- Advanced Micro Devices (AMD, Financial) is set to divest its ZT Systems data center unit to Sanmina for $3 billion.

- Analysts project AMD's stock could see a 10.01% upside over the next year.

- GuruFocus estimates a potential 38.74% increase in AMD's stock value.

Strategic Move: AMD's Partnership with Sanmina

In a strategic shift, Advanced Micro Devices (AMD) is poised to sell its ZT Systems' data center infrastructure manufacturing unit to Sanmina, valued at $3 billion in cash and stock. This transaction will establish Sanmina as AMD’s preferred collaborator for launching new AI and cloud solutions. The deal, which also includes a significant $450 million contingent payment, is expected to be concluded by late 2025. Investors should monitor this development as it could significantly impact AMD's operational focus and future growth in the high-demand AI and cloud markets.

Wall Street Analysts' Predictions

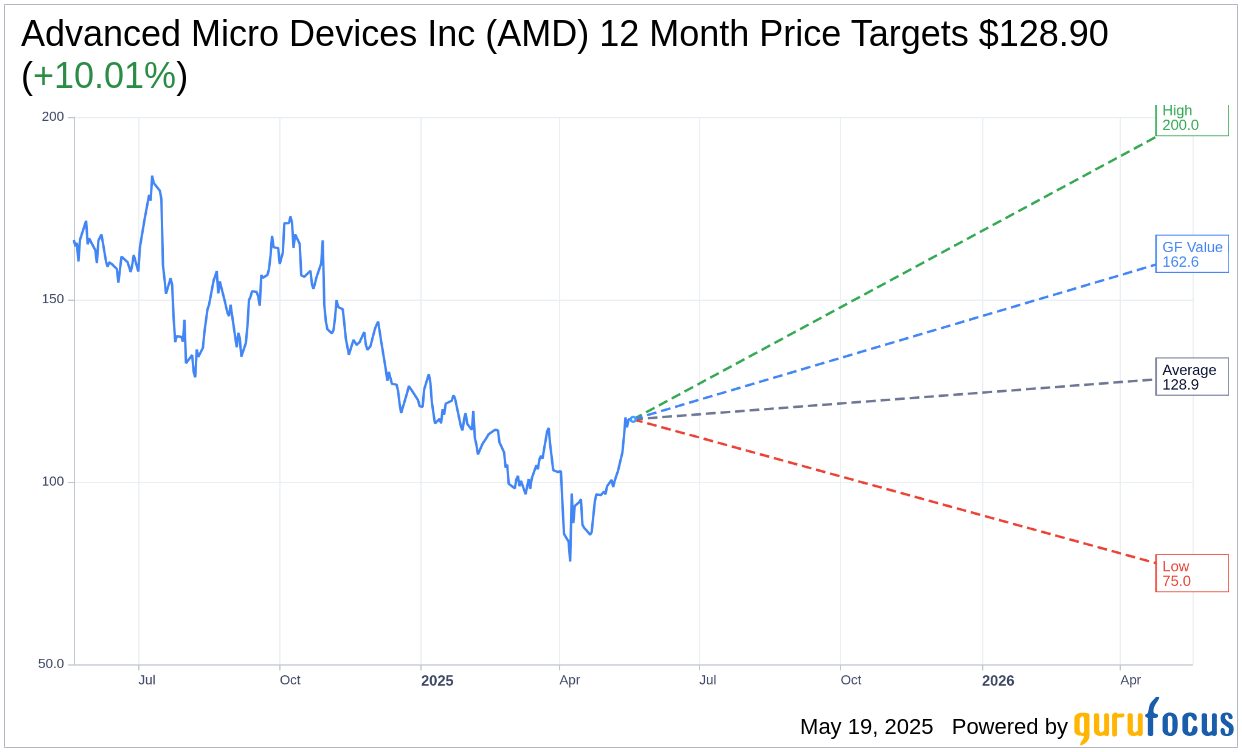

Wall Street analysts have provided one-year price projections for Advanced Micro Devices Inc (AMD, Financial), with an average target price of $128.90. This forecast presents a potential upside of 10.01% from the current price of $117.17. Price targets vary widely, ranging from a high estimate of $200.00 to a low estimate of $75.00, highlighting differing views on AMD's market prospects. For further insights and data, visit the Advanced Micro Devices Inc (AMD) Forecast page.

Brokerage Firms' Consensus

Among 52 brokerage firms, the consensus recommends an "Outperform" rating for AMD, with an average score of 2.2 on a scale where 1 indicates a Strong Buy and 5 indicates a Sell. This consensus reflects a general optimism towards AMD's potential for future growth. It's an important metric for investors considering AMD as a strategic addition to their portfolios.

GuruFocus's GF Value Estimate

According to GuruFocus, the estimated GF Value for AMD in the upcoming year is $162.56. This estimation suggests a substantial upside of 38.74% from the current market price of $117.17. The GF Value is a proprietary metric that evaluates a stock's fair trading value based on historical trading multiples, and projections of the company's business performance. For more comprehensive data, explore the Advanced Micro Devices Inc (AMD, Financial) Summary page.

By considering these varied analyses and estimates, investors can make more informed decisions about the potential risks and rewards associated with investing in AMD, particularly in light of its strategic realignment with Sanmina.