Fomento Económico Mexicano, S.A.B. de C.V. (FEMSA) has embarked on a strategic financial move by initiating an accelerated share repurchase (ASR) agreement, aimed at enhancing shareholder value. This initiative involves FEMSA repurchasing its own American Depositary Shares (ADS) worth USD $400 million via a financial institution in the U.S.

The ASR agreement stipulates that FEMSA will initially receive approximately 20% of the ADS around March 19, 2024. The total amount of ADS repurchased will depend on the daily volume-weighted average price during the agreement's term, with final settlement anticipated by the third quarter of 2024.

FEMSA operates with a focus on creating both economic and social value in the communities it serves. With a workforce exceeding 350,000 across 18 countries, FEMSA is recognized for its commitment to sustainability, featuring in several notable sustainability indexes, including the Dow Jones Sustainability MILA Pacific Alliance and the FTSE4Good Emerging Index.

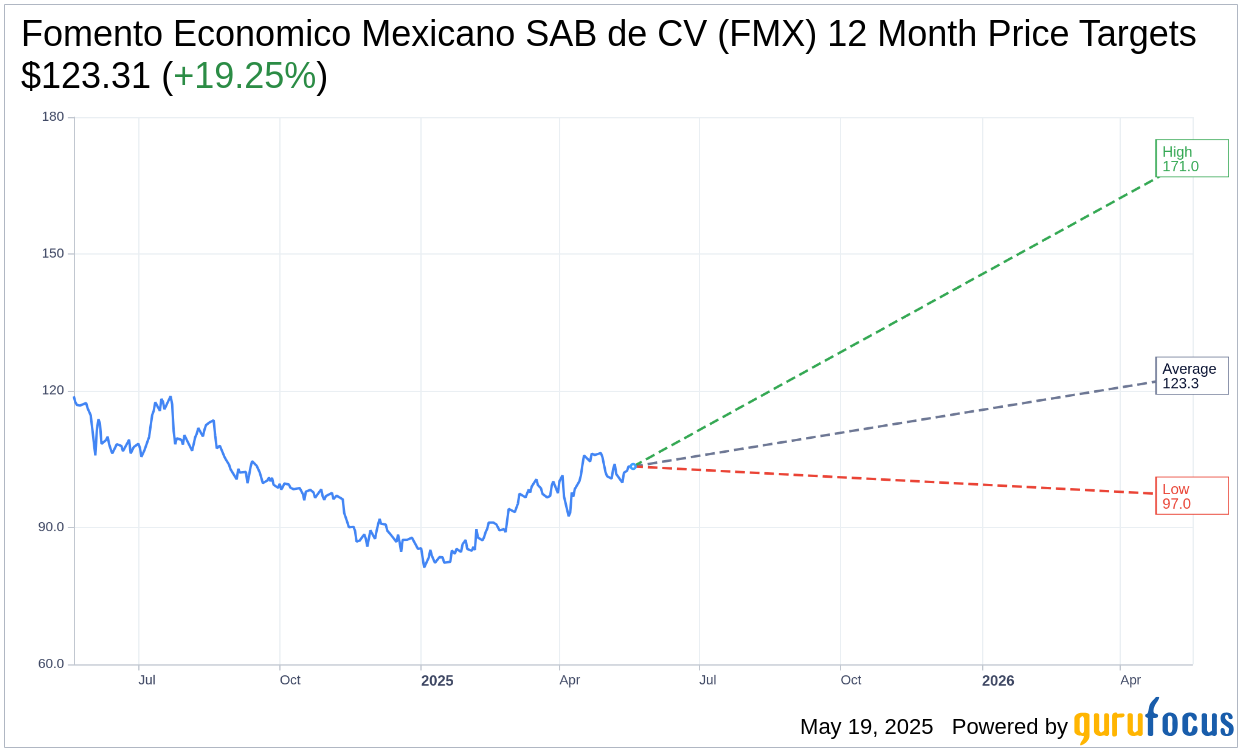

Wall Street Analysts Forecast

Based on the one-year price targets offered by 11 analysts, the average target price for Fomento Economico Mexicano SAB de CV (FMX, Financial) is $123.31 with a high estimate of $171.00 and a low estimate of $97.00. The average target implies an upside of 19.25% from the current price of $103.40. More detailed estimate data can be found on the Fomento Economico Mexicano SAB de CV (FMX) Forecast page.

Based on the consensus recommendation from 11 brokerage firms, Fomento Economico Mexicano SAB de CV's (FMX, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Fomento Economico Mexicano SAB de CV (FMX, Financial) in one year is $359.83, suggesting a upside of 248% from the current price of $103.4. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Fomento Economico Mexicano SAB de CV (FMX) Summary page.

FMX Key Business Developments

Release Date: February 27, 2025

- Total Revenue Growth: 12.8% increase in the fourth quarter of 2024.

- Operating Income: Rose by 31.5% compared to the previous year.

- Net Consolidated Income: Increased by 78.3% to nearly MXN11 billion.

- Proximity Americas Revenue Growth: 13.2% increase, 8.1% on an organic basis.

- Proximity Americas Gross Margin: Expanded by 230 basis points to 47.7%.

- Proximity Americas Operating Margin: Expanded by 50 basis points to 11.7% of sales.

- OXXO Same-Store Sales Growth: 3.8% increase.

- OXXO Store Expansion: Added 205 net new stores in the quarter.

- Proximity Europe Revenue Growth: 21.5% increase in pesos, 5.3% on a currency-neutral basis.

- Health Division Revenue Growth: 13.3% increase in pesos.

- Health Division Same-Store Sales Growth: 9.4% increase.

- Health Division Operating Margin: Expanded by 250 basis points to 5.5%.

- OXXO Gas Same-Station Sales Growth: 9.7% increase.

- OXXO Gas Total Revenue Growth: 8% increase.

- Spin by OXXO Active Users: 8.6 million, reflecting 24.9% growth year on year.

- SPIN Premia Loyalty Program Active Users: 24.6 million, 27.5% growth year over year.

- Coca-Cola FEMSA Income from Operations: Increased by 25% in the fourth quarter.

- Capital Return Plans for 2025: Deploy MXN66 billion or $3.2 billion, including ordinary and extraordinary dividends and buybacks.

- Capital Return Plans for 2026: Deploy MXN41.4 billion or $2 billion, including ordinary dividends and extraordinary dividends.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Fomento Economico Mexicano SAB de CV (FMX, Financial) reported double-digit growth across earnings line items and notable margin expansion for the full year 2024.

- The company successfully divested non-core assets, monetizing approximately $10.7 billion, and focused on core business units.

- Coca-Cola FEMSA showed strong digital capability evolution, contributing to business growth and momentum.

- The Proximity Americas division achieved a 13.2% revenue growth, driven by new store expansion and strong commercial income dynamics.

- The company plans to deploy nearly $5.3 billion in capital returns to shareholders over the next two years, representing approximately 17% of its market cap.

Negative Points

- The consumer environment in Mexico is soft, impacting traffic and sales performance.

- The company is still far from its leverage objective of 2 times net debt-to-EBITDA, requiring accelerated capital returns.

- OXXO's average traffic contracted by 2.8% due to a weaker consumer environment and cannibalization from new store openings.

- The fuel business in Mexico is facing distinct pressures, likely affecting short-term results for OXXO Gas.

- The company faces challenges in creating a platform for its US operations following the acquisition of Delek's convenience stores.