Benchmark analyst Bruce Jackson has revised the price target for Biofrontera Inc. (BFRI, Financial), reducing it from $7 to $2.75 while maintaining a Buy rating. The adjustment follows the company's first-quarter revenue of $8.6 million, which fell short of the previous estimate of $10.6 million. Now, the projected revenue for 2025 is set at $41.1 million, a decrease from the earlier forecast of $43.1 million. Jackson highlights that traditionally strong fourth-quarter sales will be crucial for achieving this year's revenue growth. The Q4 performance is expected to play a pivotal role in Biofrontera's financial outlook.

Wall Street Analysts Forecast

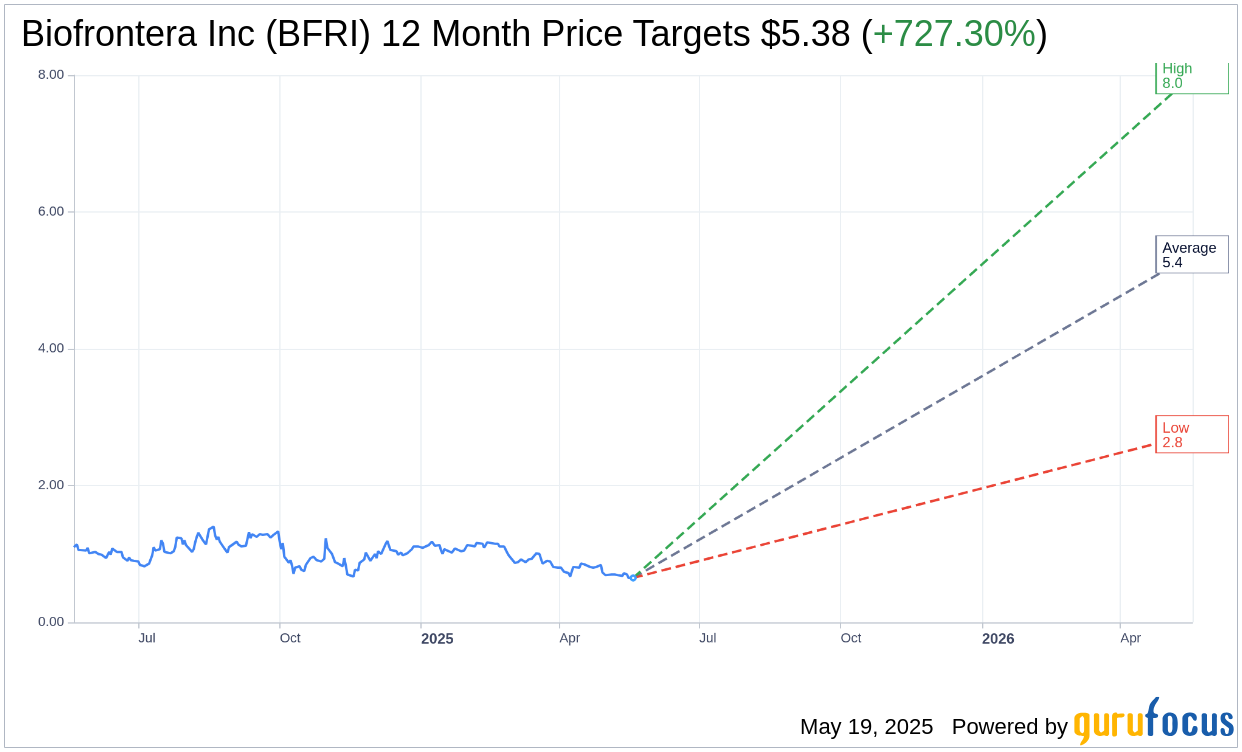

Based on the one-year price targets offered by 2 analysts, the average target price for Biofrontera Inc (BFRI, Financial) is $5.38 with a high estimate of $8.00 and a low estimate of $2.75. The average target implies an upside of 727.30% from the current price of $0.65. More detailed estimate data can be found on the Biofrontera Inc (BFRI) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Biofrontera Inc's (BFRI, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Biofrontera Inc (BFRI, Financial) in one year is $2.42, suggesting a upside of 272.48% from the current price of $0.6497. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Biofrontera Inc (BFRI) Summary page.

BFRI Key Business Developments

Release Date: May 16, 2025

- Total Revenue: $8.6 million for Q1 2025, a 9% increase from the same period in 2024.

- Ameluz Sales Increase: $0.5 million increase due to higher unit price and RotoLED XL lamp launch.

- Total Operating Expenses: $13.1 million for Q1 2025, down from $13.4 million in Q1 2024.

- Cost of Revenues: $3.1 million for Q1 2025, a 22.1% decrease from the prior year.

- SG&A Expenses: Decreased by $0.6 million or 6.5% compared to Q1 2024.

- R&D Expenses: Increased by $1.2 million due to assumption of clinical trial activities for Ameluz.

- Net Loss: $4.2 million or $0.47 per share for Q1 2025, compared to $10.4 million or $2.88 per share in Q1 2024.

- Adjusted EBITDA: Increased to $4.4 million for Q1 2025 from $4.6 million in Q1 2024.

- Cash and Cash Equivalents: $1.8 million as of March 31, 2025, down from $5.9 million as of December 31, 2024.

- Inventory: $6.5 million as of March 31, 2025, compared to $6.6 million as of December 31, 2024.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Biofrontera Inc (BFRI, Financial) reported a 9% increase in total revenues for the first quarter of 2025, reaching $8.6 million.

- The company successfully reduced its cost of revenue and operating costs compared to the same period in the previous year.

- A new formulation of Ameluz, free from the allergen propylene glycol, has been granted a patent, providing protection until December 2043.

- Biofrontera Inc (BFRI) achieved key milestones in clinical trials, including the final patient enrollment for a Phase 3 trial of Ameluz for actinic keratosis and completion of a one-year follow-up for basal cell carcinoma treatment.

- The company increased its EBITDA and gross profit, supporting its goal of reaching breakeven quickly.

Negative Points

- Biofrontera Inc (BFRI) reported a net loss of $4.2 million for the first quarter of 2025, although this was an improvement from the previous year's loss.

- The company experienced a decrease in cash and cash equivalents, dropping to $1.8 million as of March 31, 2025, from $5.9 million at the end of 2024.

- Research and development expenses increased by $1.2 million compared to the previous year, driven by the assumption of all clinical trial activities for Ameluz in the United States.

- Legal expenses increased by $1.2 million due to patent claims, partially offsetting savings in other areas.

- The sales force experienced some turnover, and the company is working on restructuring its commercial team to improve efficiency.