NVIDIA Corp (NVDA, Financial) has recently captured the attention of investors and financial analysts due to its strong financial position. With shares currently priced at $135.11, NVIDIA Corp has experienced a daily loss of 0.21%, against a three-month change of -2.95%. A comprehensive analysis, highlighted by the GF Score, indicates that NVIDIA Corp is poised for significant growth in the near future.

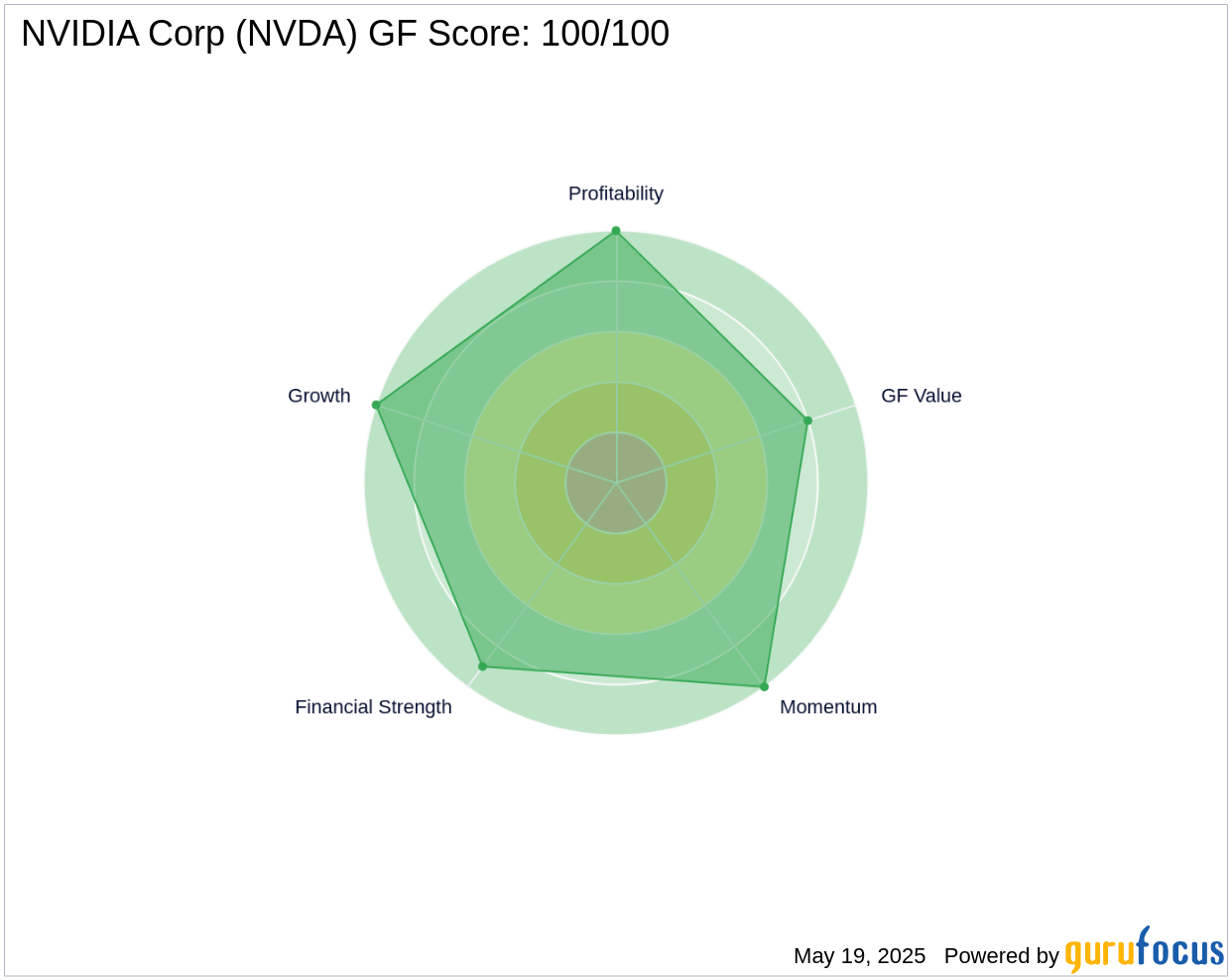

Understanding the GF Score

The GF Score is a stock performance ranking system developed by GuruFocus, utilizing five aspects of valuation. This system has been shown to closely correlate with the long-term performance of stocks, as evidenced by backtesting from 2006 to 2021. Stocks with higher GF Scores generally yield higher returns than those with lower scores. The GF Score ranges from 0 to 100, with 100 being the highest rank. NVIDIA Corp boasts a GF Score of 99 out of 100, indicating a strong potential for outperformance.

