Key Takeaways:

- BGC Group plans a significant share buyback from Howard Lutnick, totaling $151.5 million.

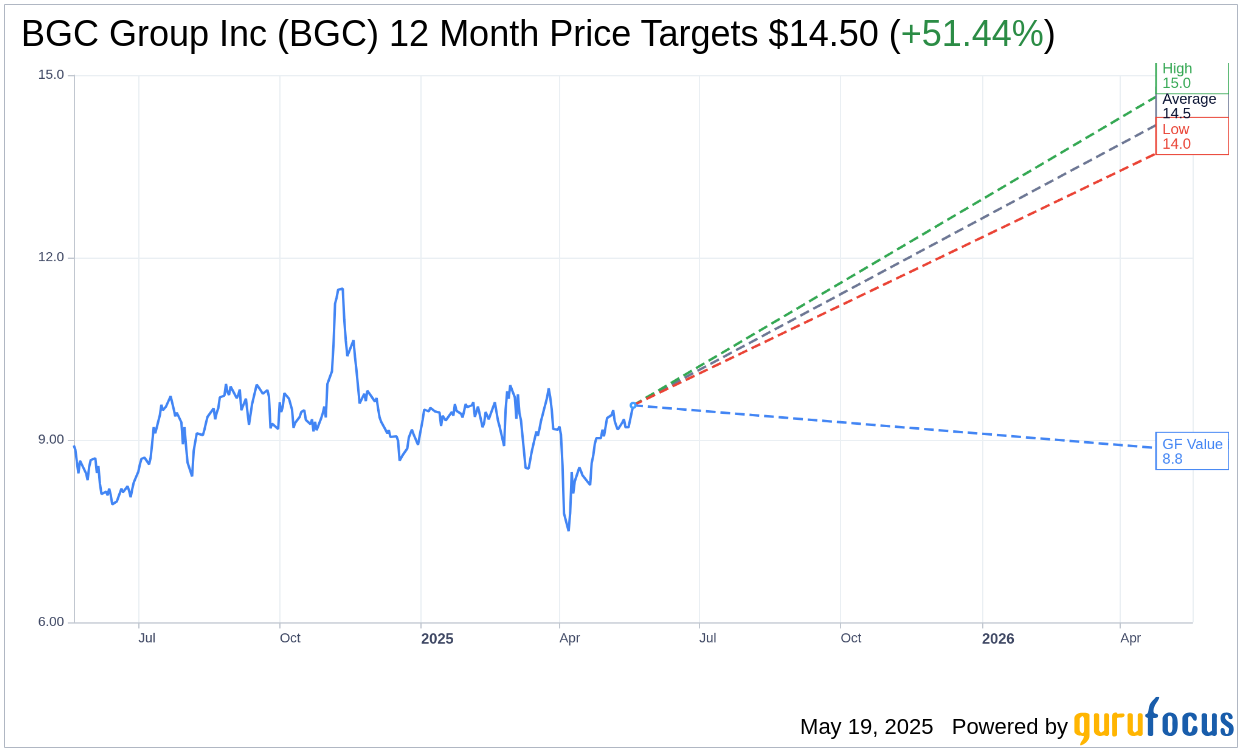

- Analysts project a notable upside potential, with a one-year price target average of $14.50.

- GuruFocus estimates indicate a possible downside, with a GF Value of $8.82.

BGC Group’s Strategic Share Buyback

BGC Group (BGC) has announced a strategic move to repurchase 16.45 million shares from its chairman, Howard Lutnick, at a price of $9.2082 per share. This buyback amounts to a substantial $151.5 million. The initiative is not only a financial maneuver but also aligns with Lutnick’s government ethics obligations, as he transfers his holdings in Cantor Fitzgerald to trusts established for his children. Following the announcement, BGC shares experienced a 3.7% rise, reflecting investor optimism.

Analyst Price Targets and Market Outlook

Market analysts have shared their forecasts for BGC Group Inc's future performance. Based on projections from two analysts, the average price target stands at $14.50, with estimates ranging from a high of $15.00 to a low of $14.00. This suggests a potential upside of 51.44% from its current trading price of $9.58. For more detailed estimate data, please visit the BGC Group Inc Forecast page.

Brokerage Recommendations

BGC Group Inc currently holds an average brokerage recommendation rating of 1.5, indicating a "Buy" status. This consensus from two brokerage firms places BGC as an attractive investment opportunity, with the rating system ranging from 1 (Strong Buy) to 5 (Sell).

Evaluating GF Value and Potential Risks

Despite optimistic analyst projections, GuruFocus estimates provide a more conservative outlook based on historical data. The estimated GF Value for BGC Group Inc in one year is $8.82. This indicates a potential downside of 7.89% from its current market price of $9.575. The GF Value is derived from the stock's historical trading multiples, past business growth, and future performance estimates. For a deeper dive into BGC Group's GF Value, visit the BGC Group Inc Summary page.

In summary, BGC Group's recent share buyback marks a significant corporate decision, while market analysts suggest potential stock appreciation. However, investors are advised to consider GuruFocus estimates and exercise due diligence, evaluating both upside potential and associated risks.