- ZIM Integrated Shipping Services reports significant revenue and earnings growth for Q1.

- Analysts see potential downsides based on current predictions.

- Experts recommend caution due to "Underperform" rating.

Impressive Financial Performance

ZIM Integrated Shipping Services (ZIM, Financial) reported robust financial results for the first quarter, with a notable increase in both earnings and revenue. The company posted a GAAP earnings per share of $2.45 and achieved a revenue of $2.01 billion, marking a substantial 28.5% increase compared to the previous year. Net income for the quarter soared to $296 million, up significantly from $92 million a year prior. Additionally, adjusted EBITDA witnessed an impressive surge of 82% to reach $779 million.

Wall Street Analysts Forecast

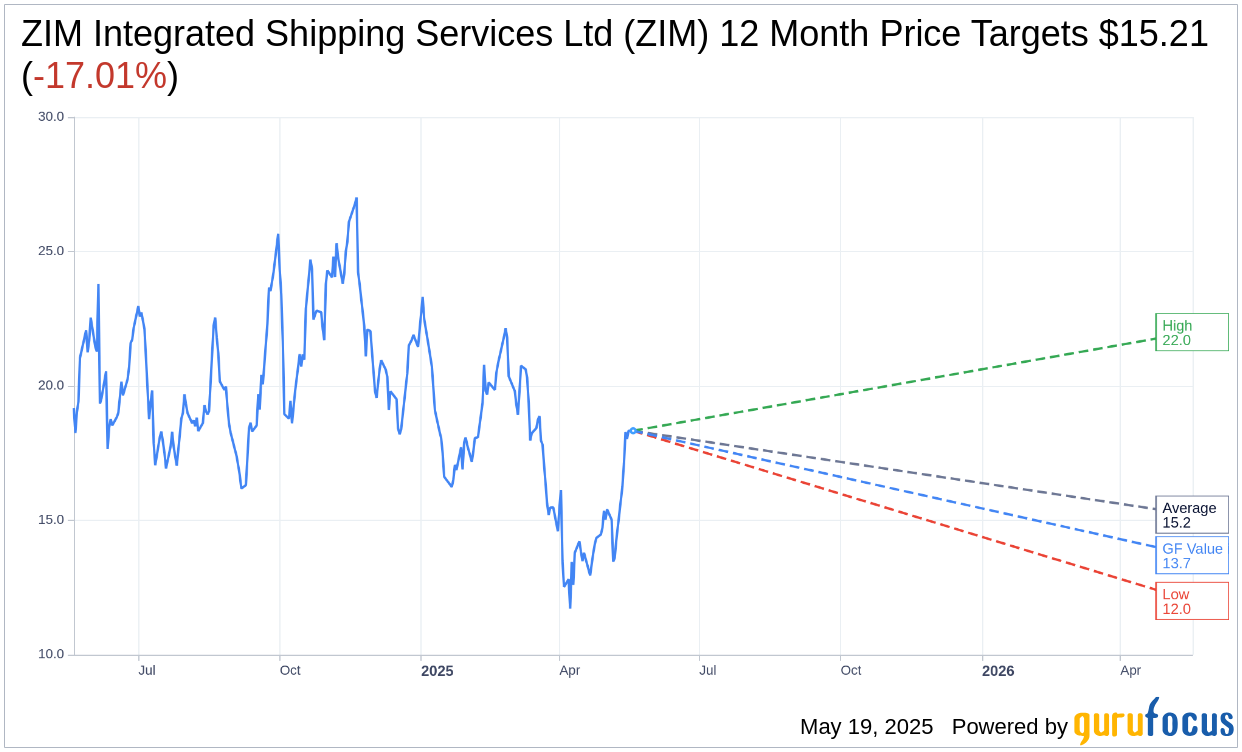

Despite the company's strong financial performance, analysts have set cautious one-year price targets for ZIM Integrated Shipping Services Ltd (ZIM, Financial). The average target price is $15.21, with estimates ranging from a high of $22.00 to a low of $12.00. This implies a potential downside of 17.01% from the current price of $18.33. For further insights, you can explore more detailed estimate data on the ZIM Integrated Shipping Services Ltd (ZIM) Forecast page.

Brokerage Recommendations

The sentiment among brokerage firms reflects a cautious approach. Currently, ZIM Integrated Shipping Services Ltd's (ZIM, Financial) average brokerage recommendation stands at 3.8, suggesting an "Underperform" status. This rating is based on a scale from 1 to 5, where 1 represents a Strong Buy, and 5 denotes a Sell recommendation.

Assessing GF Value Estimates

According to GuruFocus estimates, the GF Value of ZIM Integrated Shipping Services Ltd (ZIM, Financial) in one year is projected to be $13.70. This projection indicates a downside of 25.26% from the current price of $18.33. The GF Value is calculated considering the historical multiples at which the stock has traded, along with past business growth and future performance estimates. For more comprehensive data, visit the ZIM Integrated Shipping Services Ltd (ZIM) Summary page.