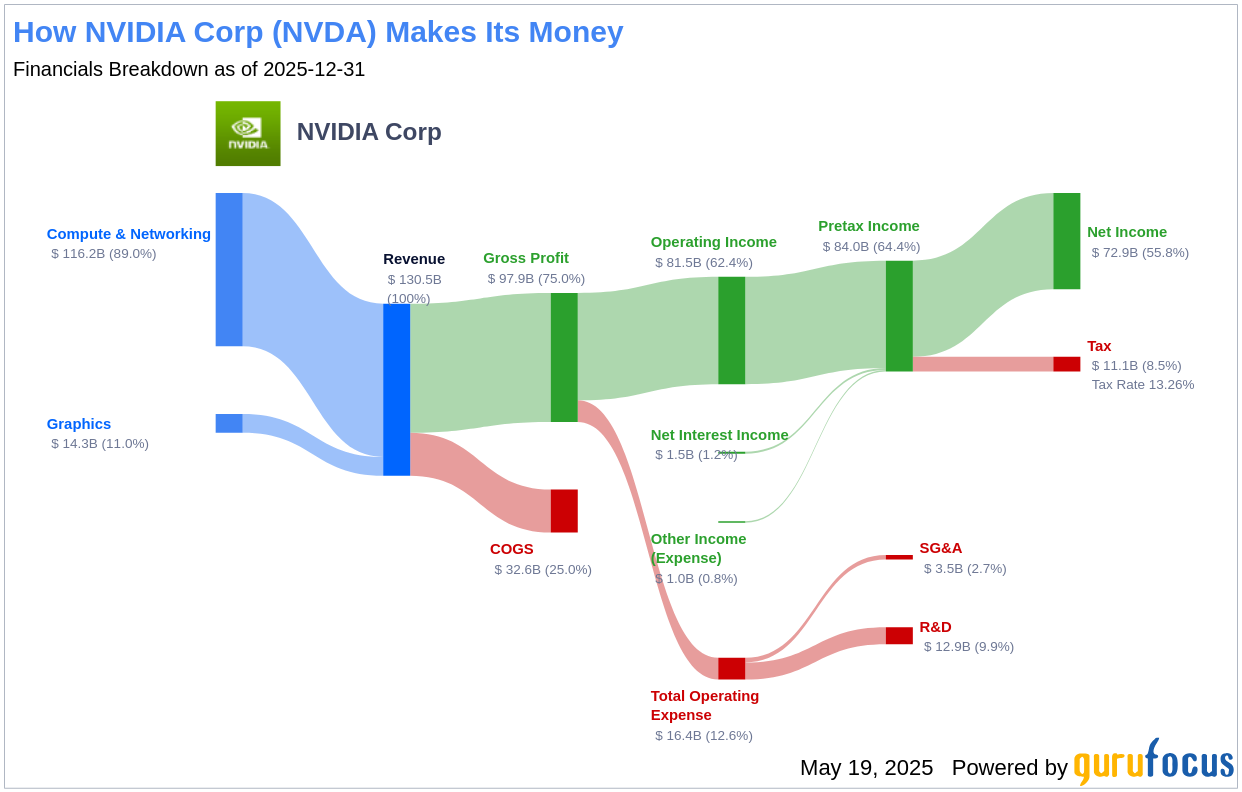

NVIDIA Corp: A Snapshot of Business Operations

NVIDIA Corp, with a market cap of $3,295,076 million, is a leading developer of graphics processing units (GPUs). Initially, GPUs were primarily used to enhance computing experiences, particularly in gaming applications on PCs. However, their use has expanded to become crucial semiconductors in artificial intelligence (AI). NVIDIA not only offers AI GPUs but also provides a software platform, Cuda, for AI model development and training. Additionally, NVIDIA is expanding its data center networking solutions, facilitating the integration of GPUs to manage complex workloads.

