Wolfe Research has started analyzing U-Haul Holding (UHAL, Financial), assigning it a Peer Perform rating, but without specifying a price target. The firm appreciates U-Haul’s fundamental business strengths. However, it expresses concerns over housing affordability issues and limited clarity in the home goods sector, which are seen as potential obstacles for the stock. These factors, combined with broader economic conditions affecting people's mobility, lead Wolfe to adopt a cautious stance on UHAL's shares.

Wall Street Analysts Forecast

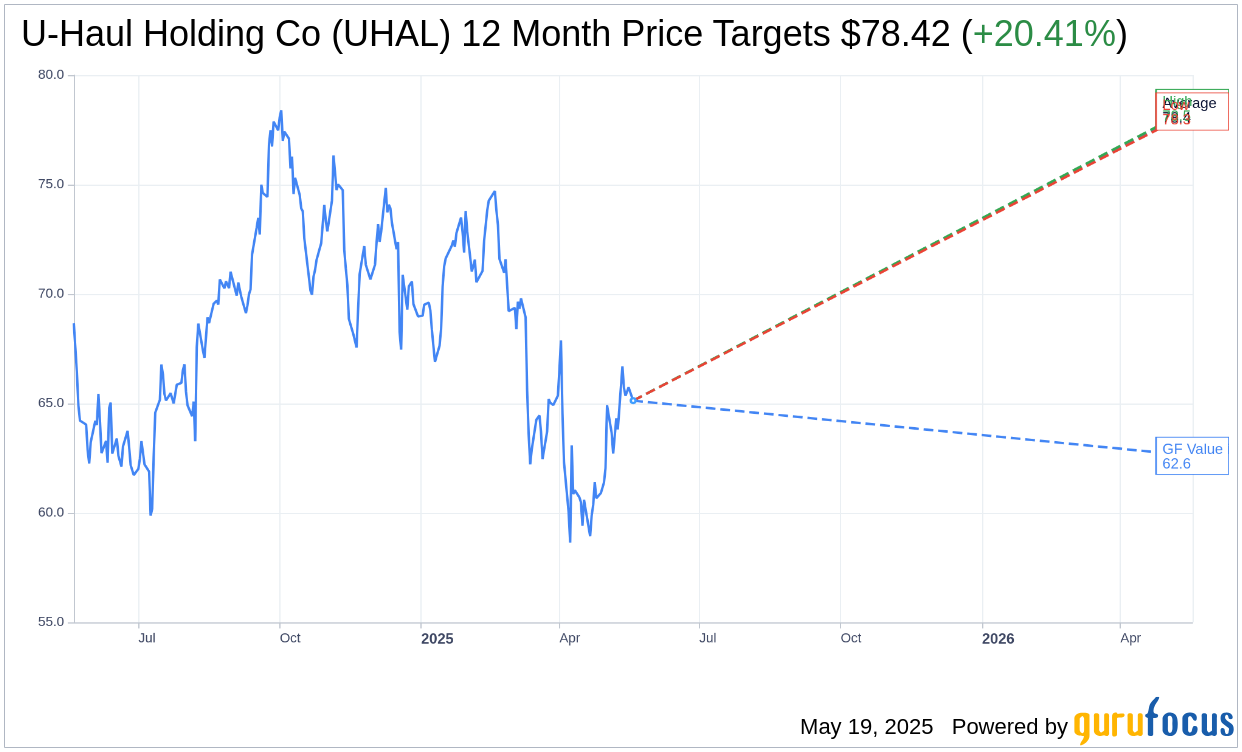

Based on the one-year price targets offered by 2 analysts, the average target price for U-Haul Holding Co (UHAL, Financial) is $78.42 with a high estimate of $78.50 and a low estimate of $78.34. The average target implies an upside of 20.41% from the current price of $65.13. More detailed estimate data can be found on the U-Haul Holding Co (UHAL) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, U-Haul Holding Co's (UHAL, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for U-Haul Holding Co (UHAL, Financial) in one year is $62.61, suggesting a downside of 3.86% from the current price of $65.125. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the U-Haul Holding Co (UHAL) Summary page.