Summary Highlights:

- ZIM Integrated Shipping Services reported a strong Q1 with net income rising significantly to $296 million.

- Analysts predict potential downside for ZIM, with target prices below current trading levels.

- Despite current earnings, ZIM's brokerage recommendation remains at "Underperform."

ZIM Integrated Shipping Services Ltd. (ZIM) made headlines as its stock saw a 2% uptick in premarket trading due to impressive first-quarter earnings. The company's net income for Q1 soared to $296 million, or $2.45 per share, easily surpassing market expectations. ZIM's revenue also outpaced analyst forecasts, reaching $2.01 billion. With the transportation of 944,000 TEUs, freight rates saw an increase of 22%.

Wall Street Analysts Forecast

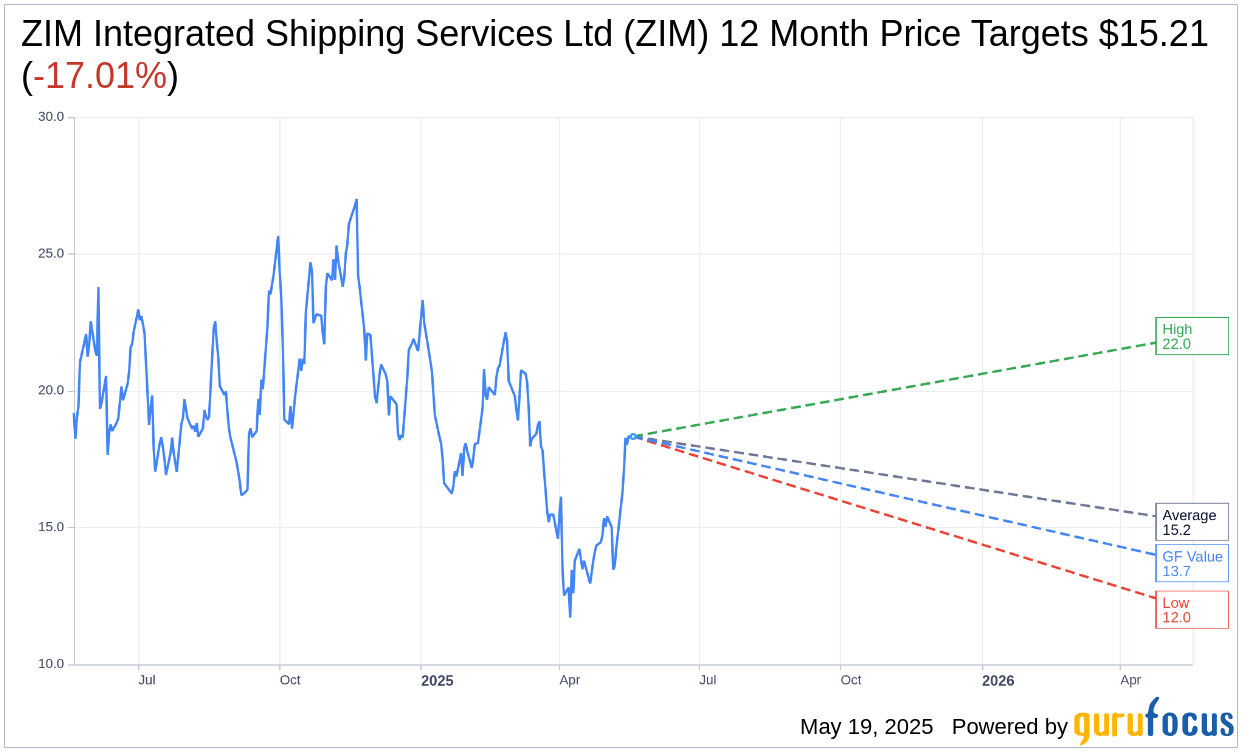

Wall Street analysts have provided one-year price targets for ZIM Integrated Shipping Services with a variety of estimates. The average target price is marked at $15.21, with a high estimate reaching $22.00 and a low of $12.00. This average target indicates a potential downside of 17.01% from the current trading price of $18.33. For a more comprehensive breakdown of these estimates, visit the ZIM Integrated Shipping Services Ltd (ZIM, Financial) Forecast page.

Broader Market Sentiments

The consensus recommendation from 8 brokerage firms positions ZIM at an average rating of 3.8, categorizing it under "Underperform." This rating falls on a scale from 1 to 5, where 1 suggests a Strong Buy and 5 indicates a Sell.

GF Value Analysis

According to GuruFocus estimates, the projected GF Value for ZIM Integrated Shipping Services in the coming year is $13.70. This implies a downside of 25.26% from the current market price of $18.33. The GF Value represents a fair trading value of the stock, derived from historical multiples, business growth trends, and future performance estimates. Investors can explore more detailed data on the ZIM Integrated Shipping Services Ltd (ZIM, Financial) Summary page.