Financial Strength: A Pillar of Stability

NVIDIA Corp's Financial Strength rating reflects a robust balance sheet, showcasing resilience against financial volatility. The company's Interest Coverage ratio stands at an impressive 329.77, highlighting its strong ability to meet interest obligations. This aligns with the investment principles of Benjamin Graham, who advocated for companies with an interest coverage ratio of at least 5. Furthermore, NVIDIA Corp's Altman Z-Score of 66.57 underscores its financial stability, while a favorable Debt-to-Revenue ratio of 0.08 solidifies its financial health.

Profitability: A Benchmark of Success

The Profitability Rank of NVIDIA Corp highlights its exceptional ability to generate profit. Over the past five years, NVIDIA Corp's Operating Margin has increased by 139.45%, with figures rising from 27.18 in 2021 to 62.42 in 2025. Additionally, the company's Gross Margin has consistently improved, reaching 74.99 in 2025. The Piotroski F-Score further confirms NVIDIA Corp's solid financial standing, while a Predictability Rank of 3.0 stars out of five underscores its consistent operational performance.

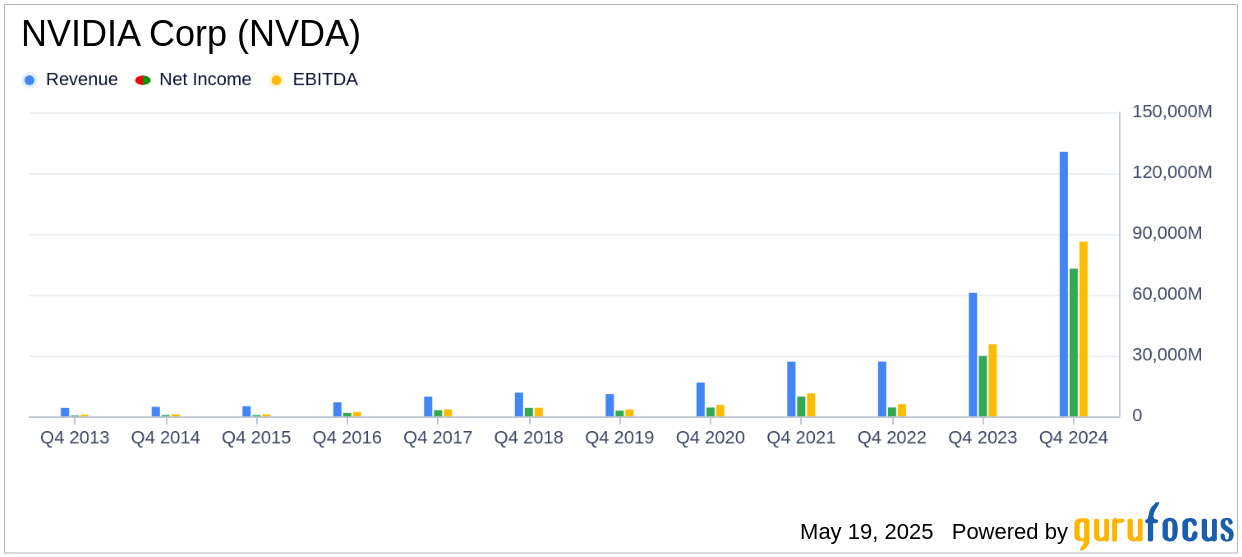

Growth: A Trajectory of Expansion

NVIDIA Corp's high Growth Rank reflects its commitment to business expansion. The company's 3-Year Revenue Growth Rate of 70.5% outperforms 98.02% of 961 companies in the Semiconductors industry. Moreover, NVIDIA Corp has demonstrated a robust increase in earnings before interest, taxes, depreciation, and amortization (EBITDA), with a three-year growth rate of 97.9 and a five-year rate of 82.3, underscoring its ability to drive growth.

Conclusion: A Promising Future for NVIDIA Corp

In conclusion, NVIDIA Corp's financial strength, profitability, and growth metrics, as highlighted by the GF Score, underscore the company's unparalleled position for potential outperformance. With a strong balance sheet, impressive profitability, and a commitment to growth, NVIDIA Corp is well-positioned to continue its trajectory of success. For investors seeking companies with strong GF Scores, GuruFocus Premium members can explore more opportunities using the GF Score Screen.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.