TD Cowen has raised significant concerns regarding the Roblox (RBLX, Financial) discovery algorithm, pointing to possible manipulation through bogus account creation in the Philippines and Indonesia. According to the firm, it's unlikely that the company's management is unaware of these activities. They highlighted the game "Grow a Garden," launched on March 25, which swiftly rose to become Roblox’s top experience due to unusual user activity from these regions. Despite Roblox management recently reaffirming the algorithm's fairness in an earnings call, TD Cowen maintains a Sell rating on the stock, setting a price target of $40.

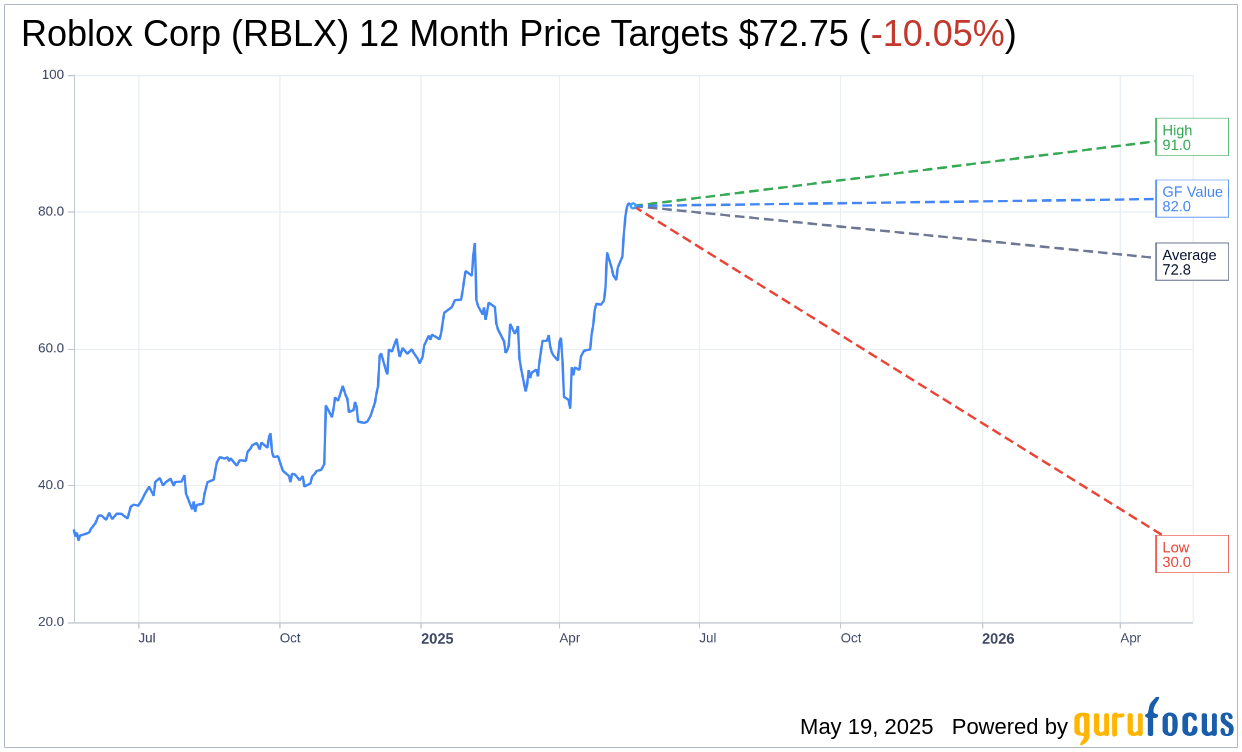

Wall Street Analysts Forecast

Based on the one-year price targets offered by 31 analysts, the average target price for Roblox Corp (RBLX, Financial) is $72.75 with a high estimate of $91.00 and a low estimate of $30.00. The average target implies an downside of 10.05% from the current price of $80.88. More detailed estimate data can be found on the Roblox Corp (RBLX) Forecast page.

Based on the consensus recommendation from 34 brokerage firms, Roblox Corp's (RBLX, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Roblox Corp (RBLX, Financial) in one year is $81.96, suggesting a upside of 1.34% from the current price of $80.88. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Roblox Corp (RBLX) Summary page.

RBLX Key Business Developments

Release Date: May 01, 2025

- Revenue: $1.035 billion, up 29% year on year.

- Bookings: $1.207 billion, up 31% year on year.

- Daily Active Users (DAUs): 97.8 million, up 26% year on year.

- Hours Engaged: 21.7 billion hours, up 30% year on year.

- Cash from Operations: $443 million, up 86% year on year.

- Free Cash Flow: $426 million, up 123% year on year.

- Trust and Safety Expenses: 13% of revenue, 11% of bookings.

- Personnel Costs (excluding stock-based compensation): $238 million, 23% of revenue, 20% of bookings.

- Developer Exchange (DevEx): $281 million, up 39% year on year.

- Top 100 Creators Earnings: $6.7 million on average in the last 12 months, up 35% year on year.

- Top 10 Creators Earnings: $36 million on average in the last 12 months, up 28% year on year.

- Gross Cash: $4.5 billion.

- Net Cash: $3.5 billion.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Roblox Corp (RBLX, Financial) reported Q1 revenue of $1.035 billion, up 29% year on year, surpassing their guidance.

- Daily Active Users (DAUs) reached 97.8 million, a 26% increase year on year, with significant growth in regions like India (77%) and Japan (48%).

- Free cash flow in Q1 was $426 million, up 123% year on year, exceeding the high end of their guidance.

- Creator earnings (DevEx) increased by 39% year on year, with creators on track to earn over $1 billion this year.

- Roblox Corp (RBLX) is seeing success with AI-driven moderation, improving content and communication safety on the platform.

Negative Points

- Despite strong growth, Roblox Corp (RBLX) has not yet reached 100 million DAUs, falling just short at 97.8 million.

- The European market is experiencing slower growth in hours compared to other regions, partly due to Turkey being offline.

- The company is still in the early stages of its differential pricing initiative, with results being neutral to slightly accretive to margins.

- Advertising revenue is not yet a significant contributor to overall bookings, with the core business dominating financial performance.

- The Shopify integration and broader e-commerce initiatives are still in early phases, with no full-scale implementation yet.