Key Insights:

- Howmet Aerospace's stock reaches a new 52-week high in response to sector momentum.

- Analysts suggest a moderate decrease from current stock prices despite positive market sentiment.

- GuruFocus calculations demonstrate a notable deviation from current market valuations.

Howmet Aerospace Inc. (HWM, Financial) has achieved a noteworthy milestone, reaching a 52-week high of $165.37 during intraday trading. This surge underscores a growing confidence within the aerospace and defense sectors, catalyzed by rising defense budgets and ongoing technological advancements.

Wall Street Analysts Forecast

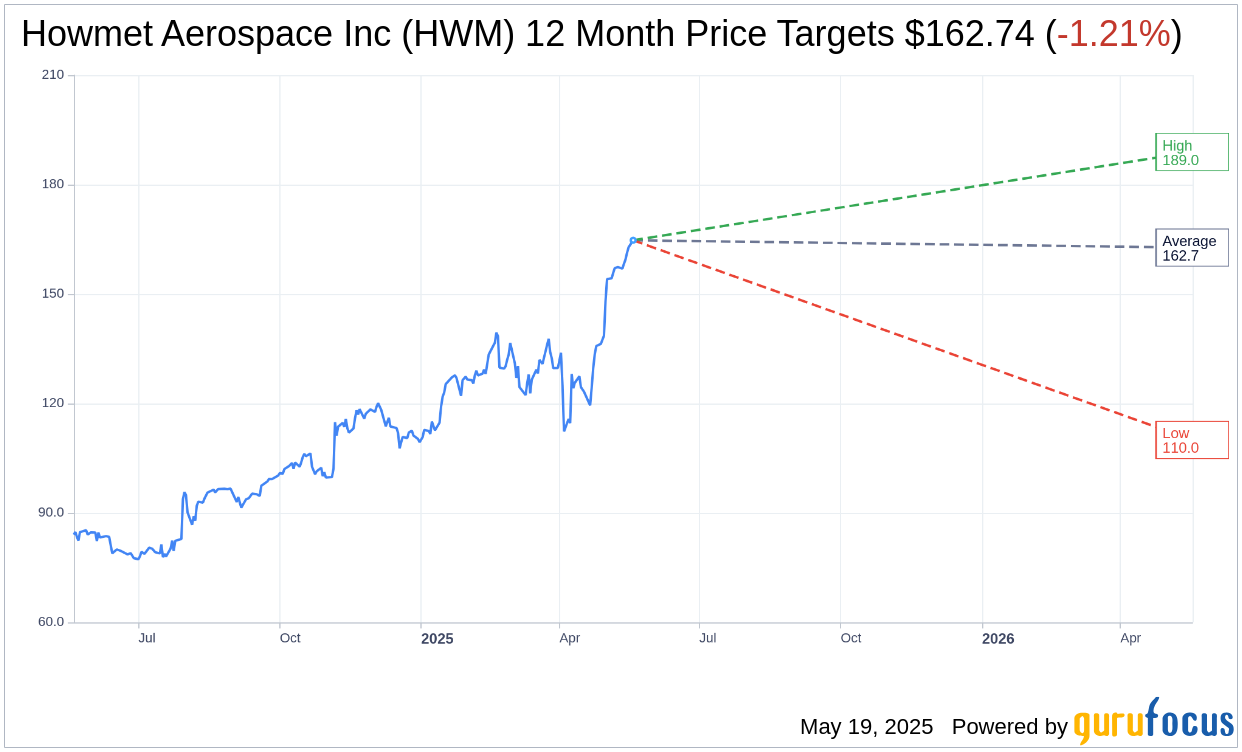

According to projections from 21 financial analysts, the average one-year price target for Howmet Aerospace Inc. stands at $162.74. There is a high estimation of $188.96 and a low of $110.00. The average target price reflects a potential downside of 1.42% from the current trading price of $165.08. For a more in-depth analysis, visit the Howmet Aerospace Inc (HWM, Financial) Forecast page.

Furthermore, based on the consensus from 26 brokerage firms, Howmet Aerospace holds an average brokerage recommendation of 2.0, denoting an "Outperform" status. This rating operates on a scale from 1 to 5, where 1 signifies a Strong Buy and 5 indicates a Sell recommendation.

GuruFocus Value Estimation

The GF Value, as estimated by GuruFocus for Howmet Aerospace Inc (HWM, Financial), is $72.14 over the next year. This estimate suggests a significant downside of 56.3% from the current price of $165.075. The GF Value is determined by evaluating historical trading multiples, past business growth, and future business performance estimates. To explore more detailed data, please visit the Howmet Aerospace Inc (HWM) Summary page.

Become a Premium Member to See This: (Free Trial):