- PepsiCo's acquisition of Poppi underscores its strategic shift towards functional beverages.

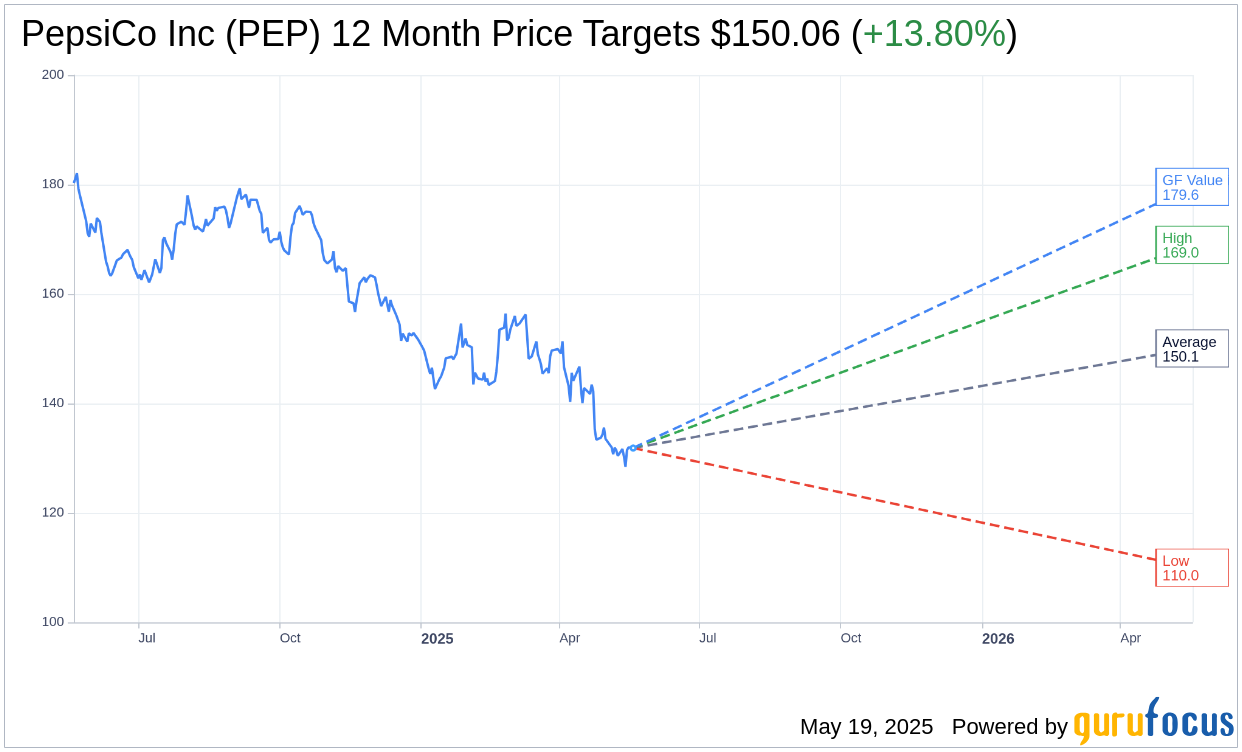

- Analysts forecast a potential upside of up to 13.80% for PepsiCo stock.

- GF Value suggests PepsiCo's stock could see a 36.19% increase from its current price.

PepsiCo Inc. (PEP, Financial) has made a significant move by acquiring the prebiotic soda brand Poppi for a substantial $1.95 billion, which includes anticipated tax benefits of $300 million. This strategic acquisition marks PepsiCo's commitment to evolving into a powerhouse of functional products, aligning with current consumer trends. Since its inception, Poppi has been a standout in the prebiotic soda sector, consistently tripling its sales each year since 2020, demonstrating the potential that PepsiCo seeks to capitalize on.

Wall Street Analysts Forecast

Delving into Wall Street’s perspective, 21 analysts have provided one-year price targets for PepsiCo Inc. (PEP, Financial). The average target price has been set at $150.06, with projections ranging from a high of $169.00 to a low of $110.00. This average target suggests a promising upside of 13.80% from the current market price of $131.87. For investors seeking detailed estimate data, further insights are available on the PepsiCo Inc (PEP) Forecast page.

The consensus from 24 brokerage firms places PepsiCo Inc. (PEP, Financial) at an average brokerage recommendation of 2.8, which indicates a "Hold" position. This rating is derived from a scale of 1 to 5, where 1 represents a Strong Buy and 5 a Sell, providing investors with a balanced view of market sentiment.

Looking at the figures derived from GuruFocus estimates, the GF Value for PepsiCo Inc. (PEP, Financial) is projected to be $179.59 within a year, hinting at a significant upside of 36.19% from the current price of $131.8676. The GF Value is GuruFocus' proprietary estimate of the fair value at which the stock should trade, calculated based on historical trading multiples, past business growth, and future performance estimates. To explore more detailed data, visit the PepsiCo Inc (PEP) Summary page.