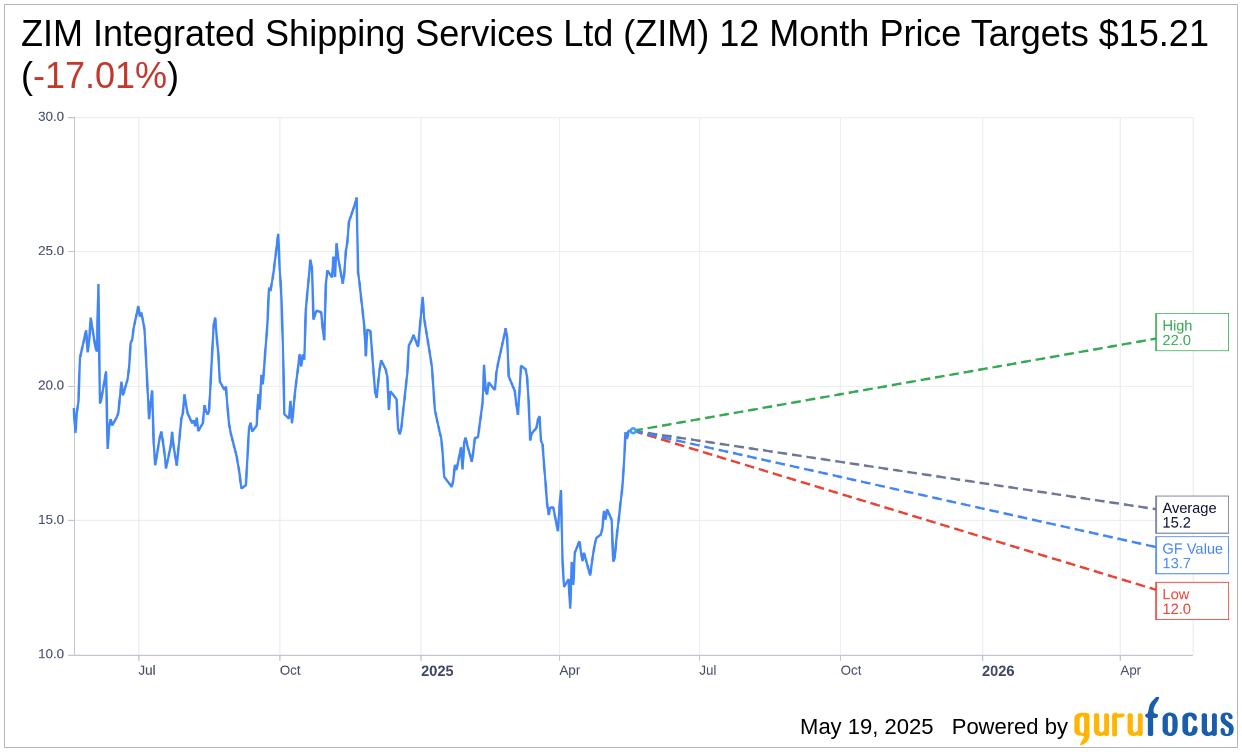

Wall Street Analysts Forecast

Based on the one-year price targets offered by 6 analysts, the average target price for ZIM Integrated Shipping Services Ltd (ZIM, Financial) is $15.21 with a high estimate of $22.00 and a low estimate of $12.00. The average target implies an downside of 17.01% from the current price of $18.33. More detailed estimate data can be found on the ZIM Integrated Shipping Services Ltd (ZIM) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, ZIM Integrated Shipping Services Ltd's (ZIM, Financial) average brokerage recommendation is currently 3.8, indicating "Underperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for ZIM Integrated Shipping Services Ltd (ZIM, Financial) in one year is $13.70, suggesting a downside of 25.26% from the current price of $18.33. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the ZIM Integrated Shipping Services Ltd (ZIM) Summary page.

ZIM Key Business Developments

Release Date: March 12, 2025

- Revenue: $8.4 billion in 2024, a 63% increase compared to 2023.

- Net Income: $2.2 billion for 2024.

- Adjusted EBITDA: $3.7 billion with a margin of 44% for 2024.

- Adjusted EBIT: $2.5 billion with a margin of 30% for 2024.

- Total Liquidity: $3.14 billion at year-end 2024.

- Dividend: $3.17 per share, totaling $382 million; total dividend payout for 2024 was $961 million.

- Average Freight Rate per TEU: $1,886 for 2024, a 57% increase from 2023.

- Free Cash Flow: $3.6 billion for 2024.

- Volume Growth: 14% increase in TEUs carried in 2024, with Trans-Pacific volume growing 27%.

- Fleet Size: 143 vessels, including 128 container ships and 15 car carriers.

- 2025 Guidance: Adjusted EBITDA between $1.6 billion and $2.2 billion; Adjusted EBIT between $350 million and $950 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- ZIM Integrated Shipping Services Ltd (ZIM, Financial) reported its best financial results ever for 2024, with a net income of $2.2 billion and revenue of $8.4 billion.

- The company achieved a 14% volume growth in 2024, significantly outpacing the overall market growth of less than 6%.

- ZIM declared a dividend of $3.17 per share, contributing to a total dividend payout of $7.98 per share for 2024, representing approximately 45% of the annual net income.

- The company successfully completed its fleet transformation, with 50% of its capacity now consisting of new builds, including 40% LNG-powered vessels, enhancing fuel efficiency and cost-effectiveness.

- ZIM maintained a strong presence in the Trans-Pacific trade, achieving a 27% volume growth in this region and expanding its market share.

Negative Points

- The company faces a high degree of uncertainty in 2025 due to external factors such as geopolitical tensions, trade wars, and potential new port charges on Chinese-made vessels.

- There has been a recent steep decline in freight rates, and it is unclear whether this is due to typical seasonality or a more persistent trend.

- ZIM's guidance for 2025 reflects a significant decline in expected freight rates compared to 2024, with adjusted EBITDA projected between $1.6 billion and $2.2 billion.

- The potential reopening of the Red Sea and its impact on capacity and freight rates remains uncertain, adding to the company's challenges.

- The company is exposed to potential additional costs due to the proposed levy on Chinese-built tonnage, which could require operational adjustments and cost recovery strategies.