On May 19, 2025, JP Morgan announced a downgrade for Endava (DAVA, Financial), changing the firm's rating from "Overweight" to "Neutral". This adjustment reflects a reevaluation of the company's market position and future prospects.

Alongside the downgrade, analyst Puneet Jain from JP Morgan also set a new price target for Endava (DAVA, Financial) at USD 18.00. This announcement did not include a prior adjusted price target, indicating a fresh evaluation of the stock's potential.

The stock trades on the New York Stock Exchange under the ticker symbol DAVA, and this latest analysis impacts its market performance dynamics. Market observers will be keen to see how this reevaluation affects both investor sentiment and future stock movements.

Wall Street Analysts Forecast

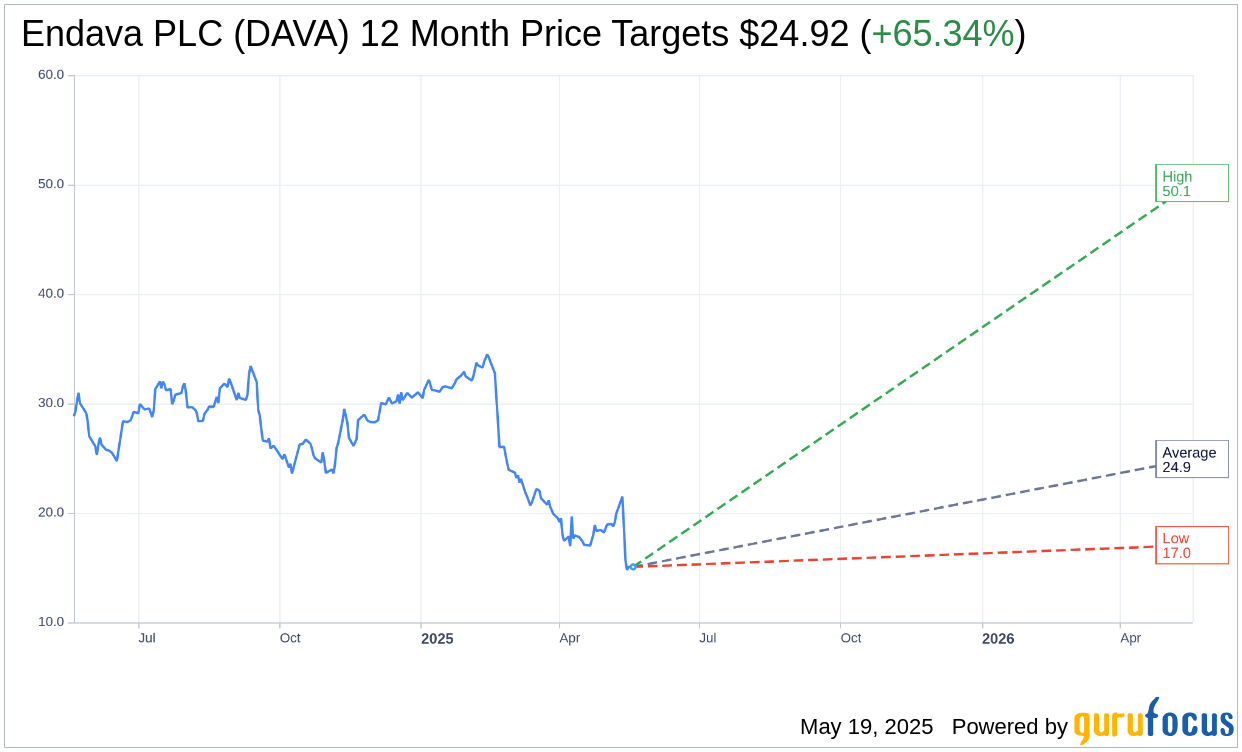

Based on the one-year price targets offered by 9 analysts, the average target price for Endava PLC (DAVA, Financial) is $24.92 with a high estimate of $50.14 and a low estimate of $17.05. The average target implies an upside of 65.34% from the current price of $15.07. More detailed estimate data can be found on the Endava PLC (DAVA) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Endava PLC's (DAVA, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Endava PLC (DAVA, Financial) in one year is $63.13, suggesting a upside of 318.91% from the current price of $15.07. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Endava PLC (DAVA) Summary page.