Key Takeaways:

- Barclays (BCS, Financial) sees a 52-week high, driven by robust investor confidence.

- Analysts' average price target suggests potential downside for the stock.

- GuruFocus' GF Value estimate indicates significant overvaluation.

Barclays (BCS) shares recently soared to a new 52-week high of $17.66, reflecting a 1.2% uptick. This surge is attributed to escalating investor confidence in the bank's strengthened earnings and strategic growth initiatives. Such factors have notably attracted the attention of long-term value investors, resulting in a remarkable 33.7% rise projected for 2025.

Wall Street Analysts' Insights

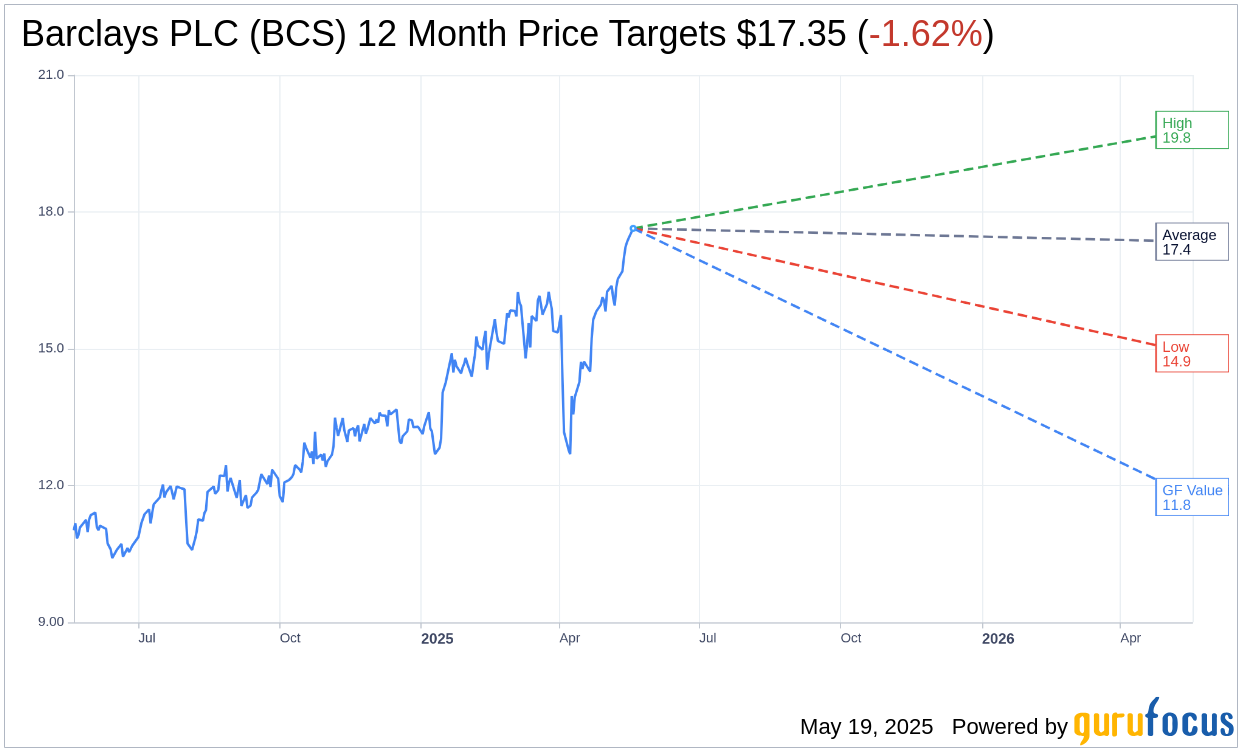

According to forecasts from two analysts, the average price target for Barclays PLC (BCS, Financial) is $17.35. Their predictions range from a high of $19.80 to a low of $14.90. This average suggests a potential downside of 1.62% from the current trading price of $17.64. For more exhaustive details, please visit the Barclays PLC (BCS) Forecast page.

The consensus from two brokerage firms currently positions Barclays PLC's (BCS, Financial) average brokerage recommendation at 2.0, indicating an "Outperform" status. This rating is on a scale from 1 to 5, where 1 indicates a Strong Buy, and 5 signifies a Sell.

Evaluating GF Value

GuruFocus estimates the GF Value for Barclays PLC (BCS, Financial) at $11.75 in one year. This points towards a significant downside of 33.37% from the current price of $17.635. The GF Value represents GuruFocus' fair value estimation, derived from the stock's historical trading multiples, past business growth, and future performance projections. For further analysis, visit the Barclays PLC (BCS) Summary page.