Morgan Stanley has increased its price target for RenaissanceRe (RNR, Financial) from $275 to $285, maintaining an Overweight rating on the stock. Analyst Bob Huang highlighted that while the results varied across different segments, there is an anticipation of continued growth and margin improvements in the personal lines sector, which is expected to remain strong through 2025. The firm projects that the overall property and casualty (P&C) insurance market will remain stable, with personal lines and brokers at the forefront of earnings growth as they approach the upcoming year.

Wall Street Analysts Forecast

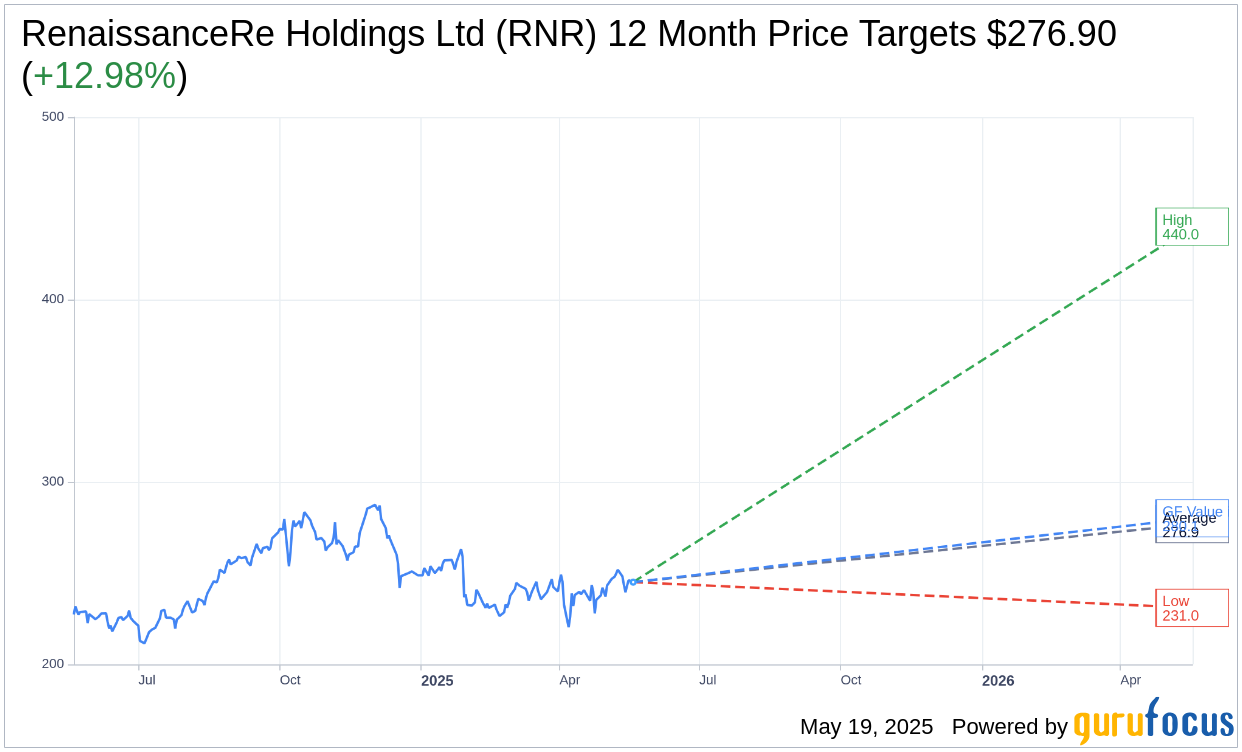

Based on the one-year price targets offered by 10 analysts, the average target price for RenaissanceRe Holdings Ltd (RNR, Financial) is $276.90 with a high estimate of $440.00 and a low estimate of $231.00. The average target implies an upside of 13.09% from the current price of $244.84. More detailed estimate data can be found on the RenaissanceRe Holdings Ltd (RNR) Forecast page.

Based on the consensus recommendation from 14 brokerage firms, RenaissanceRe Holdings Ltd's (RNR, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for RenaissanceRe Holdings Ltd (RNR, Financial) in one year is $280.07, suggesting a upside of 14.39% from the current price of $244.84. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the RenaissanceRe Holdings Ltd (RNR) Summary page.