CytomX Therapeutics, under the ticker (CTMX, Financial), has begun a new phase in its clinical trial by administering the first dose of CX-801 in combination with Merck's KEYTRUDA to a patient. This marks a significant step in their Phase 1 study, which is focused on evaluating both the safety and preliminary efficacy of this combination treatment in individuals diagnosed with metastatic melanoma.

The progress follows the successful completion of initial dosing stages where CX-801 was tested as a standalone therapy. This advancement allows the study to now explore the potential benefits when CX-801 is used alongside Merck's well-known anti-PD-1 therapy, setting the stage for further evaluation of its clinical impact.

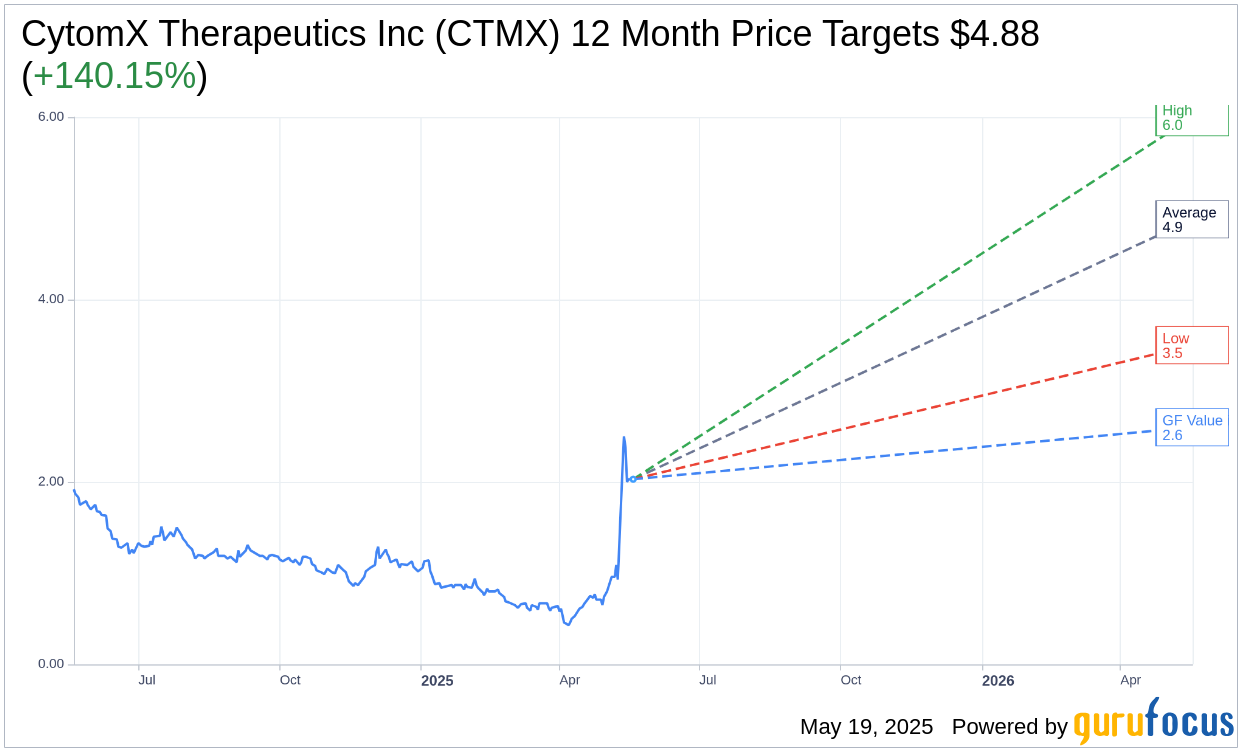

Wall Street Analysts Forecast

Based on the one-year price targets offered by 4 analysts, the average target price for CytomX Therapeutics Inc (CTMX, Financial) is $4.88 with a high estimate of $6.00 and a low estimate of $3.50. The average target implies an upside of 140.15% from the current price of $2.03. More detailed estimate data can be found on the CytomX Therapeutics Inc (CTMX) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, CytomX Therapeutics Inc's (CTMX, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for CytomX Therapeutics Inc (CTMX, Financial) in one year is $2.60, suggesting a upside of 28.08% from the current price of $2.03. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the CytomX Therapeutics Inc (CTMX) Summary page.

CTMX Key Business Developments

Release Date: March 06, 2025

- Cash, Cash Equivalents, and Investments: $100.6 million as of December 31, 2024.

- Revenue: $138.1 million for the full year 2024, up from $101.2 million in 2023.

- Total Operating Expenses: $113.1 million for 2024, compared to $107.7 million in 2023.

- R&D Expenses: Increased by $5.7 million to $83.4 million in 2024.

- G&A Expenses: $29.7 million for 2024, a slight decrease from the previous year.

- Cash Runway: Expected to fund operations into Q2 2026.

- Milestone Payment: $5 million milestone achieved in Astellas T cell engager collaboration.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- CytomX Therapeutics Inc (CTMX, Financial) advanced two new programs, CX-2051 and CX-801, into the clinic in 2024, demonstrating significant progress in their pipeline.

- The company has extended its cash runway to Q2 of 2026, allowing for continued development of key clinical milestones.

- CX-2051 is positioned as a first-in-class ADC targeting colorectal cancer, addressing a large unmet need with a novel approach.

- CX-801, a masked version of interferon alpha, shows potential as a next-generation targeted immunotherapy with promising early progress in Phase 1 trials.

- CytomX achieved a $5 million milestone payment from Astellas, highlighting successful partnerships and collaborations.

Negative Points

- CytomX Therapeutics Inc (CTMX) experienced a decrease in cash, cash equivalents, and investments from $174.5 million in 2023 to $100.6 million in 2024.

- The company decided to discontinue the development of CX-904 in collaboration with Amgen, indicating challenges in some of their partnered programs.

- Operating expenses increased by $5.4 million in 2024, primarily due to milestone payments, which could impact financial flexibility.

- Despite progress, the company faces significant challenges in achieving therapeutic levels for systemic EpCAM-targeting strategies due to potential toxicities.

- The unmet need in colorectal cancer remains high, with limited new treatments emerging, posing a challenge for CytomX to deliver impactful results.